S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Dec, 2021

By Sanne Wass, Rehan Ahmad, and Cheska Lozano

As Europe's banking sector records a significant reduction in problem loans, the European Banking Authority has raised concerns over banks' exposure to hospitality and leisure-related sectors, where nonperforming loan ratios are on the rise.

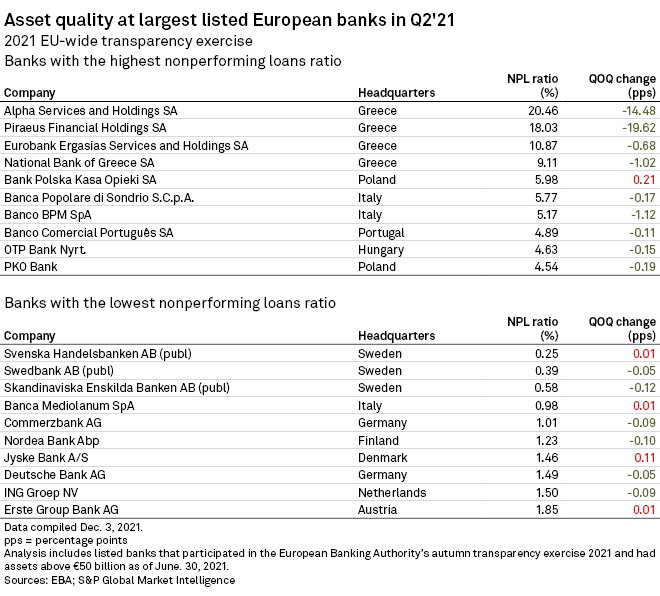

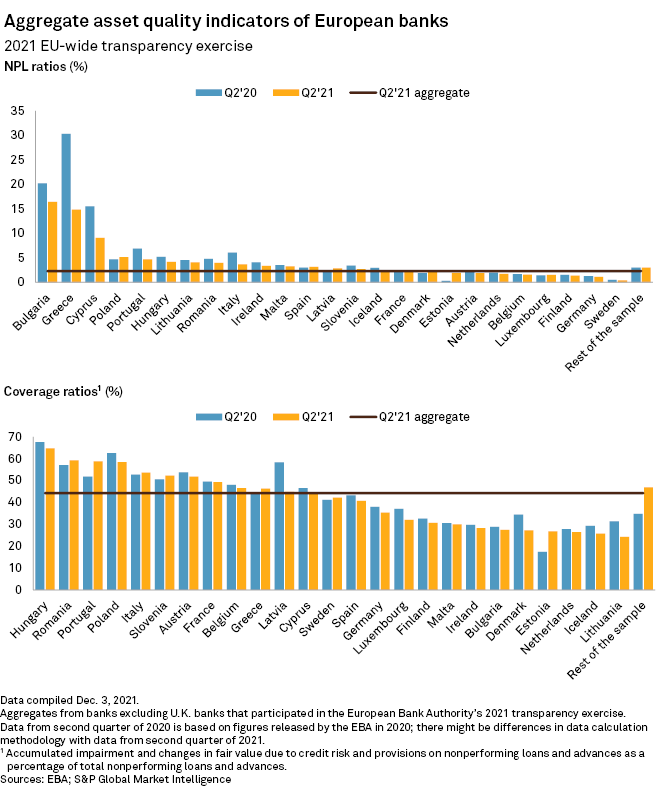

European banks' average NPL ratio decreased to 2.3% at the end of the second quarter from 2.9% a year earlier, a development supported by several large NPL disposals and securitizations in economies such as Italy and Greece, according to the EBA's annual risk assessment and transparency exercise, which covered 120 banks across 25 countries in the European Economic Area.

Click here to access the EBA Transparency Exercise template in the S&P Capital IQ Pro Template Library.

Greek banks posted an average NPL ratio of 14.8% at the end of the second quarter, down from 30.3% a year earlier, while Italian banks' NPL ratio dropped to 3.7% from 6.1%. Portuguese and French banks also contributed substantially to the reduction, the EBA found.

The average coverage ratio for NPLs decreased to 44.3% from 45.5% as the result of an approximately 18% year-on-year decrease in accumulated impairments and provisions for problem loans.

Hospitality takes hit

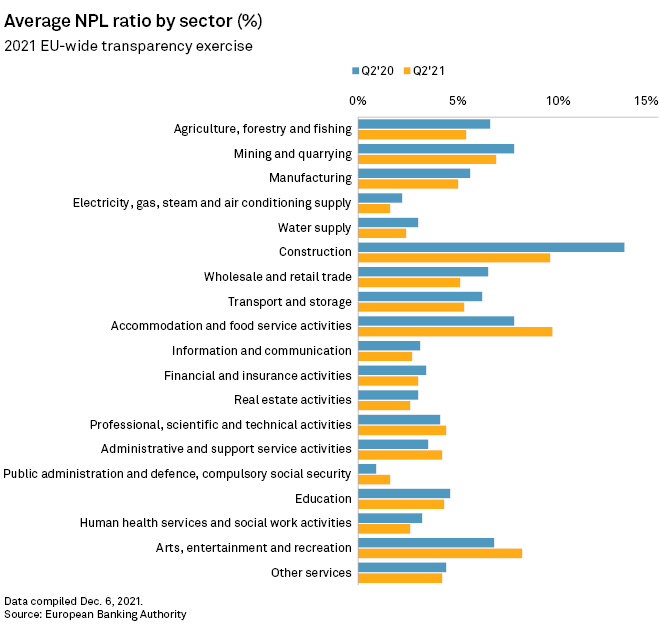

Despite the overall positive development, the EBA exercise exposed a deterioration in those segments affected most by the pandemic, in particular hospitality and leisure-related sectors, where reported NPL ratios have "edged up materially."

Europe's average NPL ratio in the accommodation and food service sector grew to 9.7% from 7.8% a year earlier. Banks in Cyprus, Greece, Croatia and Malta have the highest exposure to such activities, the EBA found, with more than 10% of their loans and advances to nonfinancial corporates being within this segment.

The average NPL ratio for the arts, entertainment and recreation sector increased to 8.2% from 6.8%, although the EBA said exposures in this segment are generally low across the region.

Loans benefiting from pandemic-related support measures are also "a source of potentially rising risks for EU banks," the EBA said, adding that an increasing share of such loans are being classified under stage 2 or as NPLs.

Stage 2 refers to loans that have had a significant increase in credit risk but do not have objective evidence of impairment. The share of stage 2 loans that have benefited from moratoriums is "particularly high" at 25%, while for public guarantee schemes this figure is 18.5%, the EBA said.

Despite reducing NPL volumes, Greek banks' average ratio was still elevated compared with the rest of Europe at the end of the second quarter. Alpha Services and Holdings SA, Piraeus Financial Holdings SA, Eurobank Ergasias Services and Holdings SA and National Bank of Greece SA ranked as the individual institutions with the highest ratios compared with peers.

The lowest NPL ratios were recorded by three Swedish banks, Svenska Handelsbanken AB (publ), Swedbank AB (publ) and Skandinaviska Enskilda Banken AB (publ).