S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Aug, 2021

By Adrian Jimenea and Marissa Ramos

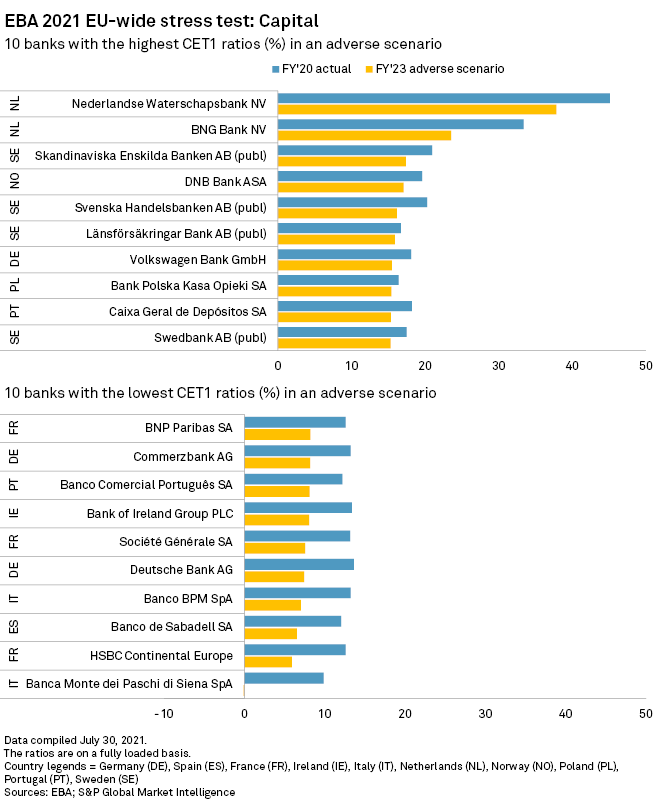

Some of the eurozone's biggest banks would have the weakest capital levels among Europe's lenders in the adverse scenario envisioned under the European Banking Authority's 2021 stress test.

The stress test posits an adverse scenario where the impact of the coronavirus crisis persists and the EU's GDP suffers a cumulative 3.6% contraction between 2021 and 2023. The exercise involved 50 banks, encompassing 70% of the bloc's banking sector.

France-based BNP Paribas SA and Société Générale SA and Germany's Deutsche Bank AG and Commerzbank AG are among the 10 banks that would have the lowest fully loaded common equity Tier 1 ratios by the end of 2023. Bank of Ireland Group PLC, Portugal-based Banco Comercial Português SA and Spain-based Banco de Sabadell SA would also be among the weakest.

Italy-based Banca Monte dei Paschi di Siena SpA would be the weakest of all, with its ratio falling to negative 0.10% in the adverse scenario. Monte dei Paschi, which is the subject of a potential tie-up with UniCredit SpA, is trying to shore up its capital levels.

Meanwhile, Netherlands-based Nederlandse Waterschapsbank NV, whose CET1 ratio was 45.10% at the end of 2020, would have the highest ratio among all banks in the sample, at 37.83%. Although Dutch peer BNG Bank NV would have the second-highest CET1 ratio of 23.51%, it would also suffer the second-highest erosion of 989 basis points from 33.40% as of 2020-end.

Swedish banks Skandinaviska Enskilda Banken AB (publ), Swedbank AB (publ) and Länsförsäkringar Bank AB (publ) and Norway-based DNB Bank ASA are among those that would have the highest CET1 ratios, according to the stress test.

The resilience of Nordic banks has led countries in the region to move to reinstate countercyclical capital buffer requirements amid a recovery from the pandemic's impact.

The EBA noted that there is a dispersion across banks, such that those with a higher focus on domestic businesses or have lower net interest income would see higher capital erosion. The regulator added that a spike in credit losses — estimated to reach €308 billion — and lower income are the main drivers for the decline, along with a "sluggish" economic environment.

All in all, the aggregate CET1 ratio of banks would diminish by 485 basis points to 10.2% from 15.0% over the three-year period.

Click here for an Industry Document detailing European banks' capital ratios.