S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2022

By Camilla Naschert

|

| Workers at a BASF plant in Germany. Chemicals producers are set to provide much of the early demand for hydrogen. Source: BASF SE |

Companies in Europe's emerging hydrogen economy received long-awaited regulatory clarity from the EU as 2021 came to a close, with proposals around a market framework laying the foundations for growth in the coming months.

The European Commission's Hydrogen and Decarbonized Gas Package, published Dec. 15, will help usher in a "golden age of hydrogen," according to Jorgo Chatzimarkakis, CEO of lobby group Hydrogen Europe.

The regulations will ease the integration of hydrogen into existing gas infrastructure and remove barriers to entry, giving countries like Germany, France and Spain greater clarity on how they might implement their national targets for hydrogen production.

"It used to be called the Gas Package, and they changed its name, which I think is in itself a significant signal," Graham Cooley, CEO of ITM Power PLC, which makes electrolyzers for hydrogen production, said on a Dec. 16 investor call.

Investors asking 'difficult questions'

The package, as well as a revision of state aid rules for climate-friendly technology also presented in late December, may have already boosted market activity.

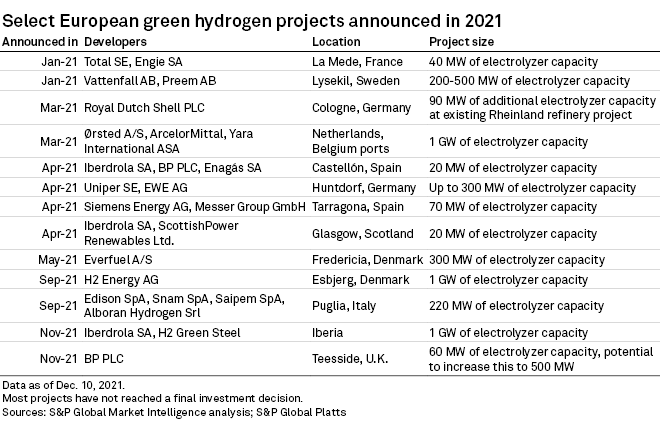

In the week after its unveiling, several new hydrogen production projects were announced or firmed up, including a 200-MW portfolio in Portugal developed by Lightsource BP Renewable Energy Investments Ltd. and RWE AG's Lingen project in Germany. A consortium including EDP - Energias de Portugal SA also moved forward on a 100-MW project in Sines, Portugal, and chose manufacturer McPhy Energy SA to supply equipment.

The EU's regulatory clarity was long overdue, with analysts pointing to previously limited headway made during 2021 on de-risking hydrogen investments and unlocking commercial-scale projects.

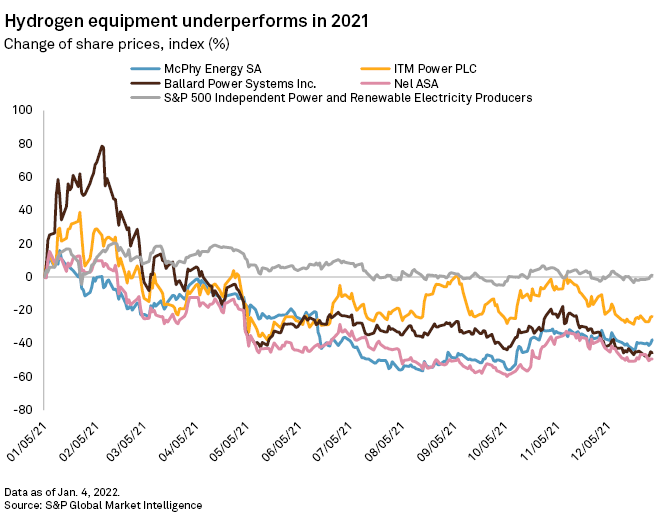

This fed through into equity markets, with some publicly traded hydrogen equipment-makers, such as Norway's Nel ASA and Canada's Ballard Power Systems Inc., losing nearly half of their value during the course of the year, having seen their share prices skyrocket in 2020. ITM Power's stock also declined, at odds with the wider market.

