S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Mar, 2022

By Sanne Wass

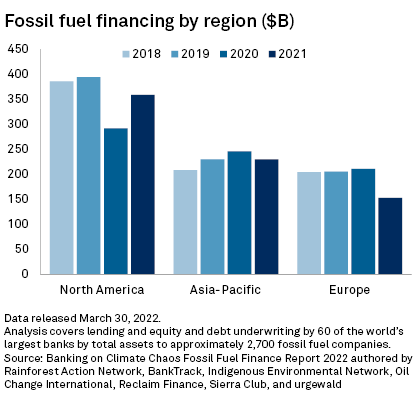

Large European banks cut financing to fossil fuel companies by 27.6% in 2021 amid mounting shareholder pressure and the publication of new funding policies, while U.S. and Canadian peers increased their financing, according to new research.

Pressure from investors is having a "clear impact" on some banks' climate strategies, with U.K. lenders such as Barclays PLC and HSBC Holdings PLC releasing new policies after facing shareholder resolutions, said Maaike Beenes, campaign lead at BankTrack, one of the environmental advocacy organizations behind the new Banking on Climate Chaos report.

Barclays' financing to oil, gas and coal companies dropped 30.1% to $19.6 billion in 2021, and HSBC recorded a 26.8% decline to $18.0 billion, the research found.

Pressure from large investor groups will only grow further, and other banks would be wise to get ahead of the game and act before shareholders force them to, Beenes said in an interview.

Nine of the largest U.S. and Canadian lenders face climate-related shareholder proposals at their 2022 annual general meetings despite efforts by some banks to have the resolutions omitted from their proxies, according to the Interfaith Center on Corporate Responsibility, a coalition of shareholder advocates.

Shareholders are especially concerned that banks may use the Russia-Ukraine conflict as a reason to expand oil and gas production, the coalition said March 28, arguing that supply disruptions resulting from the invasion highlight the need to transition to renewables and build energy independence.

North American banks increase fossil fuel financing

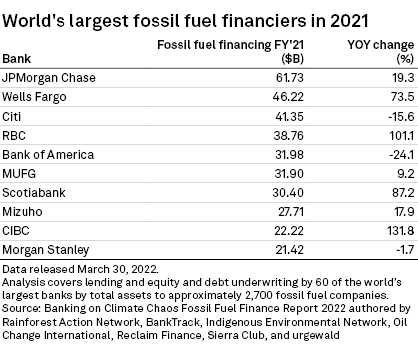

Large U.S. and Canadian banks recorded a combined 22.7% increase in funding to oil, gas and coal companies in 2021, and accounted for eight of the world's 10 worst fossil fuel funders last year, according to the Banking on Climate Chaos report.

This came as banks lined up behind ambitious carbon neutrality promises through the Net-Zero Banking Alliance and other initiatives. The report authors named 2021 the "year of hypocrisy," saying that "banks prematurely patted themselves on the back for adopting financed emissions targets a generation away while delaying serious climate action now."

The research analyzed financing to thousands of fossil fuel companies through lending and underwriting of debt and equity issuances by 60 of the world's largest banks, 44 of which have committed to net-zero emissions by 2050. Globally, banks provided a total of $742 billion to the industry in 2021 — a similar level to 2020 — almost half of which was provided by North American institutions, it found. That brings the total in the six years since the Paris Agreement on climate change to $4.6 trillion.

Most significantly, Canadian banks increased their fossil fuel financing 70.2% in 2021, while funding from U.S. institutions increased 5.7%. Beenes said the growth among Canadian institutions may be explained by a post-pandemic demand for financing from the tar sand industry.

Large U.S. lenders JPMorgan Chase & Co., Wells Fargo & Co., Citigroup Inc. and Bank of America Corp., which all joined the Net-Zero Banking Alliance last year, continue to dominate the global fossil fuel financing space, although Citi and Bank of America both saw a drop in financing compared to 2020.

JPMorgan ranked as the top fossil fuel funder of 2021, providing $61.7 billion to oil, gas and coal, a 19.3% increase from 2020, the research found. A JPMorgan spokesperson said the bank is "taking pragmatic steps" to meet its 2030 emission reduction targets while "helping the world meet its energy needs securely and affordably." The bank facilitated more than $100 billion for green activities in 2021, it said.

A Citi spokesperson said its climate strategy prioritizes the bank's role in "responsibly driving the transition to a net-zero economy," and that it focuses on working with its fossil fuel clients to help them decarbonize their businesses. The bank will continue to strengthen its policies and expectations for clients in specific carbon-intensive sectors, it added.

The picture in Japan, Europe

Japanese banks Mizuho Financial Group Inc. and MUFG also landed among the 10 largest fossil fuel financiers in 2021, having both increased their financing to the industry. A Mizuho spokesperson said the bank discloses carbon exposures in its Task Force on Climate-Related Financial Disclosures report, and that high-risk and carbon-related exposures were both down this year compared to 2020. Overall, fossil fuel financing in Asia-Pacific dropped 6.6% in 2021, according to the Banking on Climate Chaos report.

Wells Fargo, Bank of America, MUFG, Barclays, HSBC, Royal Bank of Canada, Scotiabank, Canadian Imperial Bank of Commerce and Morgan Stanley did not respond to a request for comment.

In Europe, ING Groep NV was among the few banks that increased its fossil fuel financing in 2021, by 72.4% to $10.8 billion. A spokesperson for the Dutch bank told S&P Global Market Intelligence it does not recognize the high numbers represented by the research, saying it is reducing its upstream oil and gas portfolio and bringing its funding of coal-fired power plants close to zero by 2025.

"We are taking steps, but stopping funding oil and gas overnight is going a step too far for us. It is not necessary [in order] to achieve the climate goals and it puts the security of our energy supply and its affordability at risk," the spokesperson said, adding that ING is supporting its customers in the necessary transition from fossil fuels to renewable energy.

Some of the largest financing declines happened at French banks BNP Paribas SA, Crédit Agricole SA and Société Générale as fossil fuel policies started to impact volumes.

BNP Paribas, Europe's largest bank by assets, reduced it fossil fuel financing by 65.4%, to $14.7 billion in 2021, from $42.7 billion in 2020. A spokesperson said the drop was driven by the bank's commitment to exit thermal coal by 2040, a decision to end financing for specialists in unconventional hydrocarbons, and a 2025 reduction target for exposure to oil exploration and production. Reducing its fossil fuel exposures will continue with additional commitments, it said.

French banks have implemented some of the strongest fossil fuel financing restrictions in the world, according to BankTrack, which scores every bank's oil, gas and coal policies. Crédit Agricole's fossil fuel financing was down by 49.1% in 2021, and Société Générale's by 30.6%.