S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Feb, 2021

By Gautam Naik

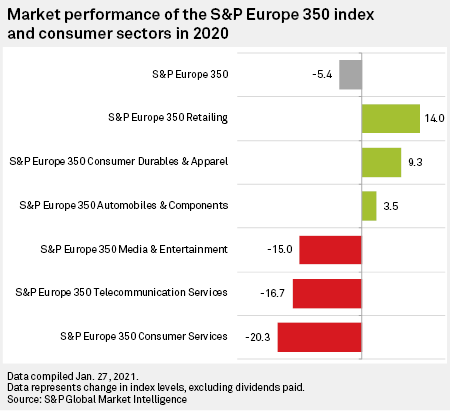

Battered by the COVID-19 pandemic, Europe's consumer sector faces an uneven recovery over the next 24 months as households spend more of their accumulated savings on food, drink, clothing and other retail items.

Household consumption is the largest chunk of Europe's economy, contributing about €8.6 trillion, or 52.6%, of the EU's €16.4 trillion in GDP in 2019, according to EU data. The sector has typically been relatively stable during past recessions, while fixed investments and trade have suffered more.

This time, because of 2020's unprecedented brew of lockdowns, reduced travel and mobility restrictions, the consumer impact has been brutal and disproportionate. To a large extent, the speed with which the consumer sector recovers will determine how the overall EU economy bounces back.

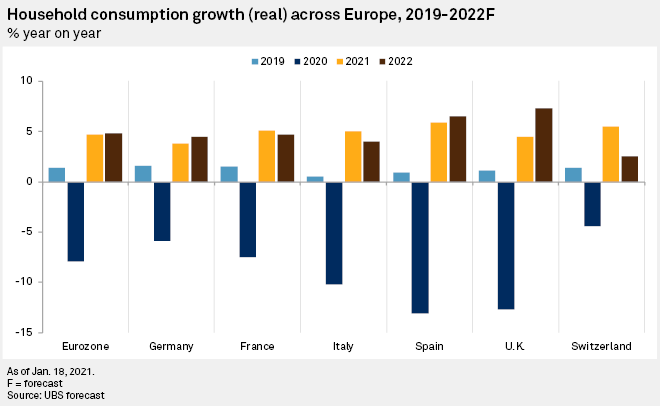

Eurozone real household consumption tumbled 7.9% in 2020, according to a report UBS published Jan. 18. The bank forecast a return to growth of 4.7% in 2021 and 4.8% in 2022 as more consumers get vaccinated, socialize, travel and shop at brick-and-mortar stores.

"The hit was unprecedented, and had it not been for governments' response through work and furlough schemes, it would have been worse," Reinhard Cluse, chief Europe economist at UBS, said in an interview. "We'll be back to pre-crisis levels by 2022. Why not quicker? We expect some scarring to remain from the pandemic. Unemployment is elevated, consumer confidence is affected and wage growth will be subdued."

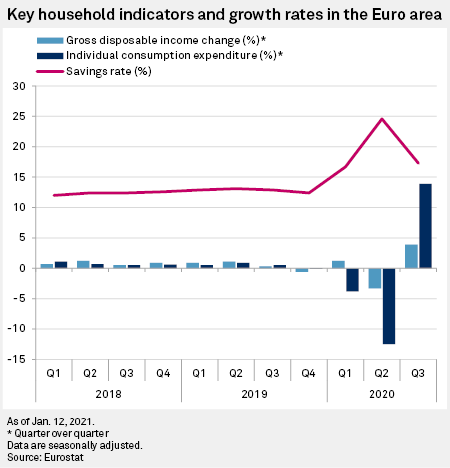

One big consequence of the pandemic was a surge in household savings, not all of it voluntary. According to UBS, the household savings rate in the eurozone rose from 12.4% in the fourth quarter of 2019 to 16.7% in the first quarter of 2020, then shot up to 24.6% in the second quarter before falling back to 17.3% in the third quarter.

"This is partly forced savings because people couldn't buy some stuff even if they wanted to, and it is partly precautionary savings," Cluse said. The large forced savings could help propel a strong consumption recovery unless nervous consumers, faced with rising unemployment, continue to keep a tight grip on precautionary savings.