"[2021 was] a year of investors taking stock and starting to ask difficult questions," Elchin Mammadov, utilities analyst at MSCI, said in an interview.

Given that most specialist hydrogen companies still lose money, much of the valuation sits within an assumed growth rate, said Will Kirkness, an analyst at Jefferies. "The stock price is driven by macro announcements. You need growing bid pipelines, orders coming in, and that news flow just wasn't sufficient [in 2021] to keep prices at the levels they were," Kirkness said.

Customer adoption still slow

In 2021, consensus was strengthened around the priorities for renewable-powered green hydrogen, particularly its use in heavy industry.

Hydrogen use-cases are clearest in so-called hard-to-abate sectors where electrification is more difficult. For existing hydrogen superusers such as ammonia producers, which use grey hydrogen made in emissions-intensive processes, a switch to the green fuel is likely, with policymakers targeting adoption here first.

"The world cannot survive without molecules. You can't make ammonia with batteries," Cooley said in a Dec. 3 interview.

Cooley expects Europe's energy crisis, in which power and gas prices have risen to record levels over recent months, to bolster the case for policy support for homegrown green hydrogen. "The EU has now realized that there are more pillars to hydrogen than just the price," Cooley said.

The spike in gas prices has temporarily made grey hydrogen, usually made with natural gas, more expensive than green hydrogen would be, Cooley said. Indeed, large producers such as BASF SE reduced ammonia production at key sites as gas prices surged in the fall.

The outlook on European gas prices hinges largely on the approval of the Nord Stream 2 gas pipeline, according to S&P Global Platts, whose analysts expect the pipeline to come into service in June 2022. Especially if gas prices fall, green hydrogen projects will need support to bridge the price premium. One solution suggested by many in the industry involves carbon contracts for difference, under which governments guarantee a fixed price for CO2 emissions reductions beyond price levels in the EU's carbon market.

Policymakers have expressed a desire to avoid a repeat of the solar industry's fate, which saw the manufacture of technology developed in Europe in the 2000s move to more cost-effective markets overseas. "We have to understand this as a global race. It's not a level playing field because the technology for this time is already in Europe," Philip Hainbach, head of energy policy and government affairs at equipment-maker Enapter AG, said Dec. 2 at the virtual Hydrogen Economy Europe conference, hosted by Reuters Events.

Throughout, policymakers need to balance the need for scale with stringent sustainability criteria. And debate around blue hydrogen, made using natural gas and carbon capture, was fanned further in 2021 as scientific findings cast doubt on its role as a transition fuel.

Money is coming

To scale up the green hydrogen market, tens of billions of euros will be needed. On Dec. 22, the EU unlocked more funding as it broadened access to state aid from member nations for the emerging technology.

The banking sector is also noting progress. Banks tend to require long-term contractual certainty for backing new technologies like hydrogen, along with a creditworthy entity delivering the project and taking on technology risks. Some financiers are expecting the first project finance funds to flow into the hydrogen sector in the near future.

"At the start of [2021], I wouldn't say that nonrecourse financing was science fiction for green hydrogen projects, but it was seen as a remote perspective for the sector's development," Ivan Pavlovic, director and green energy specialist at French bank Natixis SA, said at the Reuters event. Now, commercial banks are looking at projects "with sound economics" for project financing in the coming months, Pavlovic said.

Over the course of 2021, the financial sector has developed a better understanding of green hydrogen, its use-cases and its constraints, Pavlovic said. At the same time, project sponsors are becoming better at aligning the structure of their projects with commercial lenders' expectations for the bankability of green hydrogen projects.

"There is support for hydrogen," said Kirkness. "[Investors] would obviously need to get comfortable with the use-cases."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.