S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Jun, 2021

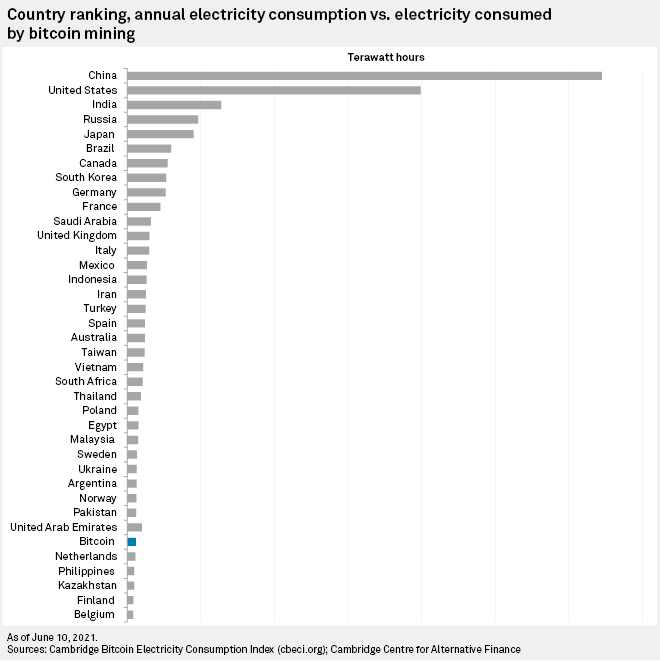

Investment in bitcoin creates a dilemma for environmental, social and governance-conscious institutional investors due to the huge amounts of energy the mining process consumes. The bitcoin network's energy consumption is roughly the same as that of the Netherlands and a large portion of it is powered by coal.

Some industry experts argue that there is a greener way to power the network, and what is more, that it is possible to structure funds that only source bitcoin that is mined through renewable energy — something that would help resolve a potential clash of values for institutional investors who are just starting to explore cryptocurrency. But not everyone is convinced.

The dilemma

Institutional investors have increasingly dipped their toes in the waters of cryptocurrency over the past year. Cryptocurrency exchange Coinbase Global Inc. said that funds from institutional investors such as pension funds, hedge funds and insurers increased 170% on its platform over the first quarter of 2021 to $122 billion.

Three-quarters of bitcoin miners are thought to be based in China, with as much as 40% of Chinese mining relying on coal-powered energy generation, according to the journal Nature.

Bitcoin's use of dirty energy use will sit uncomfortably with some institutions as the importance of ESG investing continues to come to the fore, according to Anatoly Crachilov, founding partner & CEO at Nickel Digital Asset Management, an investment manager specializing in cryptocurrency.

"Smaller investors are less sensitive about environmental concerns around cryptocurrency. But larger institutional investors are likely to want to be more ESG compliant," Crachilov said in an interview.

"ESG is something that many institutional investors inquire about as they explore digital assets, just as they ask about volatility and other considerations for this nascent asset class," a spokesperson for Fidelity Digital Assets Services LLC, a subsidiary of FMR LLC and provider of cryptocurrency custodian and other services to institutional investors, said in an email.

Institutional investors are getting increasingly serious about ESG. Some 77% of fund selectors at institutions polled by Natixis Investment Managers earlier in 2021 said that they had adopted ESG strategies, compared with 65% in 2019.

Bitcoin's high energy consumption is hardly news, but it hit the headlines afresh when Tesla Inc. CEO Elon Musk tweeted May 12 that the electric-car company would no longer accept payments in bitcoin due to its environmental impact. The price of bitcoin sank by $4,425.74 to $52,147.82 on May 13. However, Musk went on to say in a tweet on June 13 that Tesla would consider accepting payments in bitcoin again if at least 50% of the energy from the mining process came from renewable sources.

An organization named the Bitcoin Mining Council, which aims to promote transparency in mining, launched earlier in June. On its website, it said that bitcoin's energy use is a "feature not a bug," and that it plans to create a "voluntary disclosure forum" for miners to share information about their energy sources. Although Musk had tweeted in May that the creation of the council was a positive development, he has no involvement in the organization, according to its website.

A greener way?

A growing number of asset managers and investors believe that bitcoin mining and investment can be done in an environmentally friendly way. Among them is Nickel Digital Asset Management.

Crachilov is working on a proposal for a fund that provides institutional investors with access to bitcoin that has been sustainably mined, using renewable energy sources such as hydro power, wind or geothermal energy. Blockchain technology means that it is possible to provide total transparency about the provenance of individual bitcoins, he said.

Crachilov is scoping market demand and is on the lookout for a cornerstone investor to commit around $50 million for the fund to be viable, he said. Such a fund could create a virtuous cycle and would create an financial incentive to bitcoin miners to use more renewable energy.

Alyse Killeen, founder and managing partner at StillMark, a venture capital fund that invests in early stage companies involved in bitcoin, blockchain and decentralized web ecosystem, also believes that it is possible to mine bitcoin sustainably.

"I see an opportunity for [cryptocurrency investment] to push renewable energy use forward," she said in an interview. "I think this is somewhere that bitcoin can do good."

One of the challenges of renewable energy is that it is intermittent, Killeen said. Sun and wind levels fluctuate, and excess energy is difficult to store on the grid.

"There's often an over-abundance of energy at off-market times," she said.

Bitcoin mining, which can take place at any time of day or night, would be good way to use up this surplus energy, Killeen said.

Fidelity Digital Assets Services is also confident about the growing share or renewable energy in the mining mix.

"Today, a substantial portion of bitcoin mining is powered by renewable energy or energy that would otherwise be wasted (stranded gas) and miners are increasingly seeking more efficient and cleaner energy," the spokesperson said.

At present, an estimated 39% of mining is powered by renewable energy, according to the Cambridge Centre for Alternative Finance.

Do not forget the S and the G

But Martin Walker, director of banking and finance at the Centre for Evidence-Based Management, a nonprofit, is not convinced. For a start, bitcoin's energy consumption does not end with the mining process, since every transaction consumes energy, he said in an interview.

A single bitcoin transaction has a carbon footprint of 745.18 kg CO2, the equivalent of 1,651,581 Visa Inc. transactions, according to Digiconomist, a platform that explores the unintended consequences of technology change.

"The concept of a green bitcoin just doesn't make sense," Walker said.

And environmental issues are not the only reason that bitcoin and other cryptocurrencies might jar with the ESG ethos of large institutions. As Walker sees it, they also fail to offer anything that would satisfy investors' social requirements — the "S" in ESG.

"Nothing tangible emerges from trading cryptocurrency. No houses are built, no infrastructure created. Money is simply made when prices go up," he said.

It is also extremely difficult to apply norms of corporate governance to bitcoin and other cryptocurrencies, Walker said.