S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Nov, 2021

The U.S.-EU agreement to drop steel and aluminum related tariffs announced Oct. 31 will force manufacturers to scrutinize their supply chains to avoid high-carbon emitting steel and ensure tariff-free products headed to the U.S. are largely made inside the EU.

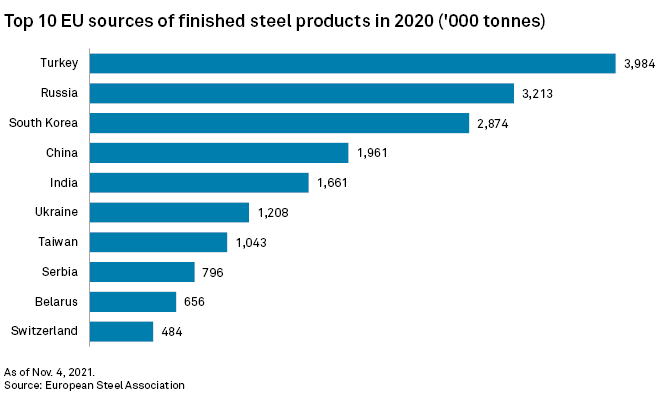

The deal drops Trump-era tariffs on EU steel and aluminum, and shifts to a quota system similar to what the U.S. has in place on steel imports from South Korea, Argentina and Brazil, while also closing several loopholes. The agreement aims to promote lower-carbon intensity steel production over cheaper, older processes commonly used in India and China. The agreement also requires that U.S.-bound products made from steel or aluminum are "melted and poured" inside the EU, thus ensuring products made in other countries do not duck tariffs by making brief EU stopovers on their way to the U.S.

"The most important thing ... is the fact that we got a melt-and-pour standard that helps fight trans-shipment and diversion of steel from non-EU countries like China, like India, like Turkey," said Philip Bell, President of the Steel Manufacturers Association in the U.S.

The annual EU quota will initially be set at 3.3 million tonnes for steel, 18,000 tonnes for unwrought aluminum and 366,000 tonnes for semi-finished aluminum. Imports that break quota thresholds will be hit with tariffs at the previous rate of 25% and 10% for steel and aluminum, respectively, unless they are subject to an exclusion.

The melt-and-pour rule will also force importers of steel to more deeply analyze the supply chain behind products they are buying to decide if they meet new trading requirements, said Dave Townsend, counsel with Dorsey & Whitney LLP.

"There may be multiple steps in the process and multiple companies involved," Townsend said. "You need to look back several layers in the supply chain to ensure that it was melted and poured in Europe."

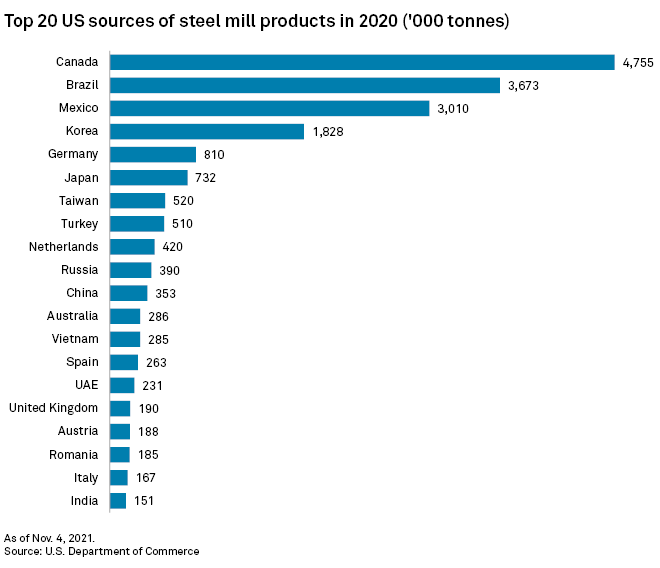

The EU is a significant source of U.S. steel product imports. Germany and the Netherlands were among the top 10 sources, accounting for 810,000 tonnes and 420,000 tonnes of U.S. steel imports in 2020, respectively.

Green steel boost

The agreement also bolsters plans to target imports of carbon-intensive steel and aluminum, giving an advantage to steelmakers that emit less carbon dioxide, a greenhouse gas, in their production. While short on details, the U.S. said it would work with the EU and other countries to "restrict access to their markets for dirty steel," according to an Oct. 31 statement from the White House, with President Joe Biden subsequently singling out China in a same-day press conference.

"That's likely going to discriminate against countries like China and India ... that use old-fashioned steel production technologies that are carbon intensive," said Raj Bhala, a trade law professor at Kansas University's School of Law. "It's going to change the supply chain and it's going to put pressure on rules of origin."

The global steel and aluminum sectors account for about a tenth of global carbon emissions, the White House said in an Oct. 31 statement.

The U.S. stands to benefit from trade rules that favor greener steel, said Bell, who touted U.S. production as significantly cleaner than most countries, especially China.

"Anywhere that still relies on blast furnaces is going to be at a disadvantage, and they should, because the carbon issue is a global issue," Bell said.

But the exact details governing green steel preferences will go far in determining the proposed trade deal's impact on climate change.

"If you see high thresholds on carbon, long transition periods where countries don't do much for five or 10 years and then it allows for a lot of other inputs from different jurisdictions, which aren't very clean, then it's not a very serious deal," Bhala said.

More immediately, the looming EU quota system adds new complexity for importers. Townsend pointed to experiences with similar U.S. quota arrangements, such as the one it has with South Korea, saying there are "tricky parts" to it.

The new system will also generate a wave of new trade cases as companies seek exemptions from the quotas for their products.

It will also create hassles for companies trying to predict their costs.

"If you have a boat on the water and you're checking the data, it's possible that it looks like the quota is still open, but by the time you get [the product] ... the volumes surpass the threshold," Townsend said. "Sometimes that's difficult for the planning process."