S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jan, 2021

By Emmanuel Louis Bacani

Emerging market currencies sustained their risk-on rally in December 2020, capping off a turbulent year with strong momentum that is expected to continue in 2021 as the global economy recovers from the coronavirus crisis.

The MSCI International Emerging Market Currency Index, which reflects the performance of 26 emerging-market currencies relative to the U.S. dollar, rose for the seventh straight month in December, gaining 1.6%, the second-largest increase on the year.

"[Emerging-market] currencies tend to rally when global growth and trade are improving and when investor sentiment is constructive," Georgette Boele, currency and precious metals strategist at ABN AMRO Group Economics, wrote in a Dec. 16 note. "We expect such an environment in 2021."

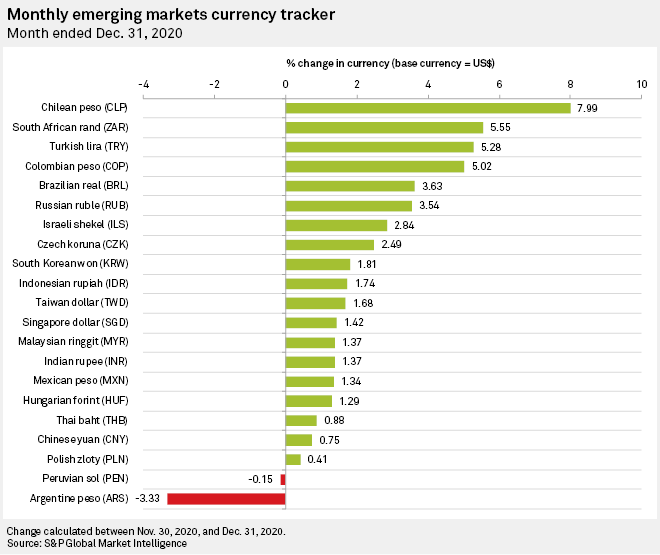

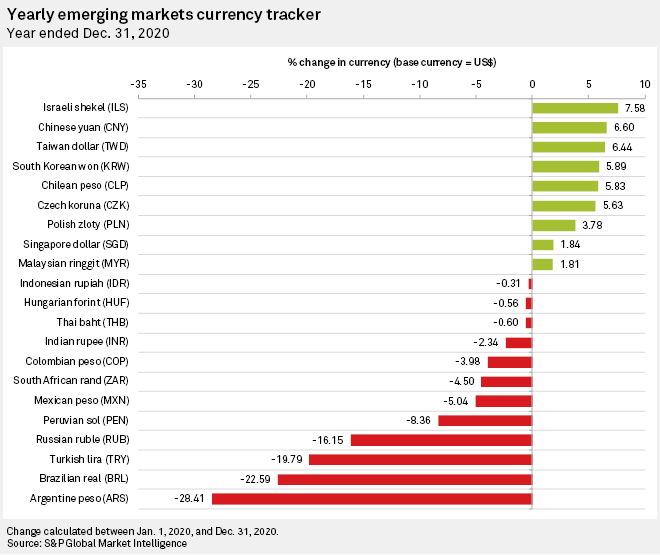

Nineteen of the 21 emerging-market currencies tracked by S&P Global Market Intelligence rallied last month. For the full year, nine currencies traded in the green.

In December 2020, the Chilean peso outpaced its emerging-market peers, surging 8% as it benefited from the jump in the prices of copper, Chile's top export. Currencies of other commodity-exporting economies were also among the month's biggest winners, such as the South African rand (+5.6%), Colombian peso (+5%), Brazilian real (+3.6%) and Russian ruble (+3.5%).

"Strong commodity prices are typically one of the key factors supporting higher beta currencies," J.P.Morgan Asset Management said in a note in early December 2020, projecting a brighter outlook for emerging-market currencies in 2021.

The Turkish lira also logged sharp gains as Turkey's central bank raised its policy rate by 200 basis points in a bid to stem inflation. The bank has now lifted the policy rate by 875 basis points following a rate hike in September 2020 and another in November 2020, when a new central bank governor was appointed.

For the year, however, the lira lost 19.8%, one of the weakest emerging market currency performances.

The Argentine peso lost 3.3% in December 2020 and collapsed 28.4% in the year.

Some of the Argentine peso's regional peers also closed 2020 among the worst-performing emerging market currencies, including the Brazilian real (-22.6%), Peruvian sol (-8.4%), Mexican peso (-5%) and Colombian peso (-4%).

"Insofar as sentiment indicators measuring the current state of economic affairs and forward expectations are concerned, Latin America generally remains behind the other two major EM regions, albeit in sync with the pace of improvement," strategists at TD Securities wrote, adding that the lag in economic recovery in the region is expected to persist this year.

In 2021, emerging market currencies are expected to fare better than their developed-market counterparts on the back of the global economic recovery, according to Dagmara Fijalkowski, head of global fixed income and currencies at RBC Global Asset Management. "The shift in outlook is driven predominantly by improved economic-growth prospects, not only within emerging-market economies but also in many of the export destinations they serve," Fijalkowski wrote in a Dec. 15 note.

The strength of the Chinese yuan, which helps lift the competitiveness of China's trading partners, would also drive the performance of emerging-market currencies this year against the U.S. dollar, Fijalkowski added. The yuan rose 6.6% in 2020 and was the second-best performing emerging market currency, behind only the Israeli shekel, which rallied by 7.6%.

Emerging market currencies would also benefit from the continued weakening of the dollar and the incoming Biden administration, whose spending priorities are likely to widen U.S. fiscal deficits and hurt the greenback. In addition, Biden's friendlier stance on foreign policy "offers relief to a market exhausted by combative tweets and will provide a boost to the countries that had attracted the most attention from the Trump administration," Fijalkowski said.