S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jul, 2022

By Sanne Wass, Rebecca Isjwara, John Wu, and Rehan Ahmad

Europe's dominance in the green bond market appears to be diminishing as Asia-Pacific supply picks up, driven by growth in China.

European green bond issuance fell to $46.5 billion in the second quarter from $74.19 billion in the same period last year, according to the Climate Bonds Initiative, a U.K.-based green debt tracker. While Europe remained the highest-contributing region to green debt globally, its share of issuance dropped to 41.7% in the quarter from 54.8% a year ago.

North American green bond supply also declined significantly in the second quarter, dropping to $9.40 billion year over year from $25.91 billion. The region's share of global issuance shrank to 8.4% from 19.1%.

Meanwhile, issuance of internationally aligned green bonds in Asia-Pacific reached its highest level to date, as new regulation and growing demand from global investors drove record supply from China. Green bond issuance in the region totaled $39.15 billion in the second quarter, up from $29.44 billion in the same period last year. It helped Asia-Pacific grow its share of global green bond issuance to 35.1% in the quarter from 21.7% a year earlier.

"China has been the major contributing factor to the [Asia-Pacific] region's growth," EY's Asia-Pacific sustainability leader, Judy Li, said. A regulatory push in China to align sustainable debt with international standards is helping green bond issuers to attract more international investors, and will support further expansion of China's green bond market, Li said.

Updated taxonomy in China

|

An update to China's green taxonomy last year was "an integral step to bridging the gap with international markets," Li said. It saw the adoption of the internationally accepted principle of "do no significant harm" and the removal of carbon-intensive projects, such as clean coal technology. The Common Ground Taxonomy, first published in November 2021 and updated in June, is also helping issuers offer green bonds that align with the green credentials of both China and the EU.

Internationally aligned green bonds in China more than doubled year over year to US$23.91 billion in the second quarter, cementing China's position as the world's biggest green bond issuer in 2022.

Elsewhere, green bond issuance generally slowed down compared to last year. Volatile markets, lower liquidity and uncertainty around interest rates have pushed up the cost of funds for issuers and prompted many to postpone deals, according to Pietro Sette, research associate at sustainable investments advisor MainStreet Partners. The industrials sector, which analysts had forecast to fuel supply growth this year, has particularly lagged, Sette said.

In Europe, which has historically dominated the green bond market, issuers increasingly moved to instead issue sustainability-linked bonds, which unlike traditional green bonds are not ring-fenced for specific environmental projects. Such securities, the pricing of which is linked to predefined environmental, social and governance targets, accounted for almost 30% of all European non-financial corporate bond issuance during the first half of 2022, up from 19% in the same period a year earlier, according to Scope Ratings. The agency expects the European ESG-linked bond supply to settle at about 29% of non-financial corporate bond issuances in 2022, while for North America and Asia, this figure is expected to be about 5% and 6%, respectively.

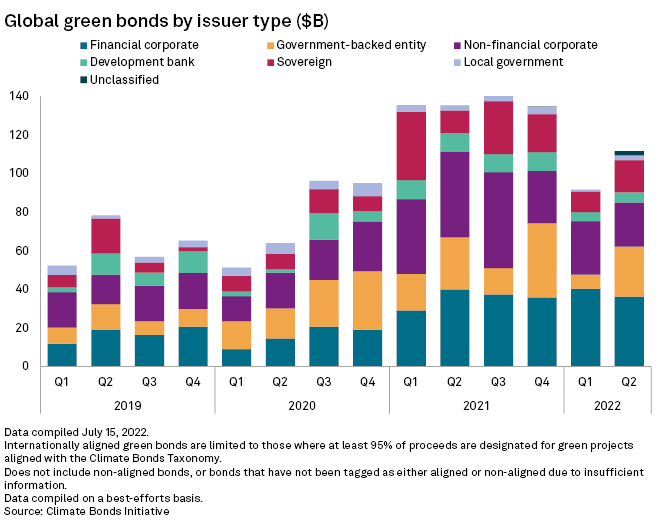

Global issuance of green bonds reached $111.63 billion in the second quarter, recovering from $91.75 billion in the first quarter, but is still below the $135.41 billion issued in the second quarter of 2021.

The data covers bonds aligned with Climate Bonds Initiative definitions. Another $17.46 billion of green bonds issued globally in the second quarter of 2022 were reported by the Climate Bonds Initiative as non-aligned, while $17.65 billion have not yet been categorized.

Global growth ahead

Analysts are optimistic that green bond issuance will pick up across regions once economic and market conditions are more stable.

"There is a big backlog," Sette said. "Companies are really ready to invest, but there is no certainty on the interest rate path for now."

The trend of growing investor interest in sustainability is undistorted by current events, said Bram Bos, lead portfolio manager for green, social and impact bonds at NN Investment Partners. "The demand is still strong. Maybe there was a very short hiccup indeed, but the trend is very much in place, and it's not going to change by any war or political events happening at the moment," Bos said.

Regulatory initiatives are also expected to fuel issuance growth in Europe, with the EU taxonomy giving more clarity to the market as to what can be labeled a green asset, the portfolio manager added.

"In some sectors, it's a bit more difficult to define what's green and what's not, for sure in industrials. So I think [the EU taxonomy] will help also to accelerate issuance in the corporate sector, specifically in Europe," Bos said.

So far, the European Commission has released its first green taxonomy criteria covering sectors such as energy, forestry, manufacturing, transport and buildings. It is set to publish more criteria this year.

Bos also expects more issuance from the EU itself, as the bloc progresses on plans to sell €250 billion worth of green bonds through 2026. EU green bond issuance came in at €11 billion, or $12.36 billion, in the second quarter, although this is classified as a supranational by the Climate Bonds Initiative, a separate category to Europe.