Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Feb, 2021

By Allison Good

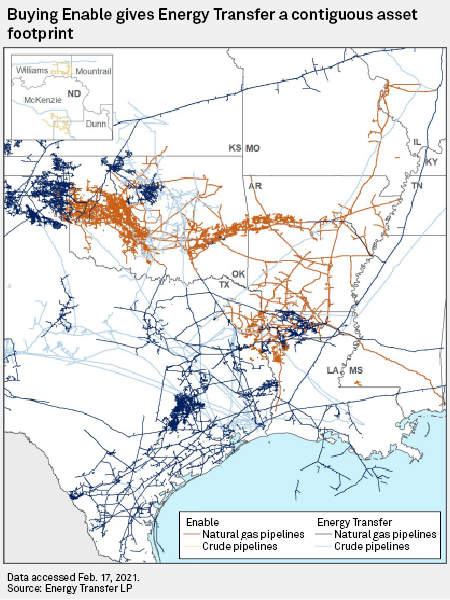

Energy Transfer LP's $7.2 billion all-equity planned acquisition of Enable Midstream Partners received mixed reactions from shareholders and analysts as the oil and gas pipeline giant announced its second midstream corporate takeover in less than two years.

Enable Midstream's two biggest unit holders — CenterPoint Energy Inc. and OGE Energy Corp. — have announced their support for the deal. OGE owns a 25.5% limited partner interest and 50% general partner interest in Enable, while CenterPoint holds a 53.7% limited partner interest in Enable. Energy Transfer would also acquire Enable's general partner from OGE and CenterPoint for a $10 million cash payment.

CenterPoint previously explored exiting its stake in Enable but dropped those plans in late 2017 after not being able to reach a "mutually acceptable" agreement.

Clarion CBRE Securities portfolio manager and master limited partnership expert Hinds Howard noted that unloading the pipeline partnership was always going to be a challenge for CenterPoint and OGE.

"The funky structure with the split ownership made a transaction extremely challenging unless the utility owners were willing to concede quite a bit on value for the [general partner] and for the [limited partner], so a deal at an 8% discount to the prior closing price is how it had to happen," Howard said in an email.

Energy Transfer last tapped the large-scale M&A market in 2019 when it bought SemGroup Corp. for $5.1 billion, and Chairman and then-CEO Kelcy Warren said in August 2020 that Energy Transfer's poor stock price performance prohibited the partnership from doing another corporate-level deal. Since making those remarks after the market closed on Aug. 5, 2020, however, Energy Transfer units have gained 7% as of the end of Feb. 16 trading to settle at $6.96.

Still, investors were not quick to welcome the combination. Energy Transfer shares were down just over 1% in midday trading, while Enable's stock plunged nearly 8%.

According to analysts at energy investment bank Tudor Pickering Holt & Co., Energy Transfer still needs to prove that it can use the cash retained from a 50% distribution cut in October 2020 prudently.

"While we view increased scale as necessary in the midstream sector ... [Energy Transfer] will need to reiterate that M&A is not the only outcome of increased financial flexibility," they told clients Feb. 17.

UBS, on the other hand, said the deal's over $100 million of annual run-rate cost and efficiency synergies should win investors over despite its price tag.

"The lack of premium combined with a likely leverage enhancing outcome, increased regulated asset footprint and dilution of the [Dakota Access pipeline] overhang, likely sways investors in favor of this transaction," UBS analysts wrote in a Feb. 17 note to clients. "Given the desire by many for [Energy Transfer] to remain inward focused we would not be surprised to see frustration by some; however, the aforementioned merits should win the day."

The transaction also garnered a positive review on the credit side. Fitch Ratings on Feb. 17 maintained Energy Transfer's stable outlook as the company retains its BBB- investment grade issuer-level credit rating. Analysts at CreditSights predicted rating agencies would remove any of Energy Transfer's negative outlooks given "the incremental scale and improved cash flow durability from [Enable's] firm contracts backed by investment-grade counterparties."