Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Sep, 2022

By Zack Hale

|

The Ethereum network's previous consensus mechanism relied on miners with energy-hungry graphic processing units, seen above. Its latest transformation relies on validators with basic laptops and stable internet connections. |

Ethereum, the world's second-largest cryptocurrency protocol by market capitalization, virtually eliminated its energy consumption overnight on Sept. 15 by successfully transitioning to a new consensus mechanism known as proof of stake.

Although the long-awaited change did not result in a sudden price action for ether, the protocol's native crypto-asset, industry experts expect the shift to gradually alleviate concerns about how the use of blockchain technology is impacting the environment and demand for energy.

The so-called "Merge" was executed as the energy intensity of cryptocurrency protocols such as Bitcoin and Ethereum has become a hot issue in Washington, D.C. On Sept. 8, the White House released a report required under an executive order signed by U.S. President Joe Biden that detailed the energy impacts of crypto mining operations.

Bitcoin miners, who use a more energy-intensive consensus mechanism called proof of work, accounted for an estimated 0.9% to 1.4% of all U.S. electricity usage in 2021, according to the report. That estimate rose to 0.9% to 1.7% when proof of work Ethereum mining was included.

The White House report called for further federal action to ensure the U.S. crypto industry develops in a sustainable way.

'All applications will benefit'

Electricity consumption is inherent in proof of work's design. Bitcoin miners secure the network by expending significant amounts of capital to purchase and run high-powered computers that solve complex math puzzles, competing for the opportunity to produce new blocks in a distributed ledger of transactions. In return, they receive transaction fees and new bitcoins from a diminishing supply that will eventually be capped at 21 million. Once the bitcoin supply reaches its hard cap, proof-of-work miners will only get paid through transaction fees.

Until Sept. 15, Ethereum miners also used high-powered graphics processing units, or GPUs, in running a proof-of-work consensus mechanism

With the transition to proof of stake, Ethereum's network security relies on validators who deposit ether as collateral into smart contracts, dubbed staked ether. In exchange, validators who have posted collateral earn block rewards by confirming and ordering transactions. Staked ether can be slashed, or confiscated, if validators propose or confirm fraudulent transactions.

As of Sept. 15, Ethereum's proof-of-stake Beacon Chain had nearly 430,000 validators, according to BeaconScan, an Ethereum-based blockchain explorer. Annual staking rewards, paid in ether, were roughly 4.7%, according to the data aggregator StakingRewards.com. Similar to bitcoin, the cryptocurrency could also become deflationary over time if demand for ether — required to make any transaction on Ethereum's primary public production blockchain called a mainnet — outpaces new issuance to validators.

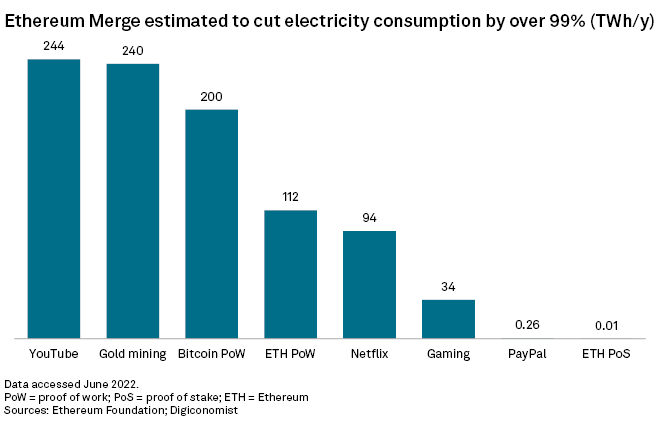

Instead of using expensive GPUs, validators simply need a basic laptop and a stable internet connection. The change will reduce Ethereum's energy consumption by more than 99%, according to the nonprofit Ethereum Foundation. That could eliminate one of the main criticisms of Ethereum, which settled more than $11.6 trillion worth of transactions last year — more than Visa Inc. and nearly three times the value settled by Bitcoin.

"Almost all businesses care about the environment, and it goes without saying that most will prioritize sustainable solutions if they can," the Enterprise Ethereum Alliance said in a recent report. The industry organization, whose members include Microsoft Corp., Ernst & Young LLP and JPMorgan Chase & Co., was formed to drive enterprise use of Ethereum technology.

