Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Apr, 2022

By Deza Mones and Rehan Ahmad

|

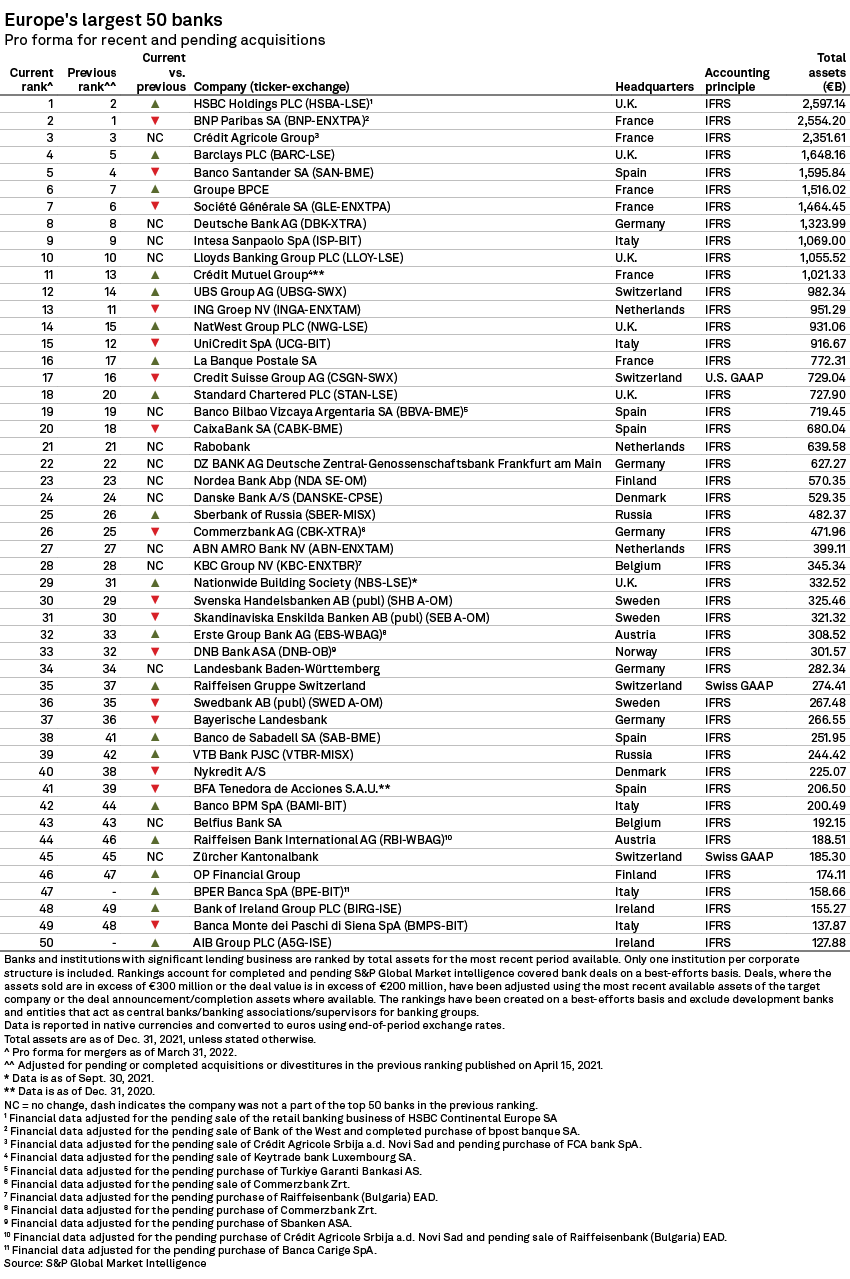

U.K.-based HSBC Holdings PLC

HSBC, which ramped up its "pivot to Asia" transformation plan in 2021, held €2.597 trillion in total assets at year-end. The bank aims to invest around $6 billion in the region over a five-year period while withdrawing

BNP Paribas, which in December 2021 agreed to sell its U.S. unit Bank of the West to Canada's Bank of Montreal for $16.3 billion

HSBC ranked eighth on Market Intelligence's global bank asset ranking, while BNP Paribas slipped two notches to place ninth.

Another European lender that has opted to exit the U.S. retail banking market

In contrast, Banco Santander SA, which has seen a steady increase in profits from the U.S. in recent years, has bolstered its exposure in unit Santander Consumer USA Holdings Inc. The Spanish lender also recently anchored its 2022 financial targets on expectations that it will maintain high profitability

Biggest movers

Italy's UniCredit SpA

Spain-based Banco de Sabadell SA

VTB, which is among Russian banks whose assets were frozen in recent months as part of international sanctions imposed on Russia over its invasion of Ukraine, had assets of €244.42 billion. Fellow sanctions-hit Sberbank of Russia had €482.37 billion in assets.

Ireland-based AIB Group PLC, which took part in the surge of deal activity in Ireland in 2021 after U.K.-based NatWest Group PLC and Belgium-based KBC Group NV decided to retreat from the Irish market, entered this year's list at 50th. Italy's BPER Banca SpA also joined the list, placing 47th.

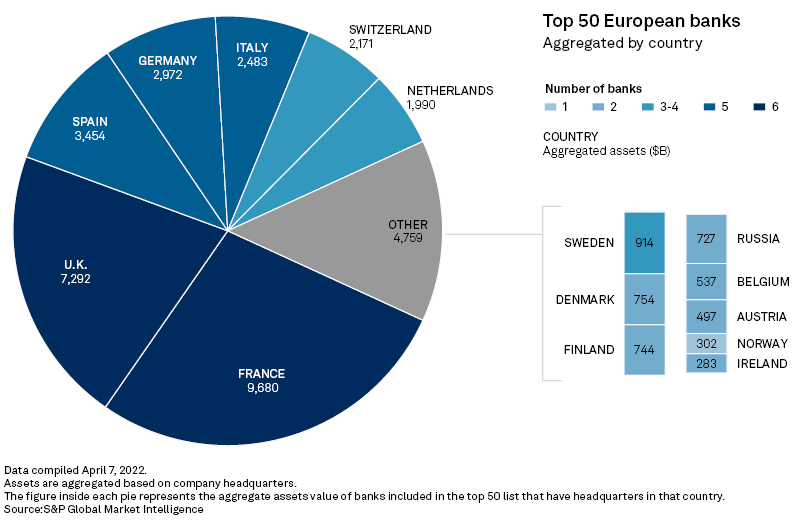

French, UK banks dominate

Overall, France and the U.K. have the highest number of banks on the top 50 list with six each, followed by Spain, Germany and Italy, each with five banks.

Four of the six French banks are in the top 10, while the U.K. has three in that group.