Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Feb, 2021

By Jon Rees and Mohammad Abbas Taqi

The European Central Bank's top supervisor has said the central bank has clamped down on banks it considers overexposed to the leveraged loan market, resulting in increased capital charges.

Andrea Enria said the ECB has been focused on the risks in the leveraged loan market, which are loans to highly indebted borrowers. This market has developed strongly over the past five years as banks searched for yield in a low-interest rate environment. Some leveraged loans are traded on the secondary market, exposing banks directly through their holdings and indirectly through their exposure to other market participants.

The ECB issued guidance on leveraged loans in 2017 advising that bigger banks should only engage in highly leveraged transactions relatively sparingly and should limit their exposure to covenant-lite transactions, which offer fewer borrower restrictions and weaker lender protection.

Despite this, Enria, who chairs the ECB's supervisory board, said the central bank now believed supervised banks' exposure to highly leveraged transactions represent about 60% of their total leveraged loan exposure. The ECB classes a highly leveraged transaction as one where debt is more than 6x earnings before interest, taxes, depreciation and amortization.

As a result, the ECB has taken action.

"Where we don't see adequate responsiveness of the banks to our supervisory pressure, we can also reflect our dissatisfaction in our supervisory recommendations, and eventually in the capital charges for the banks," said Enria Jan. 28 in remarks following a speech on the ECB's supervisory process.

"We have done a number of on-site inspections which have focused explicitly on leveraged finance, and in many cases we have asked for adjustments in the prudential treatment of these exposures, which has indeed reflected into capital impact."

Capital buffers

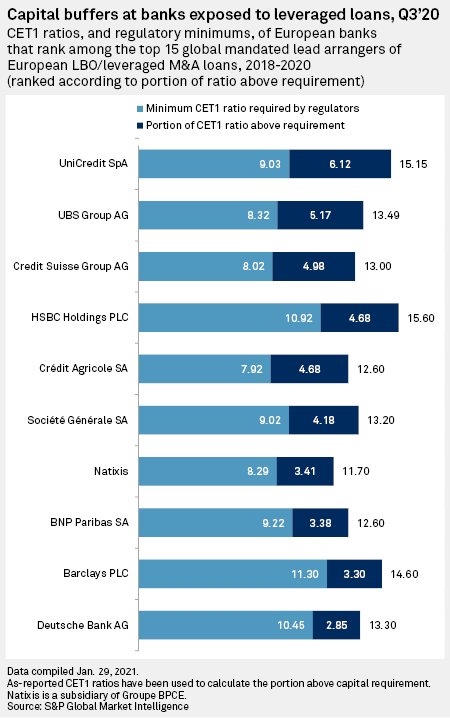

Among the leading banks in the leveraged loan market, Germany's Deutsche Bank AG has the smallest capital buffer above its minimum requirement. Under banking regulations Deutsche must have a minimum common equity Tier 1 ratio of 10.45% and it has an additional 2.85 percentage points above that requirement.

This compares with Italy's UniCredit, for instance, which has an additional 6.12 percentage points of CET1 above minimum requirements. Barclays is the closest to Deutsche on this measure, with an additional cushion of 3.30 percentage points. Deutsche, UniCredit and Barclays were all among the top 15 global mandated lead arrangers of European LBO/leveraged M&A loans between 2018 and 2020.

Deutsche was asked by the ECB to suspend part of its leveraged finance business last summer, according to the Financial Times, amid fears of inadequate risk controls, but reportedly refused to do so.

It declined to say whether the ECB had imposed capital charges on the bank as a result of its leveraged loan activities.

"Leveraged loans are an important business for the economy and many banks, including Deutsche Bank," the bank said in an emailed statement. "We have a strong track record in the business and we follow a prudent risk management approach in line with regulatory requirements. As a matter of principle we do not comment on dialogue with our regulators."

The bank's exposure to leveraged debt capital markets accounted for 2% of its loan book at the second quarter of 2020.

Before the pandemic, there were more than $2.2 trillion in leveraged loans outstanding worldwide, according to the Bank of England, more than the U.S. subprime market before the financial crisis. The ECB said that at the end of 2019 the 26 most active directly supervised banks had a total exposure to leveraged loans of €417 billion.

The BoE said last summer that a significant number of leveraged loans had been downgraded since the start of the pandemic and noted that the U.S. leveraged loan downgrade-to-upgrade ratio averaged 43:1 in the three months to May, five times greater than the peak of 8:1 during the global financial crisis.

Around a quarter of leveraged loans are held through collateralized loan obligations and U.K. bank holdings of leveraged loans and CLOs are relatively small at about 4% of the market, said the BoE, while non-banks, like hedge funds, hold around half of leveraged loans and two-thirds of the CLO market.

Pandemic effect

The pandemic has had a striking effect on the market, with deal activity dropping hugely in the first few months of last year before rebounding strongly as companies sought to adjust to the conditions imposed on markets by the virus.

In the oil and gas sector, for instance, during the first half of the year there were 48 transactions with an aggregate value of $1.72 billion, while in the second half of the year companies announced 82 deals with an aggregate transaction value of $42.81 billion, according to S&P Global Market Intelligence.

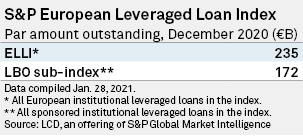

Overall, European leveraged loans in the S&P European Leveraged Loan Index (ELLI) totaled €235 billion in December 2020.

In the leveraged loan market, the biggest M&A-driven deal was the Virgin Media Finance package backing the merger of Virgin Media and O2, while the biggest players in the market include some of the biggest banks like Bank of America Corp. JPMorgan Chase & Co. and HSBC Holdings PLC.