Use cases for Ethereum include decentralized finance; payment processing; minting and trading non-fungible tokens, or NFTs; gaming; and supply chain management. But near-term adoption faces headwinds such as finding product-market fit, forthcoming regulatory actions by the U.S. government and the European Union, as well as the Federal Reserve's effort to tame inflation by reducing discretionary spending through higher interest rates.

Ethereum nevertheless has a blossoming ecosystem of what is known as layer 2 solutions that offer faster transaction speeds at dramatically lower costs by bundling large numbers of transactions together before they are posted to the Ethereum mainnet.

Individual transaction costs on the Ethereum mainnet can range anywhere from $15 to $250 or more based on the network's level of congestion. On layer 2, the same transaction could cost between 10 cents to $3, and as layer 2 usage grows, transaction costs decrease because the network fees become more socialized.

The Ethereum mainnet also has more upgrades on its development roadmap such as data sharding, a change that will help the network scale further by breaking data for different use cases down into smaller chunks, or shards, which effectively operate as autonomous blockchains.

Starbucks Corp. announced Sept. 12 that it selected the Ethereum-aligned Polygon Network to launch a new loyalty program that rewards customers with limited-edition NFTs. Polygon, a scaling solution company that also uses proof of stake, "uses less energy than first generation 'proof-of-work' blockchains," Starbucks noted in its news release.

"All applications will benefit from a reduced energy footprint," Yorke Rhodes, co-founder and director of Microsoft's blockchain strategy and an Enterprise Ethereum Alliance board member, said in a Sept. 14 email. "This upgrade is very significant and I believe it will allow enterprises to consider public Ethereum blockchain approaches where they did not prior."

Bitcoin still seen as store of value

Bitcoin proponents still see an enduring role for the world's first cryptocurrency.

Ethereum's transition to proof of stake means the network will become subject to governance by stakers, who can vote on making further changes to the protocol. And consolidation within the staking community could eventually lead to a small number of entities controlling at least 51% of the ether supply, said Andrew Webber, co-founder and CEO of Digital Power Optimization Inc., a company that works with independent power producers and other energy companies to harness excess electricity for bitcoin mining.

"That's fine for booking plane tickets or for recording real estate on these blockchains, or any number of different functions," Webber said in an interview. "But as a store of value for the entire globe, I don't know that you want those tweaks and changes put in the hands of a handful of entities that happen to control 51% of the network's coins."

Looking forward, Webber predicted a continued push to green bitcoin mining operations in the U.S.

"Over time, all of this mining activity is ultimately going to flow down to the least valuable power in the world," Webber said. "If you're competing with expensive power and a lot of other people need it, that's not going to be a good place to mine for bitcoin. It's getting more and more competitive and there are built-in halving dynamics which make it harder and harder and harder if you don't have what is effectively obscenely cheap power."

The next bitcoin halving event is anticipated in March 2024, when the rate of rewarding new coins will be cut in half algorithmically.

Webber said he expects to see bitcoin mining continue to grow in wind- and solar-rich states, such as Texas.

The White House's Sept. 8 report noted that the Electric Reliability Council Of Texas Inc. has about 17 mining facilities connected to its system, accounting for roughly 2 GW of the system's 76 GW of peak demand. ERCOT also expects to add 5 GW to 6 GW of new crypto-related demand over the next 12 to 15 months and could add another 25 GW in incremental demand from crypto mining over the next decade.

Among other things, the report recommended that the U.S. Energy Information Administration work to create greater transparency in demand response programs that reward miners for shutting off their equipment when power prices spike. The report also said the U.S. Department of Energy, in coordination with the Federal Energy Regulatory Commission and North American Electric Reliability Corp., should consider new or updated grid reliability standards if mining operations are shown to pose a risk to the bulk power system.

Ethereum's switch to proof of stake could also prompt former Ethereum miners to convert their operations to mine for bitcoins, Webber added.

"Any substantial site that had been using a lot of GPU power for Ethereum mining may very well switch that over to a Bitcoin mining site now," Webber said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.