Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jun, 2021

By Nina Flitman

The global leveraged finance markets are embracing the concept of environmental, social and governance-linked transactions, with the first half of 2021 featuring a marked uptick in sustainability-linked issuance across the leveraged loan and high-yield bond products.

In Europe in particular, the volume of term loans completed with margin ratchets linked to ESG-related key performance indicators, or KPIs, has skyrocketed in 2021, and more than a quarter of this market now has a pricing mechanism with ESG language included. While a few specific leveraged loan deals in 2019 and 2020 were completed with margin ratchets linked to the achievement of certain ESG-related KPIs, this year, the pricing mechanism has become more mainstream.

Similar margin ratchet structures are being included in a growing number of unitranche financings and even Schuldschein products.

In the leveraged loan market, the structure and language of the ESG-linked margin ratchet is bespoke to each individual issuer, although some patterns are emerging. Margin ratchets tend to be linked to between one and five KPIs — or sustainability performance targets — and while most of the targets have thus far been related to environmental issues, there have been some examples of social- and governance-related targets related to diversity and employee rights. In the main, the margin ratchets linked to KPIs have been balanced — with an equal margin step-up and step-down depending on whether a target is hit or missed — but on certain leveraged loans, issuers face a larger penalty for missing a target, with little or no benefit available if the target is hit. In terms of magnitude, the bulk of the ESG ratchets tracked by LCD this year included either a 7.5-basis-point or 10-bps step-up/step-down.

While pricing has been linked to specific KPIs for the majority of leveraged loans with ESG-linked margin ratchets, some facilities have ratchets linked to ESG scores from third-party providers, which some market participants say gives a clearer picture of a firm's overall ESG credentials across all parameters. For example, in the first quarter, the €845 million term loan backing the buyout of U.K. supermarket chain ASDA Group Ltd. by the Issa Brothers and TDR Capital from Walmart was completed with a margin ratchet of 5 bps linked to the company's ESG score from S&P Global Ratings.

Bond bonanza

While the increase of leveraged loans with ESG-linked margin ratchets in the first half of 2021 has been impressive, the growth in the sustainability-linked high-yield bond sector has been even more dramatic. Unlike in the leveraged loan market, the coupon step-ups linked to ESG-related KPIs on sustainability-linked high-yield bonds offer no pricing benefit to issuers if they hit their targets, with only a penalty in place if KPIs are missed.

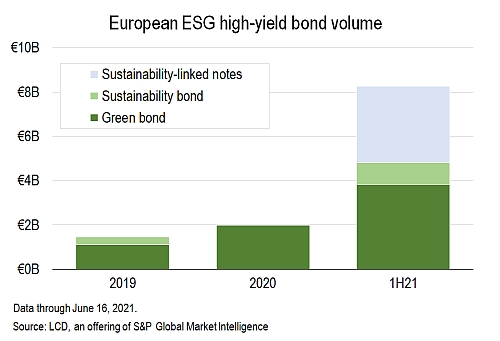

This new product did not emerge in European sub-investment grade until March, when Greece's Public Power Corp. SA placed a €650 million offering of sustainability-linked notes, but by June 16, already some €3.44 billion of sustainability-linked notes had been completed.

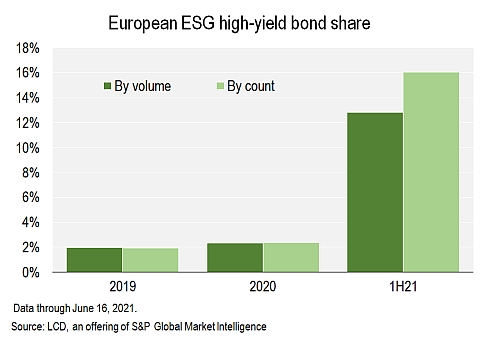

Along with the adoption of sustainability-linked notes, the increase in green and sustainability bonds — in which the use of proceeds is specified for particular green or social projects, as defined by a set of principles laid out by the International Capital Markets Association — has been dramatic, with 16% of high-yield transactions in 2021 through June 16 including some green or sustainability language.

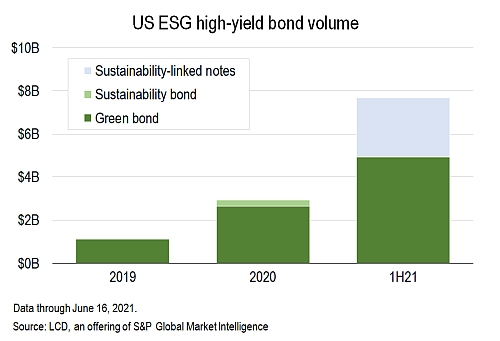

In the U.S. market, the first sustainability-linked notes were completed in January by telecommunications firm Level 3 Financing Inc., which placed a $900 million offering of notes with a coupon step-up linked to ESG-linked KPIs. Through June 16, some $2.75 billion of sustainability-linked notes has been completed in the market.

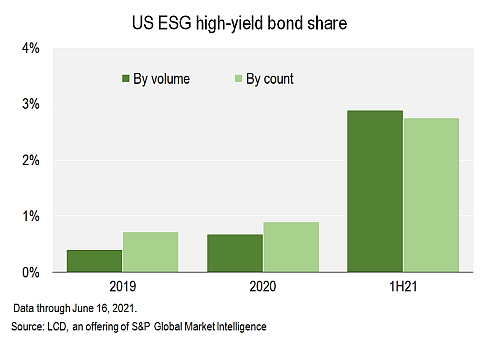

While this is a marked step-up, in the much larger U.S. high-yield bond market, ESG-related issuance still only accounts for 3% of activity.

Although the market is in a nascent stage across both regions, there are already signs that investor demand may be high enough for ESG-linked products that a pricing benefit — or "greenium" — may be emerging.

For example, the inaugural sustainability-linked European high-yield bond from Public Power Corp. was met with overwhelming demand, and the transaction was upsized to €650 million from a planned €500 million. The issuer then returned to the market the following week with a €125 million tap of the notes, and again this was increased by €50 million following strong demand.

While there has not been sufficient issuance to allow marketwide conclusions to be drawn on sustainability-linked issuance, on an individual deal basis, a slight pricing advantage for issuers including sustainability-linked language is visible. For example, that initial offering from B/BB- rated Public Power Corp. priced to yield 3.875%, while its add-on was completed at 100.75 to yield 3.709%. By comparison during the same time period, similar senior notes from European issuers with a comparable rating have averaged a yield of 4.890%.

However, despite clear investor appetite for ESG-related transactions across both the high-yield bond and leveraged loan markets, many have expressed concerns about how pricing mechanisms are being implemented. Buy-side accounts have emphasized that KPIs linked to margin ratchets or coupon step-ups must be relevant, ambitious and meaningful, and certain issuers have already been criticized for setting KPIs that are inappropriate to their main business or even for setting targets that are already "in the money" as soon as facilities are allocated.

Against this backdrop, the European Leveraged Finance Association and the Loan Market Association are collaborating on best practice guidelines to ensure that market participants incorporate ESG provisions in an effective and appropriate way.

LCD research subscribers can now access a list of the latest ESG-linked leveraged finance transactions via the ESG Leveraged Finance Tracker, a comprehensive Excel file that tracks new-issue loans and high-yield bonds in the U.S. and Europe that have an ESG component. The ESG Tracker is based on LCD News reporting, combined with transaction details from LCD's proprietary leveraged finance database. U.S. Research subscribers can access the file via this link (https://lcdcomps.com/lcd/r/research.html?rid=910) while European Research subscribers can access the file via this link (https://lcdcomps.com/lcd/r/research.html?rid=920).