Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Jan, 2023

By Cathal McElroy and Rehan Ahmad

| Christine Lagarde, president of the European Central Bank, which raised interest rates Dec. 15, 2022, for the fourth time in succession. Source: Thierry Monasse/Getty Images News via Getty Images Europe |

European banks are on course for a surge in income from lending in 2023 as central bank interest rate rises feed through to their loan books, concluding more than a decade of squeezed margins.

Analysts forecast aggregate net interest income — the difference between interest revenues and interest expenses — will grow more than 10% in 2023 at a selection of Europe's largest banks, S&P Global Market Intelligence data shows. Such an increase would give the banks more than €25 billion in additional revenue from NII, which represents the majority of income for most lenders, the data shows.

The prospect of an even greater jump in NII in 2023 was boosted Dec. 15, 2022, when the European Central Bank said further significant rate hikes were likely after it raised its key interest rates for the fourth time in succession.

Rates were raised by 50 basis points, bringing the total increase since July 2022 to 250 bps. The eurozone's central bank said further increases were necessary as inflation remains "far too high." The Bank of England and other central banks across Europe also increased rates in December 2022.

While some benefits from higher rates have already been felt, the "big increase in NII is going to be materialized in 2023," Gonzalo López, bank equity analyst at Redburn, said in an interview.

A rising tide

Of a sample of 27 of Europe's largest banks, all but one are forecast to post higher NII in 2023, Market Intelligence data shows.

Among those set for the biggest NII gains are lenders from Spain, Italy and the U.K. Spanish and Italian banks are more sensitive to rising rates due to holding a higher proportion of variable-rate loans that reprice regularly in line with Euribor, or the euro interbank offered rate, the rate at which eurozone banks lend to each other. The Euribor yield for lending over 12 months has risen from almost negative 0.5% at the start of 2022 to close to 3.2% as of Dec. 21, 2022.

"For some European banks, the recent increases in Euribor are going to be translated to their loan books in a very short period, so no more than 12 or 18 months," said López.

Spain's biggest domestic lender, CaixaBank SA, has the largest forecast NII increase for 2023 at almost 23%, with Italy's Intesa Sanpaolo SpA close behind at around 22%, the data shows.

Long-awaited recovery

The bullish outlook for NII comes after more than 10 years of record low interest rates across Europe compressed lending margins for banks, shrinking NII and weakening profitability. Lenders were forced to find ways to boost fee revenue and develop alternative income streams from sectors like vehicle leasing and property ownership.

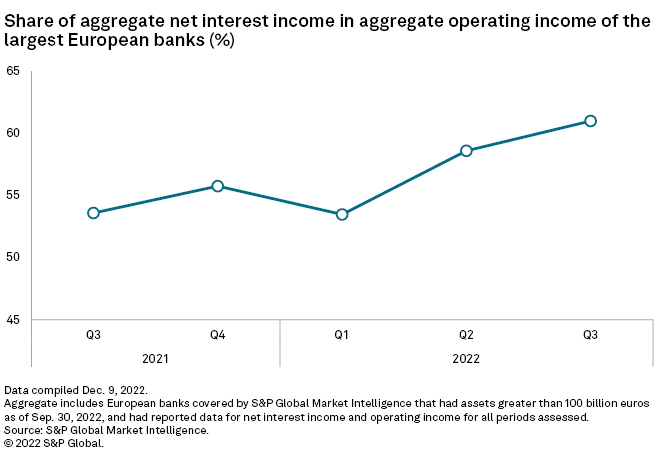

Some of the benefits of higher central bank rates have already fed through, helping lenders restore the predominance of NII in their revenue profiles. Aggregate NII increased to almost 60% of aggregate operating income at a selection of Europe's largest banks in the third quarter of 2022 from less than 53% in the same period a year earlier, Market Intelligence data shows.

Still, the pace of NII growth will vary significantly across Europe's banking sector. Banks in markets where fixed-rate loans tend to be more popular, such as France, Germany and Belgium, should benefit from issuing new loans at higher rates, but rates on older loans will only gradually reprice in the coming years, said Sam Theodore, senior consultant at Scope Insights.

"These banks will have to reprice the bulk of their loan portfolios slower than banks in Italy, Spain, the U.K., Ireland, the Netherlands or in the Nordics," Theodore said.

French banks lose interest

Lenders in France face added pressure on NII on two other fronts. The banks had higher deposit expenses in the second half of 2022 after the French government raised the rate on the country's regulated savings program, Livret A. Another increase is expected early this year.

The banks also face limits on charging higher rates on mortgages that could offset such costs due to the country's usury rate, which is capped and revised only once a quarter.

"So far, rate rises have been, net-net, a negative outcome for the French banks versus the rest," said Flora Bocahut, bank equity analyst at Jefferies.

For all eurozone banks, another NII headwind will come with the change of the terms of the ECB's third targeted longer-term refinancing operation funds. Banks in the bloc have collected interest from depositing at the ECB unused TLTRO III funding, which was created to encourage lending to the real economy during the COVID-19 pandemic. This has boosted some banks' NII by hundreds of millions of euros per year.

The TLTRO benefits from 2022 will not be repeated into 2023, said Jon Peace, head of European banks research at Credit Suisse.

The end of TLTRO could also bring added pressure for banks to increase rates on deposits, thereby squeezing margins and reducing NII. TLTRO III has provided lenders with additional liquidity, reducing banks' reliance on customer deposits for funding. Banks are due to repay €1.3 trillion of the €2.2 trillion total in June.

"This may be the trigger point when banks start competing more for deposits and we see the pickup on deposit costs," Pablo Manzano, vice president, financial institutions, at credit rating agency DBRS Morningstar.

Until then, most European banks should continue to enjoy the upsides of the higher-rate environment as the boost to NII filters through to their bottom lines.

"Finally, after many years, European banks are achieving a decent level of profitability," said Theodore.