S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Sep, 2022

By Kris Elaine Figuracion

U.S. states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use, and use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.

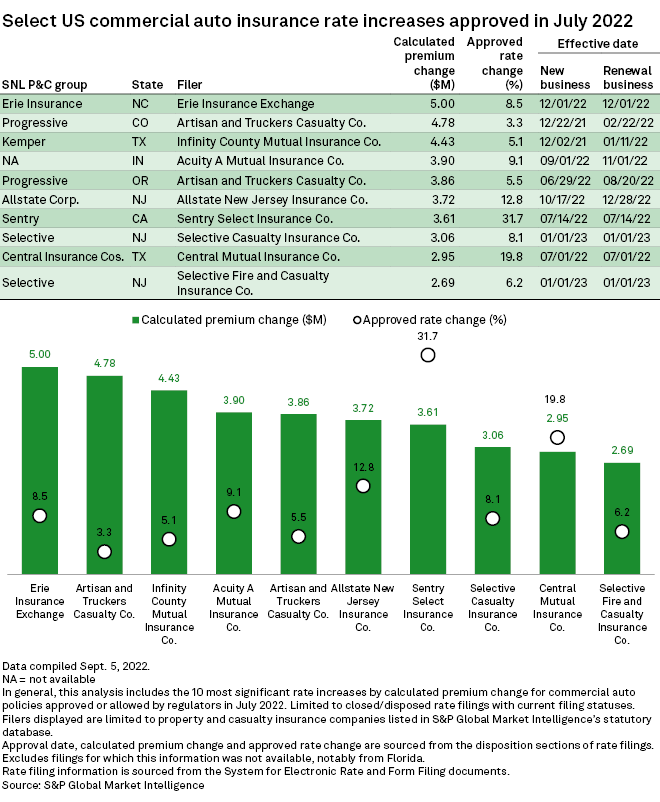

The Progressive Corp. could see the largest aggregate increase in commercial auto premiums from rate hikes approved in July, according to an S&P Global Market Intelligence analysis.

The largest commercial auto insurer received approval for four rate increases during the month, two of which entered the top five most significant increases. The two filings combined account for majority of the $8.7 million premium increase that the group could obtain from July rate hikes.

Erie Insurance

Erie Insurance Exchange, a subsidiary of Erie Indemnity Co., received approval for what looks to be the single most impactful rate hike during the month. The 8.5% rate hike is expected to boost the group's total premiums by nearly $5 million.

The rate increase will affect about 19,600 policyholders in North Carolina starting Dec. 1 for both new and renewal businesses.

* Download a template to analyze rate changes for selected entities, state or type of insurance over a selected time period.

* Read an article about the U.S. P&C industry's second-quarter results.

Fewer rate cuts in July

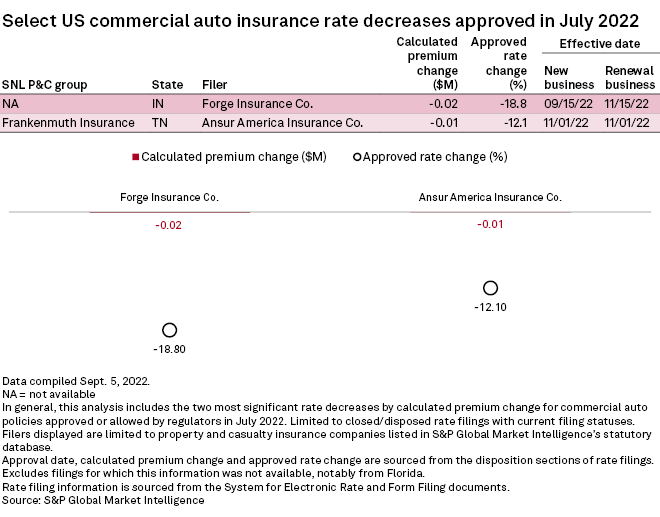

Commercial auto rate increases continue to outpace reductions in July. The month saw only two rate cut filings, which could result in written premium reductions of more than $5,000.

Forge Insurance Co. obtained regulatory approval for the most significant rate decrease during the period. The 18.8% rate cut was filed "to be more in line with the competitors."