S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Feb, 2022

By Jon Rees and Cheska Lozano

The European Central Bank is warning banks against the early release of loan loss provisions and wants to ensure the assumptions behind existing provisions prove accurate ahead of further releases.

Banks added provisions — funds set aside to cover future nonperforming loans — at the beginning of the COVID-19 pandemic and some have started to release them. The provisions include post-model adjustments, also known as management overlays, which are assumptions of expected credit losses applied when a bank's modeling is deemed insufficient.

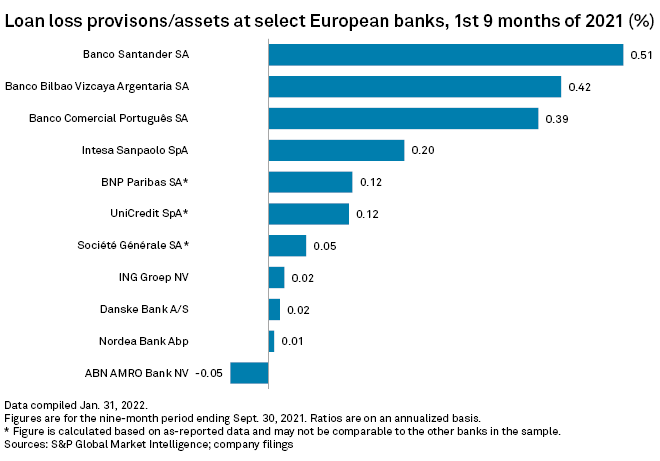

Some banks including Netherlands-based ABN AMRO Bank NV have begun to release provisions. Lenders should be "extremely prudent" and avoid releasing pandemic-related provisions too early, ECB Supervisory Board Chair Andrea Enria told French newspaper Les Échos in January. Regulators want banks to focus not just on individual borrowers' default risk but also on sector exposures, as state-backed support is wound down and inflation rises.

"The regulator is urging banks to think about when this fiscal support ends," said Osman Sattar, an analyst at S&P Global Ratings. "Particular groups of borrowers might be more stressed than others and need additional support."

Post-model adjustments

The ECB closely monitors how banks measure credit risk, including post-model adjustments, or PMAs, and has previously found that a number of banks lacked justification for decisions relating to PMAs, a spokesperson for the central bank told S&P Global Market Intelligence.

"Banks might start to see the need for additional provisions that the PMAs don't cover," Sattar said.

Some big European banks have made significant additional provisions by way of PMAs. Spain's Banco Bilbao Vizcaya Argentaria SA reported that, as of Sept. 30, 2021, it had management adjustments to its expected losses of €304 million. Italy's UniCredit SpA's overlays stood at €450 million for the same period. Denmark-based Danske Bank A/S reported 6 billion kroner of post-model adjustments at Sept. 30, 2021, down from 6.4 billion kroner a year previously.

