S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Nov, 2022

By Alex Blackburne

|

An electricity pylon in England. Autumn temperatures in Europe have been mild, but a cold snap during winter could make for a difficult 2023 in the energy market. |

The coming winter will be the first major stress test for a vastly reshaped European energy market. The outcome could determine whether even more severe energy shortages are on the horizon.

|

European Union nations have spent most of 2022 preparing for their first winter since Russia invaded Ukraine and subsequently slashed natural gas flows to the region. Governments have filled storage reserves with liquefied natural gas from the U.S. and pipeline gas from Norway, while also taking steps to reduce demand.

The EU's measures aim to avoid what Frans Timmermans, executive vice-president of the European Commission, said in July could amount to "a full-blown crisis" in winter 2023.

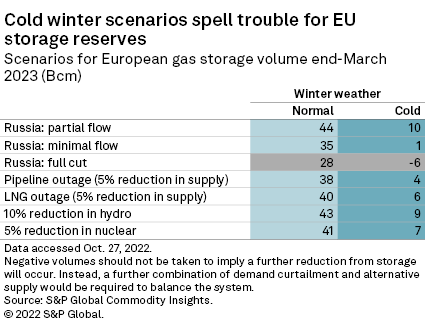

But after all the EU's preparation, the near-term fate of the energy market is now primarily up to nature: Analysts say gas storage reserves could be almost completely depleted by the time spring rolls around next year if the winter is especially cold.

Without Russian gas and with higher competition for LNG on the global market, it would then be harder — and even more expensive — to refill stocks for the subsequent winter. That is leading many observers to predict that the worst effects of the energy crisis could be yet to come, with potentially severe consequences for households, businesses and economic growth.

"This [winter], storage is full because Russian gas was still flowing through the summer," said Christof Rühl, adjunct senior research scholar at the Center on Global Energy Policy at Columbia University SIPA and former chief economist at BP PLC. "Next winter, that will not be the case and that will make it harder."

Gas storage rush has knock-on effects

In a typical winter, the EU withdraws 60 billion cubic meters of gas from storage. A cold winter could mean an additional 35 Bcm of gas is needed, whereas a mild winter could save the equivalent of 30 Bcm of storage withdrawals, according to Michael Stoppard, global gas strategy lead and special adviser at S&P Global Commodity Insights.

That creates a "65 Bcm range of uncertainty based on the weather," Stoppard said in an interview.

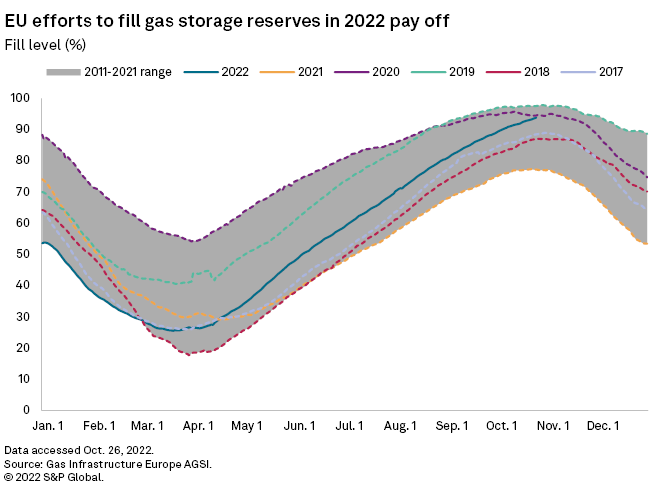

Efforts to fill the EU's gas storage reserves during 2022 have largely been a success. By Nov. 8, storage was more than 95% full, equating to 101 Bcm of gas. Current levels are far above the 80% targeted by lawmakers and are just below the 10-year peak for that date.

The race to fill storage, however, has come at an enormous expense.

The Dutch Title Transfer Facility, Europe's key gas benchmark, reached a record front-month price of €319.98/MWh on Aug. 26 compared with €45.65/MWh a year earlier and just €9.02/MWh in 2020. Soaring gas prices have in turn sent prices in the electricity market skyrocketing, putting significant pressure on domestic energy bills and industrial manufacturing.

A repeat of 2022's storage rush next year could cost billions more.

It would also likely require "concrete policy actions" from governments given the absence of "exogenous factors" that helped fill storage this year, such as Russian gas flows and weaker global competition for LNG, according to industry group Gas Infrastructure Europe.

Interventions may include heavier demand reduction. Such measures have seemingly paid off in the EU this year, with gas demand 25% below the three-year average in October, according to an analysis by Brussels-based think tank Bruegel. Warmer temperatures across the bloc have also played a role.

