S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Jun, 2021

By Sanne Wass

Nearly all of Europe's major banks are now linking executive pay to diversity and inclusion targets, which experts hail as an important move but warn that banks need to go further to diversify their workforces.

Of the 13 European lenders categorized as global systemically important banks, or G-SIBs, 11 confirmed to S&P Global Market Intelligence that they have incorporated diversity and inclusion metrics into executive pay decisions.

Spain's Banco Santander SA, for example, measures part of executive directors' remuneration against progress toward 11 targets for responsible banking, including a goal to increase female representation in leadership roles to 30% and reduce the gender pay gap to zero by 2025. British lender Barclays PLC uses metrics such as the improvement of inclusion scores in employee surveys and progress against a 28% female leadership target by 2021.

Crédit Agricole SA's group CEO and deputy CEO are evaluated against targets around the number of internships provided to students living in less-favored regions and improvements related to non-French employees considered in top governance succession plans.

HSBC Holdings PLC, ING Groep NV, UniCredit SpA, Standard Chartered PLC, UBS Group AG, Deutsche Bank AG, BNP Paribas SA and Société Générale SA are also among European G-SIBs with similar measures. Credit Suisse Group AG declined to comment on whether diversity and inclusion targets are included in its executive compensation, while Groupe BPCE did not respond to the request.

None of the 13 banks agreed to be interviewed on the matter.

Early-moving banks

The trend of linking executive pay to environmental, social and governance measures more broadly is "gaining a lot of momentum" across industries, but banks have been early movers when it comes to using diversity targets, said Katy Bennett, a director at PricewaterhouseCoopers focused on diversity and inclusion in financial services.

A recent PwC report found that 45% of the U.K.'s 100 largest companies now include ESG targets in decisions around executive bonuses, long-term incentive plans, or both, and that 28% use metrics relating to "newer" ESG topics such as climate change, employee inclusion and diversity. The latter most commonly appear at financial services institutions, the research found.

The average weighting of diversity-related measures among the 20 largest financial services companies in the U.K. is 6.7% in the annual bonus and 5.3% in the long-term incentive plan, according to PwC.

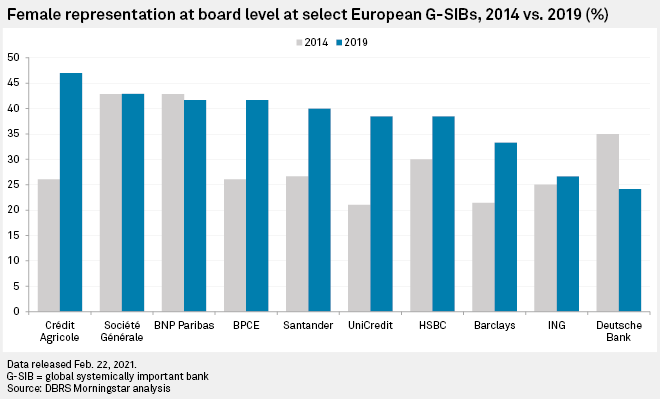

Female representation at board level increased at most European G-SIBs from 2014 to 2019, a DBRS Morningstar analysis shows, though there was a notable drop at Deutsche Bank, which has undergone a major restructuring in recent years.

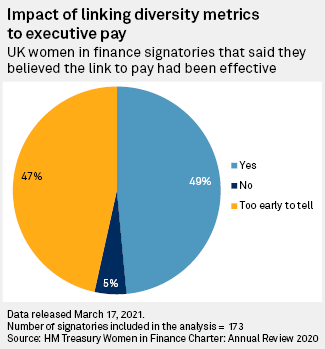

Not only have financial services firms moved quickly on this front, they are also taking "an increasingly granular approach to implementing the link to pay," and have a "greater expectation that senior leaders will deliver," according to the U.K. government's latest annual review of the progress made against the Women in Finance Charter. It said 2020 marked "a step change in the quality and quantity of signatory reporting on the link between pay and diversity targets."

The HM Treasury Women in Finance Charter, launched by the U.K. government in 2016, has now been signed by more than 400 banks and financial services firms, including many of Europe's largest lenders. Signatories to the charter commit to a range of measures, including linking senior executive pay to performance against internal gender diversity targets. Some institutions have extended this to include objectives related to ethnic diversity, according to the charter review, which was published in March.

The charter, along with strong interest from financial regulators in diversity and inclusion, has been one of the key drivers for banks adopting such measures, according to PwC.

Targets 'not sufficient'

Adopting diversity targets in executive pay evaluations is "important, because ultimately, the things that you use to determine pay are a really strong indication of the things that you're saying are important strategically," Bennett said in an interview.

|

But getting the targets right is "really difficult" as there are no objectively "good" or "bad" diversity objectives and they will depend on banks' own culture and often also the country in which they are based, she added.

One challenge is that diversity and inclusion targets will often have qualitative dimensions that can rarely be captured in metrics, PwC said in its report. Furthermore, including certain targets in pay decisions "could risk a focus on a single dimension of diversity at the expense of others, for example ethnic diversity or cognitive diversity." A company may hit its board-level gender diversity target but fail to address the challenge of creating an inclusive culture, PwC said.

Linking executive pay to diversity and inclusion is "necessary but not sufficient," said Lorna Fitzsimons, co-founder of The Pipeline, a British consultancy focused on diversity. "Diversity and inclusion targets on their own do not move the dial.

"You can set a target, but if you're not resourcing against it, and the behaviors of the chief executive aren't showing the organization that they're serious about it, the target is harder to reach and you will not get as much return on investment."

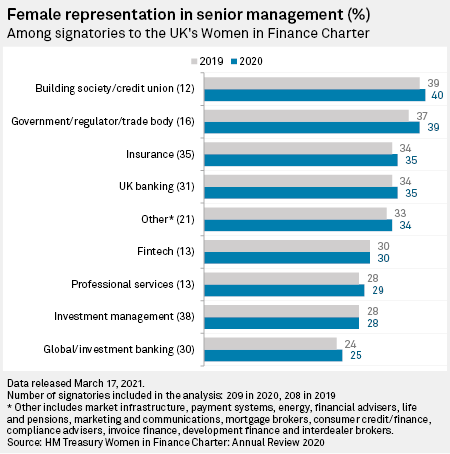

The average level of female representation in senior management among the Women in Finance Charter signatories increased to 32% in 2020, from 31% the year before, according to the review. The financial services industry is "moving in the right direction" on its diversity efforts, it found, but also recorded "disappointing" developments, as more than half of the charter signatories with a 2020 deadline missed their targets.

Whether incorporating diversity metrics into pay structures is efficient as an incentive will depend on how the leadership uses the tool when pay is determined, and also how the weighting translates into monetary amounts, said Roianne Nedd, global head of diversity and inclusion at consultancy Oliver Wyman. At some institutions, the "penalty" for failing to meet a target may not be material, she added.

ING executive board remuneration, for example, is guided by a target to "increase gender balance in ING's leadership cadre," but failing to meet this goal "doesn't immediately mean that the variable remuneration will not be granted, because it is possible to overachieve on other targets" within a broader "people" category, a spokesperson for the bank said in an email.

"You can have anything written down on a piece of paper, but it's really about the courage of the top leader and whether they're going to pull that lever or not," Nedd said.