Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jul, 2021

EU regulators may take a more flexible approach to the implementation of the final Basel III banking reforms as banks call for adjustments to the rules amid a pandemic-battered economy.

Still reeling from the impact of the coronavirus pandemic, European banks such as Deutsche Bank AG and BNP Paribas SA fear the finalization of the rules, which were mooted in response to the 2008-2009 global financial crisis, could affect their capitalization and ability to lend. Top bank executives and sector associations have urged policymakers to consider the impact of higher capital requirements at a time when European economies are depending on bank lending to recover from COVID-19.

The European Commission's proposal "will meet our international commitments to implement the Basel III standards, but adjustments to those will be made to reflect the specificities of the EU economy and banking sector," an EC spokesperson told S&P Global Market Intelligence.

The new standards, aimed at reducing disparities in the way banks calculate credit risk, will be phased in from January 2023. The EC plans to forward a proposal for their translation into EU law in September or October 2021.

The main concern about the final implementation of Basel III package relates to the impact of the so-called output floor, which was the most controversial part of the regulations and the reason for the long phase-in period.

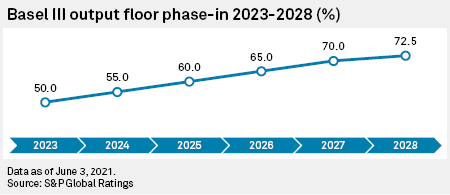

Banks can either calculate their capital through a regulator-approved standardized approach or use an internal model. The output floor will require banks that calculate their risk-weighted assets, or RWAs, by internal models to align their estimates to the regulator's standard. Under the output floor, banks that use the internal model RWA estimate must ensure it is no lower than 72.5% of the one calculated by the Basel III standardized approach. RWAs are key to risk management as they determine how much capital a bank must hold. Although banks have until 2028 to phase-in the rules, they worry that the output floor will make their capital requirements more onerous.

Basel III with an EU twist

Regulators have shrugged off concerns regarding Basel III given the long phase-in period, but they could give banks some latitude in the adoption of the new standards in the EU.

"The overarching objective will be to address reaming deficiencies in the banking prudential framework without incurring in a significant increase in capital requirements overall," the EC spokesperson said in an email. "Furthermore, and taking into account the challenges on economic growth created by the COVID-19 pandemic, banks' capacity to finance the economic recovery should be maintained. We are aware that the starting point from which banks will have to implement the final elements of the reforms has indeed changed because of the COVID-19 crisis."

The launch of the last set of Basel III rules was postponed by a year from the original date of Jan. 1, 2022, due to the pandemic, but now that some uncertainty around the impact of COVID-19 has receded, the appetite for another delay is low, experts said.

What is more likely to happen is a dilution in the way the rules are implemented, Alexandre Birry, chief analytical officer of financial institutions at S&P Global Ratings, said in an interview. The rating agency considers a divergence in policies to be a possibility as local authorities take different paths to adoption. Three factors will drive such decisions — complacency about the need for tighter requirements given the banks' resilience to the pandemic so far; a shift in focus on business model viability as bank profitability remains a bigger concern; and continued emphasis on domestic short-term policy goals as authorities consider banks conduits for economic and monetary measures, the agency said.

Regulators may be open to accept some flexibility in the implementation of the final Basel III standards, Michael Huertas, head of financial institutions regulatory Europe at PwC, said in an interview. "We have seen good examples of such an approach with a number of rules that have come into effect in the past, at an EU level but also at an international level. You may be technically noncompliant but you are working on an implementation plan and then effectively policymakers and supervisors are comfortable that you are able to get where you need to be by the time you need to be there," Huertas said.

The EU has deviated from the Basel III framework before. The Basel Committee for Banking Supervision found the bloc's implementation of some credit risk assessment standards for small and medium-sized enterprises, corporate and sovereign exposures "materially noncompliant" and its counterparty credit risk framework "noncompliant" with the rules in 2014.

Even if they were inclined to allow more flexibility in implementation, policymakers are not likely to make the market immediately aware of that, according to Huertas. "The moment you remove the stick from the carrot-and-stick approach, the less attractive the carrot becomes, and nobody fears the stick," he said.

Comparability issues

The uneven implementation of the Basel III standards across the EU and globally means that investors "would have to take any regulatory metrics with a pinch of salt," Birry said. It would take "quite a bit of judgment to try and compare the common equity Tier 1 ratio of a European bank versus that of a U.S. bank and that of an Australian bank," he said.

While final revisions of Basel III are "a big step toward greater comparability," inconsistencies will remain, S&P Global Ratings said. "The EU is not alone in having adapted and adjusted some of the existing standards into local legislation, and we believe this will remain the case when the time comes to pass the revised standards into law."

Comparability of bank capital ratios within the EU will also be difficult even after the full implementation of Basel III because the output floor would still allow a big deviation between RWAs calculated by internal and standardized models, said Willem Pieter de Groen, head of the financial markets and institutions unit at European think tank CEPS.

The average deviation of banks using internal models is 5% to 10%, according to ECB estimates, which will not be captured by the floor that limits deviation to 27.5%, de Groen said. Comparability between banks that use internal models could even worsen as a result of the floor, he said.