S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Aug, 2021

By Umer Khan

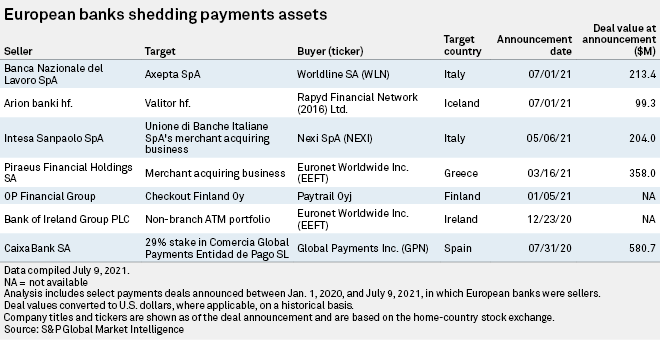

Lenders have sold at least $1.46 billion of payment operations since June 2020, including Greece-based Piraeus Financial Holdings SA's $358 million sale of its merchant acquiring business to Euronet Worldwide Inc. in March. Kansas-headquartered Euronet along with French payments giant Worldline have emerged as leading buyers.

Banks are selling these assets, or parts of them, after falling behind pure-play payments giants when it comes to building the huge networks needed to make a business viable. Specialists are keen to buy operations to add more reach in the European market, in which transaction volumes are slated to grow by 28.3% this year to $1.17 trillion, according to Finaria, an Italian investment and financial information company.

Deals "make a lot of sense for both sides," said David Vignon, equity research analyst, software and payments, at Bryan, Garnier & Co. And more may follow, given how many banks still own payment services, he said.

The buying of bank assets follows a period of consolidation during which payments companies bought peers, with Italy's Nexi SpA, for example, buying SIA SpA in a deal that created a merged entity with a value of more than €15 billion.

The great divestment

In July, BNP Paribas SA's Italian subsidiary Banca Nazionale del Lavoro SpA said it was selling a majority stake in payment processor Axepta SpA to Worldline SA, while Sweden's Svenska Handelsbanken AB (publ) announced it was sell its card-acquiring business, also to Worldline.

Payments is a business that operates best at scale, with companies increasingly favoring a "stack 'em high, sell 'em cheap" business model in order to stay competitive, according to Gary Prince, chief strategy officer and vice chairman at SimplyPayMe, a fintech that provides payments and invoicing services for small and medium-sized enterprises. Prince drew a parallel with the mobile telecom sector, where telcos had to function at vast scale in order to defend profits and market share due to very low margins.

In this "big is best" environment, it makes sense for banks to sell and for "pseudo infrastructure" companies such as payments giants to buy, Prince said in an interview.

Cyrus Pocha of law firm Freshfields has observed a trend of banks or bank consortia divesting payments business over the past 15 years.

In some cases, these were forced disposals — in a famous example, RBS (now NatWest Group PLC) had to sell WorldPay to U.S. private equity firms Advent International Corp. and Bain Capital LP in 2010 as part of the conditions of its bailout — but there are other reasons for the pullback, according to Pocha, who serves as partner, financial services regulatory and co-head, of the global fintech group at Freshfields in London.

Banks are often not the best owners of payments businesses, in part because the development of a stand-alone payments industry has meant payment services are often not considered to be part of a bank's core services, Pocha said.

Furthermore, payments businesses need funding in order to grow, innovate and remain competitive, which is something banks might not be in a position to provide, he said.

PE: Missing in action

Private equity companies have been active buyers of unwanted bank assets over the past two years, with Cerberus Capital Management LP's recent deal to buy HSBC Holdings PLC's French retail banking arm being one example of many. But during that period they have been almost entirely absent from deals involving European payments assets; this is in contrast to the 2010s, when they made a number of high-profile payments investments.

Large payments firms Worldline, Euronet Worldwide and Nexi have been key buyers, along with Atlanta, Ga.-based Global Payments Inc., which bought a 29% stake in a CaixaBank payments business, Comercia Global Payments, in 2020.

Meanwhile, some banks, such as Finland's OP Financial Group, have decided it is better to partner with payments companies rather than owning them. The bank concluded the sale of Checkout Finland Oy to major Nordic payments company Nets Holding A/S in January this year.

"[The payment services provider] business needs continuing development, and we want to focus our development efforts on our strategic focus areas," OP's Jari Jaulimo, head of transaction banking, said in an email. OP Financial Group already has a good relationship with Nets, and a partnership will result in "wider coverage" to distribute its services through the e-commerce market.