S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jul, 2022

By Sanne Wass

European banks are vulnerable to climate-related credit risks in the short term, yet most institutions have not yet included climate in their credit risk models, according to the European Central Bank.

Four in five institutions neither consider climate risk as a variable when granting loans, the ECB said.

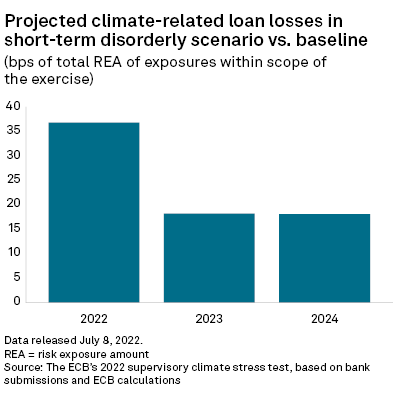

Banks participating in the ECB's supervisory climate stress test projected an increase in cumulative credit impairments of about 73 basis points of total risk exposure over the next three years in the event of a sudden increase in the price of carbon emissions.

High-carbon sectors, such as refined petroleum products, mining, minerals and land transportation, drove most of the losses. These sectors recorded cumulated credit impairments of more than 200 basis points, the ECB said.

The figures are likely to be higher in reality, according to the regulator. It said the projection made by banks "significantly understates the actual climate-related risk" and reflects "only a fraction of the actual hazard." The test suffered from scarcity of available data and limitations in the modeling, scope and scenarios, it added.

The ECB's complete exercise also found that

In total, 104 eurozone banks participated in the exercise, with 41 taking part in the bottom-up stress test in which institutions had to make projections on loan losses under different scenarios. It found that banks faced "a non-negligible increase in credit risk" in its "short-term disorderly transition scenario," which assessed European banks' vulnerabilities to climate risk between 2022 and 2024.

A "sharp, abrupt increase in the price of carbon emissions", coupled with floods and droughts, could lead to aggregate losses of about €70 billion for the 41 banks by 2024, the ECB found. The regulator did not disclose the carbon price used to make such an assessment.

Banks also made projections for loan losses when confronted with three different climate scenarios over a 30-year horizon. An orderly scenario assumes early, ambitious action to achieve a net-zero emissions economy by 2050, while a disorderly scenario assumes that action to reduce emissions is late, disruptive, sudden and/or unanticipated. The most severe "hot house world" scenario assumes limited action to reduce emissions, leading to a world with significant global warming.

Here, banks forecast loan losses between 16.5 basis points and 19.5 basis points of performing exposures in scope of the test. This "relatively low number" in the long-term scenarios was caused by the methodology, which assumed a dynamic balance sheet approach, said Frank Elderson, vice-chair of the European Central Bank's supervisory board, speaking at a press briefing. This means banks were allowed to project how their balance sheet will change under changing circumstances and as such adjust the portfolio that was tested in the exercise.

Capital impact

The test could have an indirect impact on banks' Pillar 2 requirements this year, said Elderson, as the results will feed into the Supervisory Review and Evaluation Process, or SREP, and may affect the scoring of banks' business models, internal governance or risk management. SREP assesses the way a bank deals with risks and the elements that could adversely affect its capital or liquidity, and it helps supervisors determine Pillar 2 capital requirements or guidance for an institution.

The ECB said the stress test is not a capital adequacy exercise but described it as a "learning exercise for banks and supervisors alike." The aim is to identify vulnerabilities, best practices and challenges banks face when managing climate-related risk.

Elderson hinted that climate stress tests will gain more importance and may have a more direct impact on capital requirements in the future.

"As with all material risks, climate-related factors will eventually be integrated in our risk-based supervisory approach," he said.

The Bank of England recently conducted a climate stress test on the largest British banks and also highlighted deficiencies in lenders' preparedness and ability to measure climate risk.