S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Apr, 2021

By Vanya Damyanova and Rehan Ahmad

Loan loss provisions at major European banks should record a moderate decline in 2021 after peaking in the immediate aftermath of the COVID-19 outbreak in 2020, but are not likely to drop below pre-pandemic levels before 2022, credit rating analysts said.

A key factor affecting provision levels as economies recover will be the withdrawal of government and bank support schemes that bridged the short-term liquidity of pandemic-impacted borrowers, according to analysts at S&P Global Ratings, Fitch Ratings and DBRS Morningstar. As the schemes are wound down, credit loss provision levels may fluctuate as banks cope with an increase in bad loans.

Most large European lenders should be able to handle asset quality deterioration thanks to high capital buffers, but regional differences remain, the analysts said.

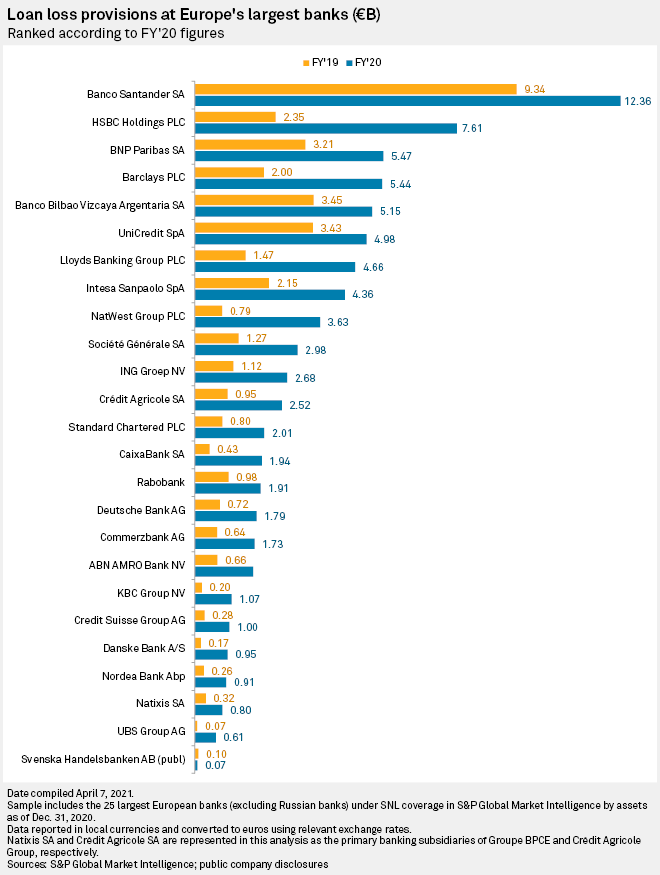

In 2020, 24 of Europe's 25 largest banks booked a year-over-year increase in loan loss provisions, with many doubling or even tripling their reserves as they braced for the impact of COVID-19, S&P Global Market Intelligence data shows. Spain's Banco Santander SA booked the highest provisions in the sample, of €12.36 billion, followed by U.K.-based HSBC Holdings PLC with €7.61 billion and France's BNP Paribas SA with €5.47 billion. Sweden's Svenska Handelsbanken AB (publ) was the only bank to book a year-over-year decline in 2020 provisions, but its cost of risk is expected to more than double in 2021.

Asset quality concerns

Fiscal support provided by governments has lasted longer than expected, meaning the emergence of problem loans, particularly in the corporate sector, will be delayed, according to Osman Sattar, director at the EMEA financial institutions team at S&P Global Ratings. Payment holidays and other forbearance schemes have been extended in various European countries and this obscures underlying asset quality issues which will become visible once they finish, he said in an interview.

An uptick in problem loans is likely to materialize in late 2021 and in 2022, Sattar said.

In 2020, European banks' nonperforming loans remained fairly stable as borrowers benefited from government support measures, Maria Rivas, senior vice president at the global financial institutions team of DBRS Morningstar, said in a written comment. In 2021, banks' cost of risk is expected to stay high, particularly when support measures are taken away, she said.

"The baseline expectation is that asset quality is going to deteriorate from 2021," Rafael Quina, director at the financial institutions team of Fitch Ratings, said in an interview. The mean impaired loan ratio at 20 large European banks reviewed by Fitch for the fourth quarter is 2.8%, and this is expected to reach 4% to 4.5% in 2021. Fitch Ratings has projected a gradual decline in the loan impairment losses in 2021, but says they will remain above pre-pandemic levels.

Assessing the performance of the top 50 banks in Europe, S&P Global Ratings has estimated the banks' credit loss provisions will fall to around $123 billion in 2021, after their peak of about $135 billion in 2020. In 2022, provisions should fall to approximately $88 billion, but still remain far above the actual credit losses of $54 billion booked in 2019, it said.

"Indeed, we expect that 2019 marked the end of a multiyear period of benign credit losses for banks globally, even as economies continue to recover from the pandemic," S&P Global Ratings said in a Feb. 2 annual overview.

