S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Nov, 2022

By Zeeshan Murtaza, Dylan Thomas, and Annie Sabater

2022 is set to rank as one of the top years for private equity investment in the electric vehicle ecosystem after a surge of deals in the third quarter.

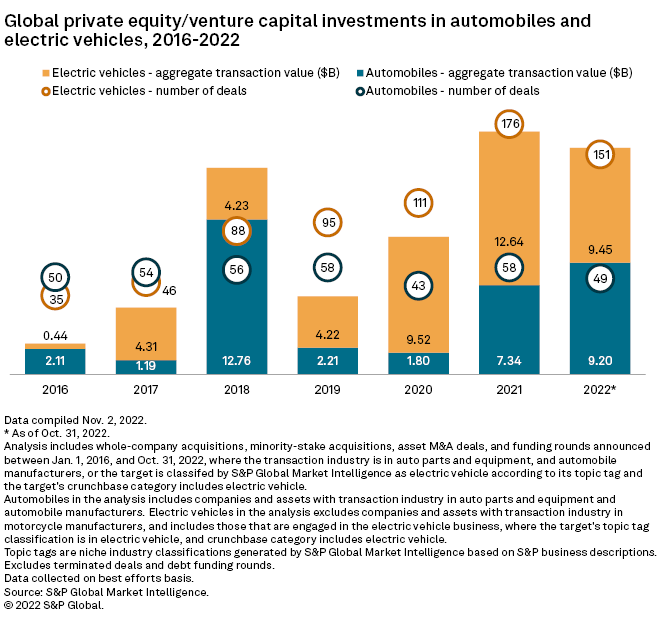

In aggregate, global private equity and venture capital investments in electric vehicles and components stood at $9.45 billion through the first 10 months of 2022, compared to a record-high total annual investment of $12.64 billion in 2021, according to S&P Global Market Intelligence data. The next-highest annual total was in 2020, when private equity invested $9.52 billion in the electric vehicle industry.

Electric vs combustion

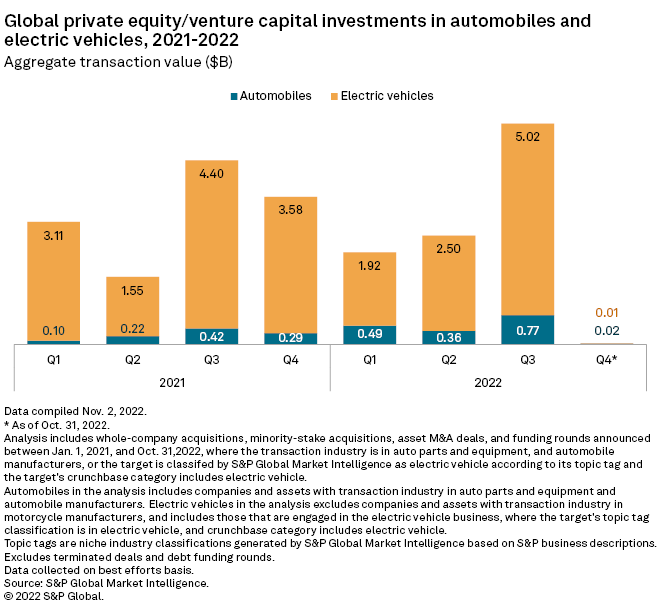

In the third quarter, the electric vehicle ecosystem attracted $5.02 billion of private equity investments, a 50.2% increase from the previous quarter and a 12.3% jump from the third quarter of 2021.

Private equity investments in the conventional automobile sector are also on the rise, surpassing last year's total in just 10 months. For the year to Oct. 31, investment in businesses linked to conventional automobiles this year totaled $9.2 billion, compared with $7.34 billion all of 2021.

|

* Download a spreadsheet with data featured in this story.

*Explore more private equity coverage. |

Battery-makers attract PE in 2022 deals

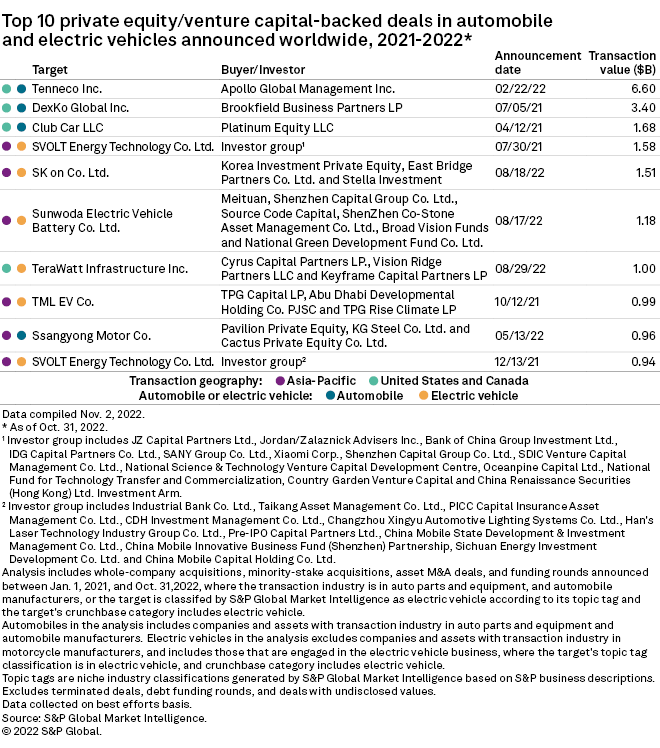

SVOLT Energy Technology Co. Ltd., which manufactures batteries for electric vehicles, raised $1.58 billion in the largest funding round of 2022 for an electric vehicle company. Bank of China Group Investment Ltd. and Shenzhen Capital Group Co. Ltd., among several others, participated in the round.

Another electric vehicle battery manufacturer, SK on Co. Ltd., raised $1.51 billion in a funding round held in August. Investors included East Bridge Partners Co. Ltd. and Korea Investment Private Equity.

Apollo Global Management Inc. agreed to purchase Tenneco Inc. for $6.6 billion, marking it the largest private equity deal in the conventional automobile sector for 2022.