As the measures kicked in and the scramble for gas imports subsided, gas prices recently fell to levels not seen since before the summer. There is "currently not that much need to buy LNG at any price" like there has been in recent months, said Eric Heymann, director and senior economist at Deutsche Bank Research.

Still, the European Commission estimates that a full interruption of Russian supplies would leave a gap of uncontracted demand of up to 100 Bcm each winter until 2025. The bloc's total annual gas demand before the war was about 400 Bcm.

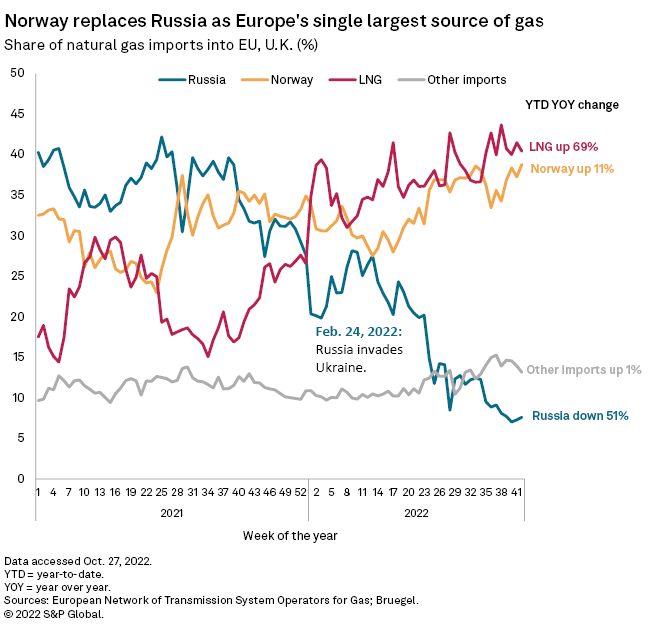

Since the war began, Russian imports into the EU have been substituted with LNG, predominantly from the U.S. but also from the Middle East and Africa. Norway has ramped up gas production to replace Russia as the largest supplier of gas to the bloc.

The EU's LNG imports in 2022 so far are 51 Bcm higher than in the same period last year, and the increase has laid bare the continent's lack of regasification capacity.

Some governments have moved to procure floating storage and regasification units, or FSRUs — special ships used to regasify LNG and transfer the product from tankers to the mainland gas grid. A new terminal in Eemshaven, Netherlands, started up in September, with subsequent vessels due in operation in Germany, but not until 2023 at the earliest.

Until those FSRUs arrive and new permanent terminals are built, Europe faces import capacity constraints — tangible evidence of which was seen in October, when dozens of ships carrying LNG were left queuing off the coast of Spain, according to a report by Reuters.

"That means that we can actually get very low short-term prices because there's nowhere to put the gas," said Anders Porsborg-Smith, managing director and partner in Boston Consulting Group's office in Oslo, Norway. "It's creating a lot of uncertainty and potential volatility."

|

A natural gas pipeline now under construction will allow Germany to import LNG by ship from places like the U.S. and Qatar. |

Uncertainties ahead

While weather is the biggest swing factor in determining the health of Europe's energy sector next winter, there are also other influences.

Much depends on France, historically Europe's largest exporter of electricity, which has been a net importer for most of 2022 because of problems in Electricité de France SA's fleet of nuclear power plants. Hydropower generation in the Nordics and Southern Europe has also suffered this year due to droughts and high temperatures.

These variables are largely outside of Europe's control, but others are not, such as the deployment of renewables. The European Commission is urging member states to simplify and accelerate permitting processes for wind and solar projects as a means of ramping up green power capacity quickly and strengthening the EU's energy security.

|

"If we want to reduce the risk markedly, we have to do that," Porsborg-Smith said about the need to ease permitting bottlenecks for renewables. "We absolutely need to rewrite the rules."

In the gas market, whereas this winter's problem might be in regasification capacity, next year's issues will be the supply of LNG and refilling storage, according to Stoppard.

Asian and Latin American nations "will intensify the competition [for LNG] between the markets" as they return to growth after economic slowdowns related to COVID-19, the analyst said. Much of the LNG that Europe imported in 2022 from the U.S. and Africa was available because Chinese imports were down about 14% year over year amid lockdowns, according to Wood Mackenzie.

Even mild temperatures this winter will not be enough to avoid what Stoppard describes as an international "tug of war for LNG" in 2023. But at least European gas importers will have the benefit of foresight when it comes to refilling storage reserves.

"When you see the train coming, you have a fairer chance of avoiding a crash than if you don't see it coming like this year," Rühl said. "[The] surprise element is missing."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.