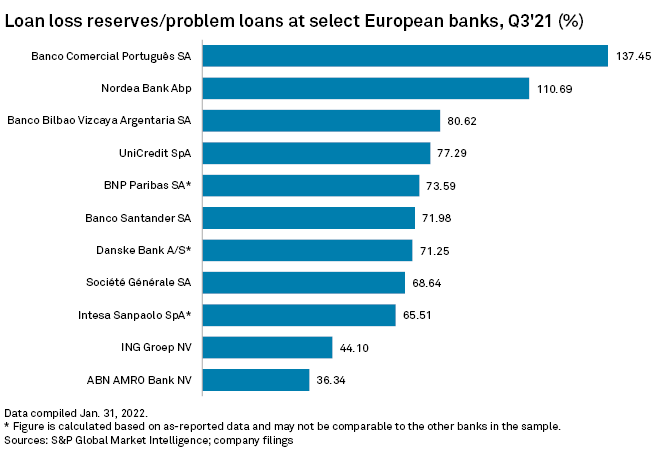

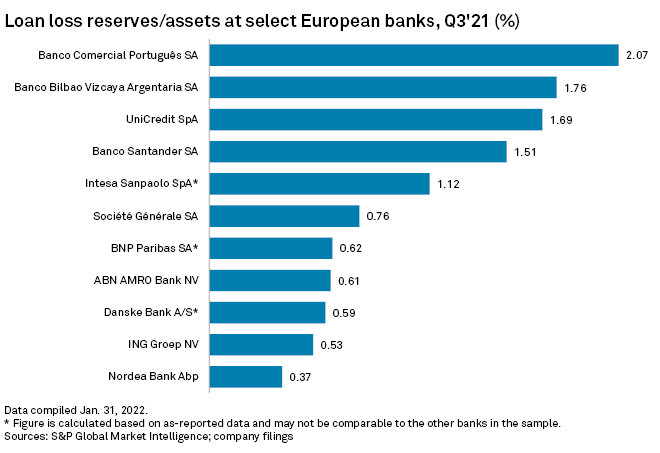

Among a selection of large European banks, Banco Comercial Português SA had the highest level of loan loss reserves as a proportion of total assets at the end of the third quarter of 2021, at 2.07%, while Finland-based Nordea Bank Abp had the lowest at 0.37%. Over the first nine months of last year, Spain's Banco Santander SA added the most loan loss provisions, while ABN AMRO released provisions worth 0.05% of its total assets. UniCredit, the one bank in the sample that has reported fourth-quarter 2021 earnings, made provisions of 0.09% of total assets in the quarter, or 0.18% for the full year.

Removal of state support, inflation

The European Banking Authority said in late 2021 that banks' provisions could have been significantly affected by their failure to use the "collective assessment" method included in accounting standards, which allows groups of borrowers to be moved into a higher loan loss category if they are deemed to be at risk from the same factors. Banks can avoid collective assessments if they can show that they can examine all loans individually, however.

Asset quality is expected to deteriorate as government support schemes are lifted. Inflation is also rising, potentially putting pressure on borrowers if it increases rapidly.

"We're not expecting a sharp deterioration but we do expect a deterioration. So, I would expect the banks to remain cautious," said Olivia Perney, head of western European banks at Fitch Ratings.

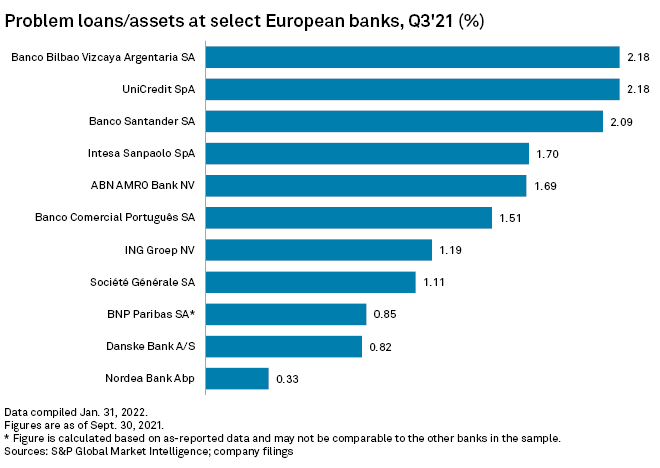

BBVA, UniCredit and Banco Santander have the highest level of nonperforming loans among large European banks, while Nordea, Danske and BNP Paribas SA are least exposed to problem loans.

Several leading European banks have focused on reducing their stock of impaired loans in recent months. UniCredit sold €222 million of nonperforming exposures to KRUK Group in January. Fellow Italian bank Intesa Sanpaolo SpA has reduced its gross NPLs by about €34 billion under its current four year business plan, which concludes this month.

'Massive overlays'

The European Banking Federation said banks had boosted their provisions through "massive overlays" at the end of 2020 ahead of expectations of a huge rise in NPLs that did not materialize so levels of provisions were very high. Indeed, the ECB said the average NPL ratio of supervised banks had fallen from 8% to 2.3% in the seven years to June 2021, continuing to drop during the pandemic.

"We understand that supervisors tend to be very conservative, but there is also an issue if a bank retains too big provisions without application over the long term, and we are already two years after the COVID-19 hit," said Gonzalo Gasos, senior director of prudential policy and supervision at the European Banking Federation. Gasos said banks were entitled to act according to their judgment of economic circumstances.

"Therefore, without being complacent, it is fair that banks assess with a higher degree of accuracy the future losses that can be expected according to the generally accepted economic scenarios," he said.

The ECB said moratoriums on state-guaranteed loans had proved effective in allowing consumers and corporations to get through the worst of the crisis. Customers had generally resumed their payments as moratoriums had come to an end.

The French government has announced a new six-month moratorium on certain types of state-guaranteed loans, but moratoriums in Italy and Spain have expired and loans portfolios have proved resilient, said Fitch.

"There are grace periods in some countries when borrowers didn't have to pay either interest or the principal and these are targeted mechanisms that should help some of the most affected borrowers," Perney said. "So, we'll see a deterioration in assets, but it's going to be very gradual."

Nevertheless, asset quality risk could remain a key area of differentiation among banks, according to S&P Global Ratings.

"For some banks the question is whether they can fully release the spike in 2020 provisions, but this depends in part on whether their economic projections support this; for others, the question is how much additional provisioning is still needed," the rating agency said in a Jan. 31 report.