S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Aug, 2021

By Francesca Ficai

The first half of the year has passed with little friction in the European direct lending space, and even though the COVID-19 crisis has by no means been resolved, the market is eagerly waiting for the last quarter of 2021 with a well-filled deal pipeline. "We are totally overworked, and are already preparing for deals in September," said one market participant.

The deals that are expected to populate the market after the late-summer break will mainly be leveraged buyouts, financed by direct lenders. Even at the height of the pandemic, LBOs made up the majority of market activity. In the first quarter of 2020, for example, some 73% of European mid-market deals supported acquisitions, by deal count, while 15% were refinancings (note that these figures are anecdotal, as reported by LCD News).

The story was much the same in subsequent periods, until the second quarter of 2021, in which the split was roughly 81% for acquisition financings versus 11% for refinancings, and 5% for recapitalizations (compared to 1% on average for the latter category over the preceding five quarters), according to LCD News. Back in the first quarter of 2020, some 55% of deals supported buyouts, rising to 70% in the fourth quarter of that year, before falling back to 62% in the second quarter of 2021.

In 2020 and so far in 2021, all the classes of lenders have fought for the best deals in the European mid-market space, seemingly undeterred by the pandemic, and with an incredible amount of liquidity to play with. Direct lenders wedged their way into all kinds of financing deals, taking advantage of banks being busy with state loans, and their different tolerance to risk.

Since the beginning of 2020, the direct lending market has outpaced the banks when it comes to mid-market lending, sources agree.

However, banks have most certainly not exited the sector, and might even end up working with direct lenders to some extent.

"There will be a need for both banks and direct lenders to work together, with instruments such as first-out/last-out facilities," said a market participant. Indeed, managers are finding more ways to collaborate with bank lenders as the market matures. The recent Pulsant deal provides a case in point, which saw banks and direct lenders work together to offer a stretched senior facility (Antin Infrastructure Partners acquired Pulsant, a provider of data center and cloud infrastructure in the U.K., from Oak Hill Capital and Scottish Equity Partners).

Wrestling match

Direct lenders have also been challenging the broadly syndicated loans market on bigger deals, and it looks as though this wrestling match has no upper limit. "Historically … private debt was not able to write the size of check that the broadly syndicated lending market could, and so borrowers didn’t have much option,” said Aymen Mahmoud, a partner at McDermott Will & Emery. "Broadly syndicated lending pricing was far lower than that from private debt [historically]. Today, private debt funds can write significant checks (some at $2 billion), and so borrowers have had significant option value.

"Private debt funds can also typically move a little faster than broadly syndicated markets with fewer points of contact, no syndication materials required, very little in the way of ratings involvement, and so on. In addition, pricing in the private debt markets has reduced significantly from the pricing levels seen in 2012, for example, owing to a low-interest rate environment and the availability of significant dry powder. When combining the above with the fact that the regulatory overlay associated with the more traditional BSL banks, which can lead to more precipitant action during difficult times, private debt’s patient (less regulated) capital has been able to further strengthen its position within the private equity community. Finally, many traditional broadly syndicated lending-style clearing banks are viewed to have been overburdened with liquidity requests during the pandemic, giving the vast amount of private debt credit a little more marketing opportunity in the last 18 months."

Private lessons

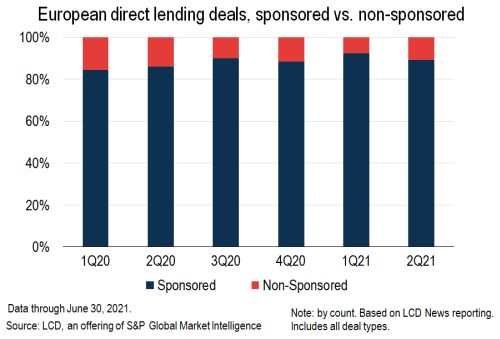

Deals involving a private equity sponsor account for the overwhelming majority of transactions in the European direct lending space, and on average since the first quarter of 2020, 88.5% of the deals recorded in the mid-market per quarter were sponsored, according to LCD.

Many direct lenders specializing in the lower mid-market are attracted by making sponsorless deals in order to break into uncharted and lucrative territories, however this is not an easy approach, and not many mid-market alternative lenders have the necessary documentation that allows them to provide sponsorless deals. These assets have not been “educated” in terms of private lending by a sponsor, and therefore the origination of such deals represents a very different prospect than the plain vanilla lender/sponsor relationship. Also, originators on sponsorless deals need to branch out into dealing with advisers — sometimes all the way to the small-town accountant — while the private lender in effect then becomes a "sponsor" in its relationship with the company's management — "almost as if the lender itself has taken the keys to the business," as one direct lender explained.

