S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Aug, 2023

By Darragh Riordan and Marissa Ramos

Deposits held by banks across Europe fell in the past 12 months, reflecting customers' efforts to seek higher-yielding products and pay down increasingly expensive debt.

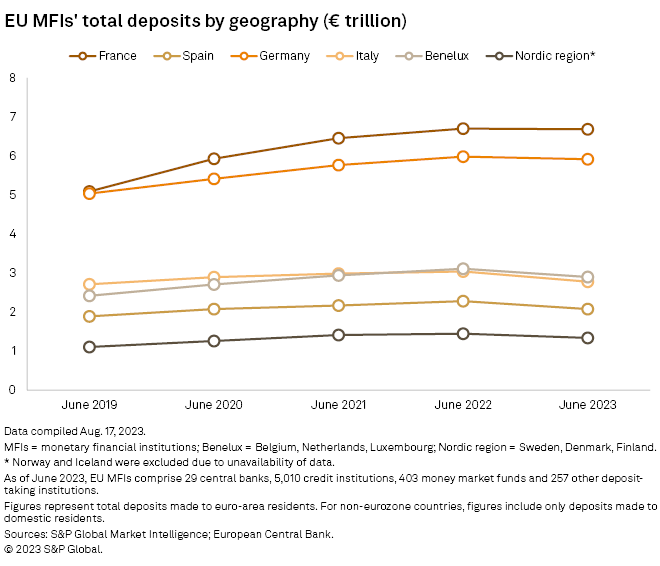

Total deposits at European monetary financial institutions in France, Germany, Spain, Italy, and the Benelux and Nordic regions fell 3.9% year over year to €21.675 trillion in the 12 months to June 2023, data from S&P Global Market Intelligence and the European Central Bank shows. Deposits fell in all markets, with Spain leading the way with a 9.0% drop.

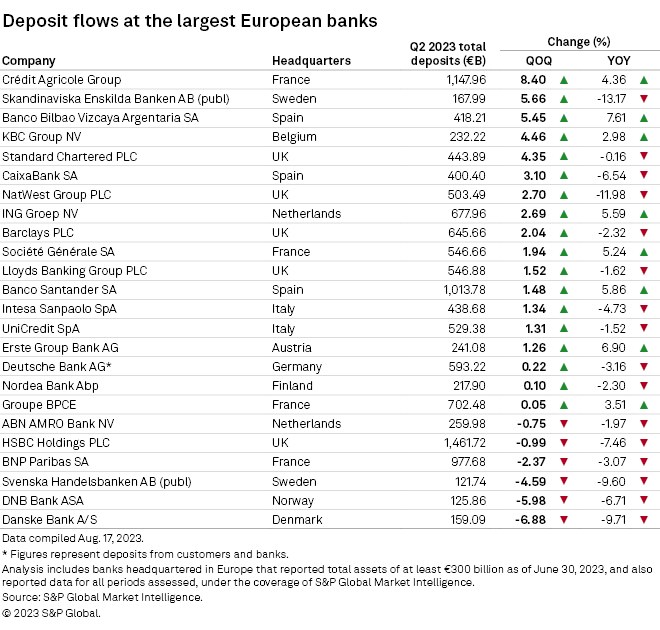

Among a sample comprising 24 of Europe's largest banks, 16 reported year-over-year decreases in deposits for the second quarter, Market Intelligence data shows.

NatWest Group PLC had the second-largest year-over-year deposit decrease in the sample at nearly 12%, behind only Skandinaviska Enskilda Banken AB (publ) at 13.2%. The UK bank has noticed customers using deposits to pay down more expensive forms of debt such as mortgages, CFO Katie Murray said on its latest earnings call.

NatWest has also seen customers shift from noninterest-bearing accounts to term deposits, which now comprise 11% of all deposits compared to 6% at the start of 2023.

Banks have been slow to pass on higher interest rates to depositors, which has prompted customers to shift money to higher-yielding term accounts and other products. The slow rate of transfer, known as the deposit beta, has also drawn criticism from politicians and regulators and contributed to the introduction of windfall taxes across the continent.

There are indications that deposit flows are stabilizing, however, with just six banks reporting quarter-over-quarter decreases compared to 14 of 26 banks sampled after the first quarter. Danske Bank A/S, which reported the largest quarterly decrease at almost 6.9%, attributed the fall to foreign exchange headwinds and said deposit volumes actually rose during the period.

UK lender Lloyds Banking Group PLC expects there to be "fewer prods" for customers to move deposits in the second half of the year as base rates near their peak, CFO William Chalmers said on an earnings call. Wage increases are having a positive impact on deposit levels, Chalmers added.

– Access the peer analysis template on S&P Capital IQ Pro.

– View loan and deposit composition data for NatWest on S&P Capital IQ Pro.

– Read the transcript for Lloyds Banking Group's latest earnings call.

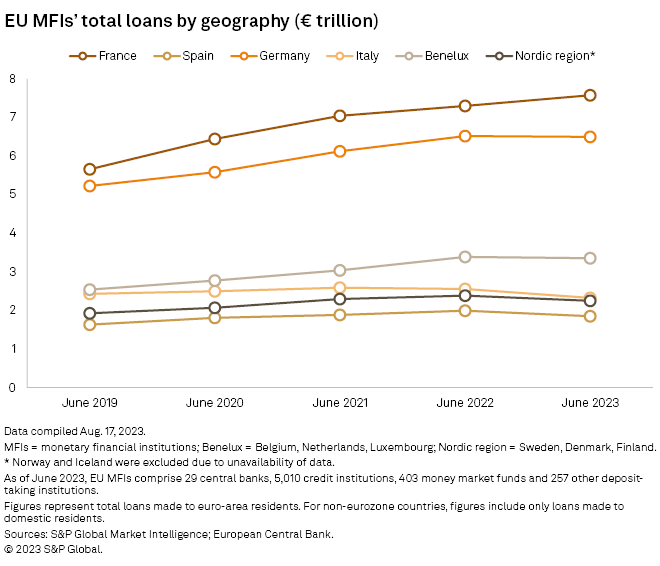

The picture for loans was more mixed. Aggregate loans across the region fell 1.2% to €23.852 trillion in the year to June 2023, but there were significant variances between markets. Total loans in France, for instance, rose 3.8%, while loans in Italy fell 9%.

The aggregate loan-to-deposit ratio among Europe's biggest banks nudged up one percentage point year over year to 100.12%. Svenska Handelsbanken AB (publ) had the highest ratio at 162.92%, up from 155.95% in the year-ago period, followed by Nordic peers Nordea Bank Abp, Danske Bank and DNB Bank ASA.

Standard Chartered PLC's loan-to-deposit ratio fell on a yearly basis from 63.15% to 59.87%, the lowest ratio in the sample. Fellow UK banks HSBC Holdings PLC and Barclays PLC also had low ratios.