S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Jul, 2022

By Camilla Naschert

|

An engineer testing a heat pump at Octopus Energy's training center in Slough, England. |

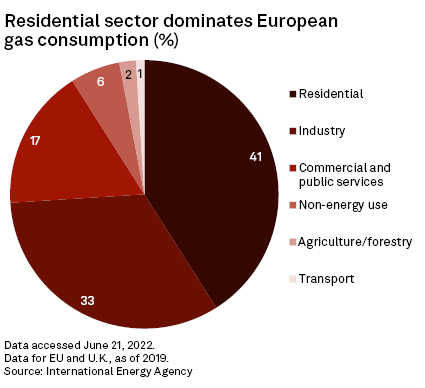

The transformation of Europe's residential heating sector — the continent's largest gas consumption setting — is moving into policy focus amid surging gas prices and commitments to pivot away from Russian energy imports.

More than 40% of Europe's gas usage is from residential heating, exceeding that of industry and the electric utility sector.

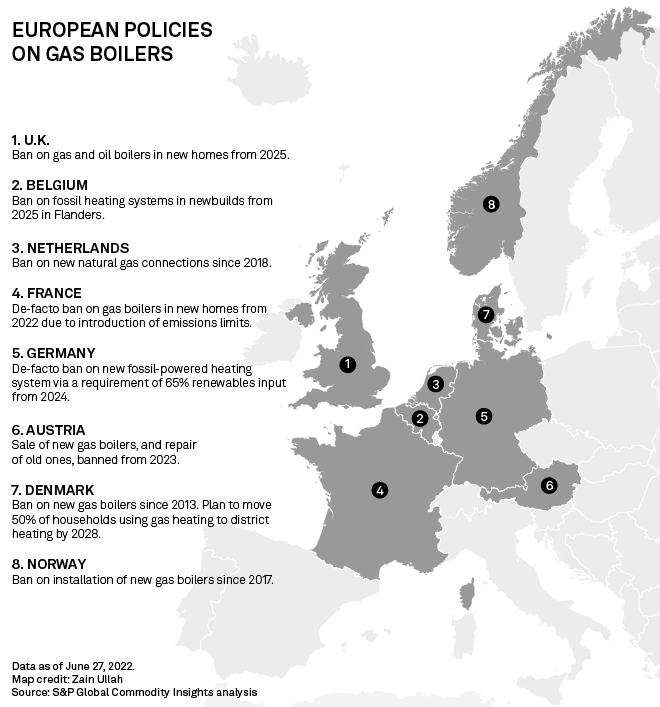

Some countries already have introduced an end date for installing new gas boilers. Austria recently legislated a gas and oil heating ban in new buildings and also the sale of replacements for existing buildings from next year, accelerating the policy by two years.

"Every gas boiler that we get rid of is another step out of dependency on Russian gas," Leonore Gewessler, Austria's climate protection minister, said in a June 13 statement. "Every apartment and house we can heat with sustainable heating systems makes us more free and less susceptible to blackmail."

Other European nations, including Denmark and the Netherlands, already have bans on gas-only systems in place.

Action by the EU

The EU has made no such declaration, though calls for a blanket end date are getting louder.

Asked about the prospect of a ban, a European Commission spokesperson noted that existing legislation gives member states the power to curb the use of gas in heating. Legislation includes the EU's "Fit-for-55" climate strategy and REPowerEU, its plan to shift away from Russian gas imports. Emissions standards in buildings are covered by the Energy Performance in Buildings Directive, which was revised in December 2021.

Member states are urged to end subsidies for fossil fuel boilers by 2025 at the latest and encouraged to redirect support programs to heat pumps instead. National energy efficiency requirements for new buildings also must meet zero-emissions standards before 2030, the commission spokesperson said. Major renovations of existing buildings should be used to connect households to efficient district heating systems in densely populated areas.

Alongside such measures, member states are instructed by the Fit-for-55 and REPowerEU energy policy packages to set stricter limits for heating systems, implying 2029 as an end date for stand-alone fossil fuel boilers and relegating these boilers to the bottom of the energy class. "Such ... measures will incentivize the roll-out of heat pumps and will contribute to the goal of doubling the rate of installation of heat pumps," the spokesperson said.

Countries can also ban fossil fuels in existing and new buildings by setting requirements for heat generators based on greenhouse gas emissions or the type of fuel used. "It is already possible under the existing legislative framework to go ahead with such measures, which are already being introduced by several member states," the spokesperson said.

Growing business case for heat pumps

The European Commission could go further on gas heating than it does in REPowerEU, according to Jan Rosenow, principal and European program director at the Regulatory Assistance Project, a think tank. "There's going to be resistance from some member states. It's a difficult policy proposal. But it would send the right signal," Rosenow said in an interview.