Mixed 2021 picture

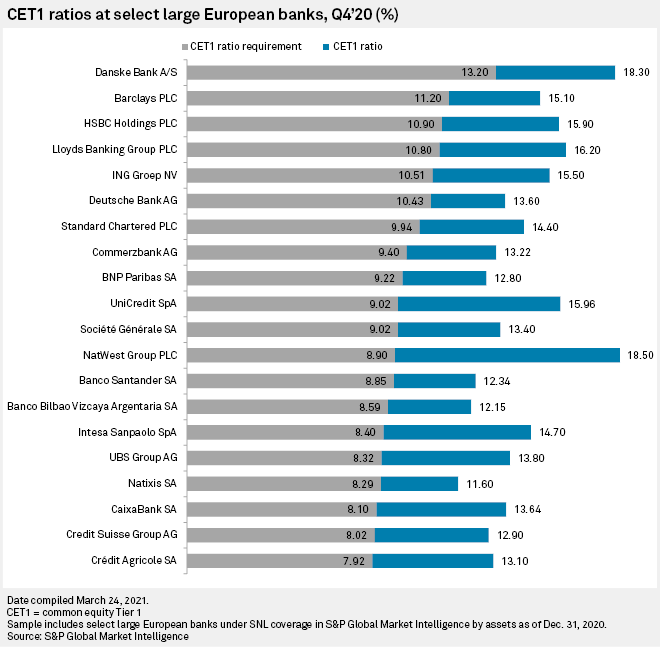

The largest European banks are well-positioned to deal with worsening asset quality and continue to reduce loan loss provisions. Their overall capitalization increased in 2020, driven by regulatory support measures as well as a de facto ban on dividends imposed by the ECB and national regulators across Europe.

The mean common equity Tier 1 ratio at Europe's top 20 banks rose by 100 basis points to 15% in 2020, according to Fitch Ratings. This means many are resilient enough to absorb moderate shocks going forward, Fitch's Quina said. Although many banks plan to resume dividends in 2021, the distributions are largely reflected in their CET1 ratios already and should not weigh on capitalization, he said.

Seven of the top 20 European banks had CET1 ratios above 15% in 2020, including Danske Bank A/S, HSBC, Barclays PLC, Lloyds Banking Group PLC, NatWest Group PLC, ING Groep NV and UniCredit SpA, S&P Global Market Intelligence data shows. Eight had ratios above 13% or 14%, while four banks — including BNP Paribas, Santander and Banco Bilbao Vizcaya Argentaria SA, and Credit Suisse Group AG — booked ratios below 13%. France-based Natixis SA was the only lender with a CET1 ratio lower than 12%.

Nevertheless, the future cost of risk and asset quality levels at the various banks will depend on their individual portfolio exposures and conditions in their domestic markets, given the divergence of economic and banking sector health in different European countries, according to the analysts.

"There have always been differences in terms of asset quality between the north and the south [of Europe]," Olivia Perney Guillot, managing director at the financial institutions team of Fitch Ratings, said in an interview. This north-south divide was observed in economic deterioration and the level of provisions taken across geographies in 2020, Perney Guillot and S&P Global Ratings' Sattar said.

Some banks in Spain, Italy and Portugal booked fewer provisions in 2020 compared to peers in the U.K., Ireland and the Netherlands, and may need to catch up in 2021, Sattar said. "It will be a little bit of a mixed picture," he said, referring to 2021 provision levels.

"We've seen a much bigger use of state- guaranteed loans and moratoria in the south," Perney Guillot said, which means banks in this part of Europe may face worse asset quality deterioration than those in northern Europe. S&P Global Ratings has also noticed the volume of loans granted under government guarantee schemes has been "pretty dominant" in countries like Spain and Italy, Sattar said.

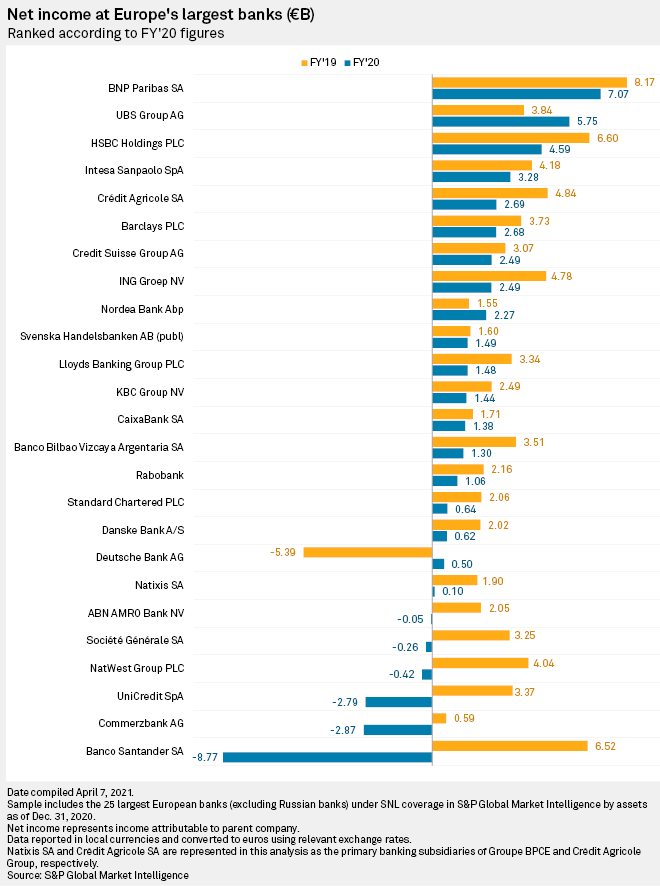

Despite topping the loan loss provision list alongside Santander, BNP Paribas and HSBC booked the largest and third-largest net income in 2020, respectively, S&P Global Market Intelligence data shows. Santander booked the largest loss in the sample. Seven out of the top ten performers by net income in 2020 came from the U.K., the Netherlands, Switzerland and the Nordics, the data shows. UBS Group AG, Deutsche Bank AG and Nordea Bank Abp were the only banks to book a better result in 2020 than in 2019.