S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Sep, 2021

By Nina Flitman

The first high-yield bond and leveraged loan to launch after the traditional late-summer break in Europe have both included sustainability language, in a signal that issuance linked to the principles of environmental, social and governance criteria looks to set to make up an increasingly important part of the market in the latter part of this year. However, sustainable issuance across the high-yield bond and leveraged loan asset classes is still in its nascent stage, and that means many areas in the market are ripe for potential growth, change and development.

On Sept. 1, European Energy A/S priced a €300 million offering of green floating-rate notes, with the deal increased from a planned €250 million following strong demand, while Dutch holiday park operator Roompot Holding BV on Sept. 2 launched a €1.05 billion covenant-lite term loan to fund a takeover and refinance debt that includes sustainability-linked language.

Shape of things to come

These early-September transactions are illustrative of a leveraged finance market this year in which ESG-related issuance has become more prevalent. A report published Aug. 23 from S&P Global Ratings entitled "The Fear of Greenwashing May Be Greater Than The Reality Across The Global Financial Markets" predicts more than $1 trillion of sustainable bond issuance (including green, social, sustainability, and sustainability-linked notes) by the end of 2021. While this anticipated figure includes all global bond volume, the European high-yield market will play a part in generating this supply.

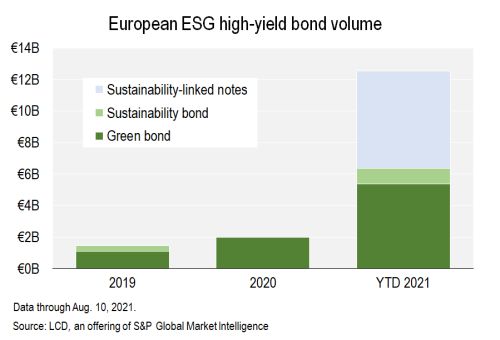

Indeed, there was €12.53 billion of green, sustainability, and sustainability-linked issuance in the European high-yield bond market in the year to Aug. 10, according to LCD.

For roughly half this total, the use of proceeds was specified for particular green or social projects (based on reporting by LCD News), as defined by a set of principles laid out by the International Capital Markets Association. Meanwhile, there has been €6.17 billion of sustainability-linked high-yield bond issuance (whereby a coupon step-up kicks in if the issuer misses its ESG-related key performance indicators, or KPIs) since the product was first introduced to the European sub-investment-grade market by Greece’s Public Power Corp. SA in March.

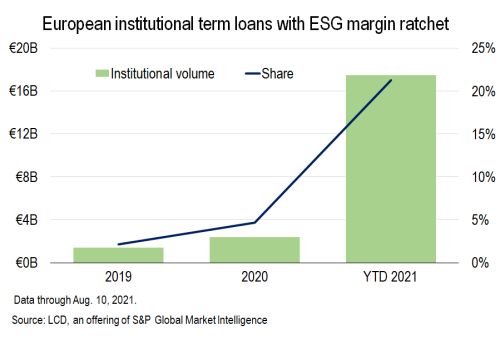

In the European leveraged loan market, the volume of term loans completed with margin ratchets linked to ESG criteria or with ESG-linked features has also risen dramatically this year, to reach €18.52 billion by Aug. 10.

Stepping stone

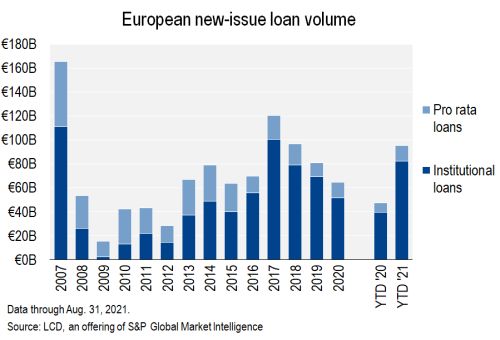

The step-up in ESG-linked issuance reflects a general increase in activity across non-investment-grade capital markets this year. In the leveraged loan market, the total issuance volume stood at €95.59 billion to the end of August — well above €47.35 billion recorded in the same period in 2020, and highest tally for the first eight months of a year since 2007.

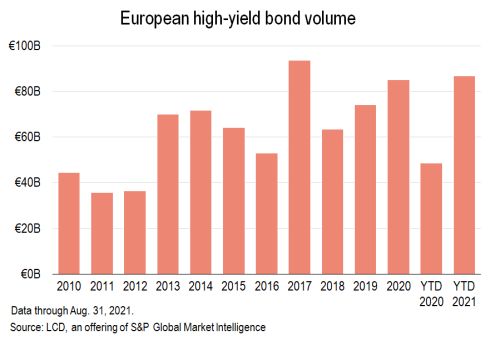

Even more dramatically, in the high-yield bond market the total volume to the end of August stood at €86.83 billion — well above €48.53 billion recorded in the same period in 2020, and the biggest such year-to-date tally on record.