The EU recently sent such a signal to the auto industry and consumers when it announced an end date for the sale of new fossil-powered cars by 2035. An analogous message to the heating sector would provide clarity to invest, Rosenow said.

|

Wind and solar have become cost-competitive alternatives to fossil-based power generation. But the business case for replacing a gas boiler with an electric-powered heat pump so far has not stacked up in most households' calculations. Gas has been cheap compared to electricity for the past 10 years, partly because of tax structures that added renewables subsidies to a consumer's electric bill. "This has now clearly changed; the business case is now a lot stronger," Rosenow said.

To create a lasting advantage for heat pumps, however, a policy package including gas bans, reform of energy taxation and public subsidy programs for heat pumps would be needed, Rosenow added.

"We need concerted action. ... The commission has done this already for hydrogen and batteries, and we've called on them to do the same for heat pumps," Thomas Nowak, secretary-general of the European Heat Pump Association, said in an interview.

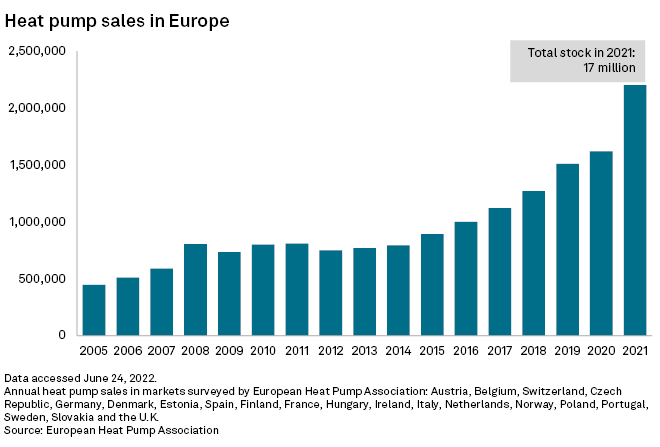

In the markets tracked by the lobby group, a record 2.2 million heat pumps were sold in 2021, bringing the total stock to 17 million. Sales are growing fastest in Poland, Germany and the Netherlands, said Nowak.

Gas boiler installations are still much larger. More than 4.3 million were sold in the major markets tracked by the Association of the European Heating Industry in 2020.

Doubling EU installation rates of heat pumps from the current trajectory would save 2 billion cubic meters of gas use within the first year, the International Energy Agency said in its 10-point plan to reduce Europe's reliance on Russian gas imports. The total additional investment required for this would be €15 billion, the International Energy Agency said. Combined with policy and financial incentives, heat pump installations in existing buildings should be coupled with upgrades to the house itself to maximize energy efficiency gains, the agency added.

But heat pumps will not save the day in a more immediate gas crunch. "If in October, [Russian President Vladimir] Putin shuts off the gas, and I think that's a probable scenario, how many heat pumps are going to be installed? Not many," said Kristian Ruby, secretary-general of utility association Eurelectric. "The scale of the challenge shows that we have to work with all available solutions."

"That doesn't change the fact that heat pumps are fundamentally a very, very good idea," Ruby said in an interview. Eurelectric has not come out in favor of a gas boiler ban. Ruby added, however, that a first step should be ending gas boiler subsidies, which still exist in many member states. "That's like a Putin subsidy these days," Ruby added.

Most newly built homes, meanwhile, could already run on heat pumps and district heating solutions. A decarbonization scenario analysis commissioned by the European Commission's directorate-general for energy showed heat pumps making up the largest share of heating across Europe's building stock by 2050. Next is district heating, followed by waste heat, large-scale heat pumps, biomass and solar thermal.

Cleaning up heating presents challenges

Gas lobby group Eurogas said that although heat pumps and district heating are important in cleaning up the sector, variations in the building stock and energy infrastructure across the EU will challenge their rollout.

"Limiting the number of solutions ... would be a big mistake, slow down decarbonization and make it more expensive," Bronagh O'Hara, spokesperson for Eurogas, said in an email. Decarbonized gases also should be considered in a systems-based approach, O'Hara added.

While hydrogen is sometimes touted as a clean alternative to natural gas heating, no independent research supports its use in this setting, due mainly to higher costs, Rosenow said.

Deploying heat pumps presents challenges as well. Microchips needed to operate fans, pumps and the controllers for the heating systems are in short supply globally. "Scarcity is affecting both components and final products. This limits further growth, while at the same time demand is skyrocketing," the European Heat Pump Association's Nowak said.

Smaller heat pumps are made mostly in Asia, including in Korea, Japan and China. Larger systems used in commercial buildings such as hotels and hospitals more often are made in Europe, mainly in Italy, Nowak added.

In addition to other electrification drives, such as the proliferation of electric cars, the rollout of heat pumps will also compound Europe's electricity usage in the coming decades. A scenario of 50 million to 70 million heat pumps across Europe is possible, Ruby said, but we "should be honest and say that will come with some grid reinforcements," particularly on medium-voltage grids.

Risks in the gas supply picture are expected to grow over the coming weeks and months, with EU member states now focusing on filling gas storage ahead of winter. While industry is already braced for supply curtailments in the event of a systemic shortfall, residential heating is not expected to be touched by demand-side responses.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.