Leverage

As for the profile of the deals themselves, the average EBITDA on mid-market deals is around €24.5 million, while the average quarterly deal size is €124 million from Q1'20 until Q2'21. More often than not, deals of this size have been already snatched up by private equity funds.

Over the past 18 months, the European mid-market has trended towards the most resilient sectors that naturally have higher leverage levels attached. But though average leverage has risen, market participants say that the dam has not broken and leverage multiples remain easily within the agreed level in their documentation.

The highest-quality assets that have attracted both sponsors and lenders alike have also seen their valuations rise steeply, along with leverage multiples. While private equity funds have been praised for having sharply increased their equity stakes in order to face those valuations, some deals have seen an increase in the debt leverage as well as payment in kind tranches. One of the most talked-about deals of 2021 so far is Blackstone’s acquisition of Belgian industrials asset Desotec, for example, which after a very competitive process was financed by an 8.5x cov-lite unitranche facility from Macquarie and Blackstone Credit.

Despite this example, however, the average multiple in the European mid-market since the second quarter of 2020 is around 5.08x. While this is relatively high, it is very much in line with leverage offered by alternative lenders. "I do not think Desotec sets a trend," said one debt adviser. "Even though it is obvious that it is a competitive market, you need a pretty strong company to be able to support that much leverage."

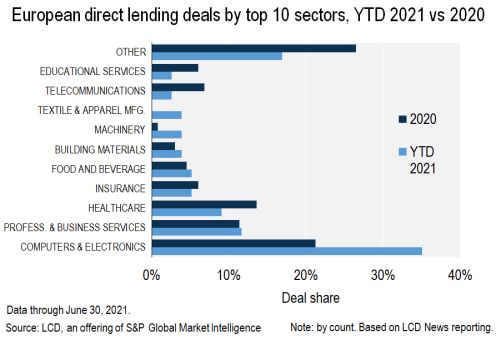

While some sectors are attracting funds like bees to honey, lender interest is mostly focused on computers and electronics, healthcare, and business services.

Lender education

However, with market participants reporting that competition in certain sectors is becoming “too much”, lenders and private equity funds alike are starting to turn away from the frenzy and look at other assets. "We are at a stage where both private equity and direct lenders do not want to spend an enormous amount of time to work on a deal that they would likely lose because of the competition, or even take too many risks in order to get the deal," said one debt-adviser source.

The educational services segment is a good example of an area where lenders are diversifying into new sectors, especially in France. In the past year, for example, deals such as those for ACE, Skill & You, Talis, College de Paris, L’Ecole Francaise, Medisup, AD Education, ISPS and Amphi have all filled the pipeline.

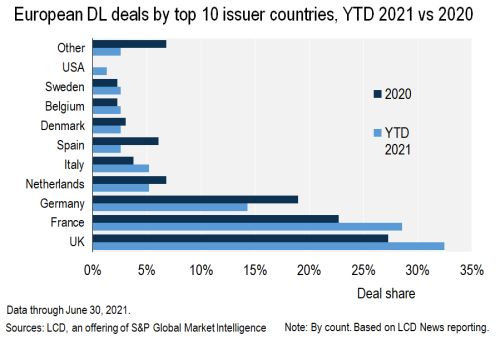

Indeed, France is one of the most active regions in direct lending, with the U.K. in pole position and Germany in the third place. In 2020, France accounted for 22.7% of total deals on LCD's measure, the U.K. for 27.3%, and Germany for 18.9%. So far in 2021, this split has increased to a 28.6% share for France and 32.5% slice for the U.K., while Germany's share has fallen to 14.3% of transactions.

ESG on the radar

One notable change in the European direct lending market since the beginning of the pandemic has been the introduction of environmental, social, and governance-related pricing criteria to transactions. Interest in ESG has been boosted by the health crisis, and now a number of mid-market deals include pricing mechanisms linked to ESG-related key performance indicators, or KPIs.

"In five years ESG investment will be one third of all global assets," said an ESG-specialized lender. "The only issue is that we do not have enough hindsight yet. It is however an increasingly scrutinized field, and KPIs are slowly standardizing."

Indeed, while the structure is still relatively new, terms are now becoming more standardized. For instance, the Loan Market Association and European Leveraged Finance Association have recently published a '"Best Practice Guide to Sustainability Linked Leveraged Loans" to provide practical guidance for market participants and improve transparency in the market.