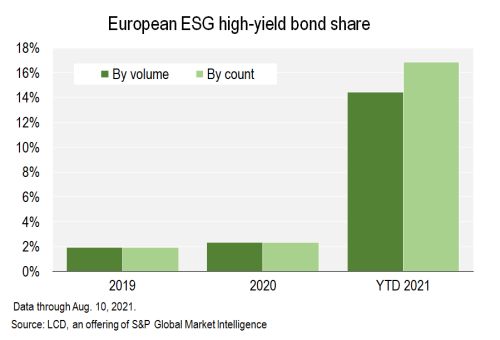

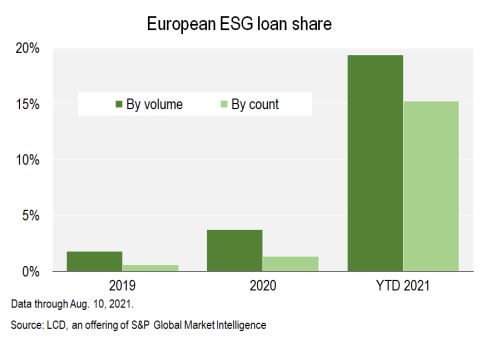

However, even this impressive general rise in leveraged finance volume cannot by itself account for the increasing prevalence of ESG-related issuance. In the European leveraged loan market, for example, sustainability-linked transactions have accounted for 19% of deals by volume in 2021, and 15% by count.

New structures

In July, for example, Seaspan Corp issued one of the few "blue transition bonds" (to fund projects related to ocean sustainability and water-related initiatives) in the high-yield space in the U.S. Proceeds from Seaspan’s $750 million offering of 5.5%, 8-year (non-call 3-year) senior blue transition notes will be used to acquire or refinance new or existing eligible projects as part of the firm's efforts to improve the environmental performance of its container-shipping fleet, and to move towards decarbonization.

Change ahead

Participants expect to see other developments in the market too, and in particular, investors have been consistent both in voicing their fears about greenwashing — whereby an issuer overstates its green credentials to obtain better financing terms — and in their requests for a higher level of consistency and transparency from borrowers in the future when it comes to sustainability-linked deals. Indeed, the insistence that issuers engage with ESG topics in a robust and responsible way was one of the key messages to emerge from a survey of investors published by the European Leveraged Finance Association (ELFA) in July, entitled “The Emergence of ESG Provisions in Leveraged Finance Transactions”. According to this survey, a majority of leveraged loan buy-siders (roughly 70%) said a third party should be involved in setting up KPIs linked to margin ratchets, to assuage worries about borrowers inflating green credentials for their own advantage.

Meanwhile, S&P Global Ratings’ latest ESG report notes that corporates are already becoming more consistent in their sustainability reporting in the face of such investor pressure. "In our view, investor scrutiny of the transparency, robustness, and credibility of sustainability commitments will continue to become bolder and broader in scope," says the report. "We anticipate this will be true at the individual instrument level and at the entity level. It's becoming clear that entities can no longer simply state their sustainability goals or long-term targets. Stakeholders want to see companies produce detailed transition action plans, backed by data and shorter-term interim targets, which demonstrate strong commitments toward a more sustainable future. Ultimately, we believe that companies that can substantiate their environmental claims, and align financing with a business strategy rooted in long-term ESG goals, will be better fit to withstand potential reputational, financial, and regulatory sustainability-related risks that will evolve over time."

Regulation issue

The regulatory backdrop will also drive more change on this issue, with the European Union leading the charge for standardisation across the market. From January 2022, the EU’s Sustainable Finance Disclosure Regulation (SFDR) will require periodic reporting on environmental and social characteristics and sustainable investment objectives, while the climate mitigation and adaption requirements of its taxonomy regulation will also come into effect. Furthermore, the proposed Corporate Sustainability Reporting Directive (CSRD) may introduce more involved guidance on how large companies operating in the EU disclose their sustainability risks and impact from operations.

Finally, market participants will also have practical guidance in the shape of the "Best Practice Guide to Sustainability Linked Leveraged Loans", published by the Loan Market Association (LMA) and ELFA in July, which aims to improve transparency and harmonisation regarding ESG-related issuance. These guidelines are likely to have the greatest impact on the issuance of ESG-related debt over the coming few months, and will provide best-practice guidance on the selection, disclosure, calibration and reporting of the KPIs or sustainability performance targets to which ESG margin ratchets are linked.