Any recovery is likely to be uneven both geographically and for different subsectors of the consumer landscape. UBS economists are predicting a faster recovery in Germany, Switzerland and France and a slower improvement in the U.K., Italy and Spain, which suffered a larger initial shock from COVID-19. The situation in the U.K. is further hampered by the complications of Brexit, while Spain's fiscal response was smaller than that of other less-affected countries.

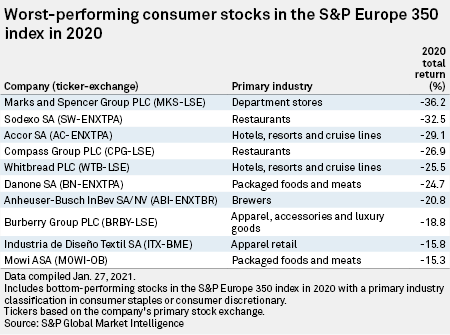

Parts of Europe's consumer sector that are structurally impaired by COVID-19, such as airlines and leisure activities, could take longer to rally. Sales of makeup and sun-care products are also likely to stay subdued as long as many Europeans continue to work from home and eschew social events and foreign travel.

Europe's dominant luxury players such as LVMH Moët Hennessy - Louis Vuitton Société Européenne, Kering SA and Compagnie Financière Richemont SA have been affected by a weaker fourth-quarter holiday shopping season, usually one of the most lucrative times of year for them. The overall sector lost 15%-25% in global industry value in 2020 and is expected to stay 10%-20% below 2019 levels in 2021, according to a Dec. 10, 2020, report by S&P Global Ratings. "As consumers become more mobile and global travel spending returns, luxury spending should return, although we expect the recovery to be slower than most other consumer discretionary segments," the report concluded.

Companies that sell big-ticket consumer items, such as cars, have to climb out of a particularly deep hole. EU passenger car sales in 2020 shrank 23%, the biggest annual decline since records began, according to the European Automobile Manufacturers Association. All 27 EU markets recorded double-digit declines. Among the region's biggest car markets, Spain posted the sharpest drop at 32.3%, followed by Italy at 27.9% and France at 25.5%. In Germany, the decline was 19.1%.

In a Sept. 15, 2020, report, Moody's said a greater demand for working capital in 2020 raised European consumer companies' leverage ratios temporarily, and credit ratios would only reach 2019 levels by the end of 2021. "Corporates are likely to remain focused on strengthening balance sheets for now, but could turn towards mergers and acquisitions in the future to offset lower organic growth," Moody's said.

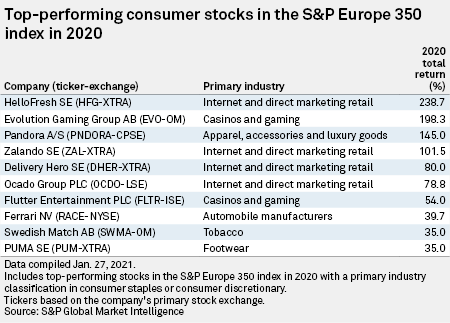

Once infection rates fall significantly and the economy regains its poise, European sectors such as general retail, food, drinks and personal-health products should see accelerating sales. Consumer items that did well during the pandemic should continue to sell briskly.

"The items that were in high demand earlier in [2020] are still hugely popular," Celine Pannuti, head of European staples and beverages research at J.P. Morgan, said in a statement published Nov. 23. "Overall, consumers want very high standards of hygiene, so the reality is cleaning and disinfectant products are going to be in demand for quite some time to come." That should provide a continuing lift to companies such as Reckitt Benckiser Group PLC, maker of Lysol and Dettol, and Henkel AG & Co. KGaA, maker of Persil.

The pandemic has ushered several wide-ranging shifts in consumer behavior that are likely to persist even after the virus has been controlled, including remote work, less commuting, fewer business trips, more online shopping and greater demand for everything from "ethical brands" to plant-based foods and nonalcoholic beer.

"These trends have been triggered or amplified by the crisis," said Cluse of UBS. "There's no reversing them."