S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Mar, 2021

By Abby Latour

For private credit providers, the special purpose acquisition company trend is roses and thorns.

On one hand, the trend has meant more repayments for lenders, including for borrower companies that have been struggling. But it also means debt investment opportunities disappear, a problem for private credit providers trying to deploy capital when competition for new assets is intense.

Take GK Holdings Inc., which operates as Global Knowledge Training LLC. The educational technology company announced in November a merger with competitor Skillsoft Ltd. and listing via a SPAC. That transaction is slated to close in May, subject to shareholder approval.

The deal is likely good news for lenders to Global Knowledge, which has been an underperforming asset in loan portfolios in recent quarters. The borrower missed interest payments due as of March 31, 2020, on its revolver and first- and second-lien term loans.

Among the lenders is Goldman Sachs BDC Inc., which announced last month it expects nearly a full recovery on a first-lien claim in GK Holdings as a result of the SPAC transaction. The pending SPAC transaction also suggests better-than-expected recovery on GK Holdings' second-lien debt. For Goldman's claim, the lender expects to recover "in excess of our third quarter quarter-end mark," according to Goldman Sachs BDC COO Jon Yoder in a Feb. 26 earnings call.

As of the third quarter, Goldman Sachs BDC booked GK Holdings' $8.5 million Libor+800 (1% floor) first-lien debt due 2021 with a fair value of $4.5 million, and a $3 million holding of an L+1,225 (1% floor) second-lien loan due 2022 at $750,000 fair value. The loans are marked as non-accrual, meaning they don't pay interest to the lender.

The debt stems from Rhone Capital's buyout of the company from MidOcean Partners. Joint bookrunners Credit Suisse and Macquarie arranged a $175 million first-lien term loan (L+550, 1% floor) and a $50 million second-lien loan (L+950, 1% floor) for the borrower in January 2015. Financing included a $20 million, five-year revolver.

Large and small

An unprecedented flood of blank-check companies has come to market. In fact, it has taken only 70 days in 2021 for the number of new listings of SPACs to overhaul the annual record of 227 set in 2020, according to S&P Global Market Intelligence data.

While a SPAC transaction may be particularly welcome news for a struggling company, sought-after borrowers of private loans are ensnared, too. As in the syndicated loan market, SPACs are contributing to repayments, a trend not likely to subside soon.

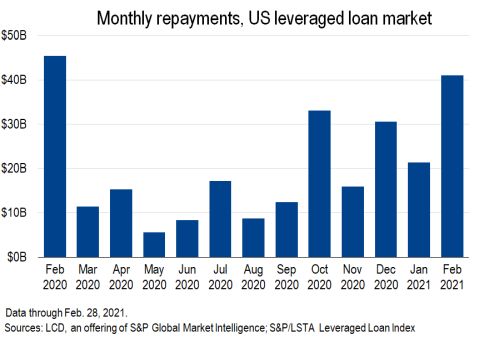

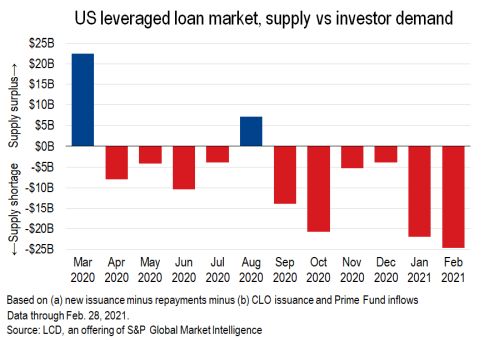

|

Last year, supply chain management software company E2open LLC announced plans to merge with a publicly traded SPAC, CC Neuberger Principal Holdings I. The combined entity was listed as E2open Parent Holdings Inc. on the New York Stock Exchange.

As part of the SPAC transaction, a credit agreement from 2019, led by Golub Capital, was refinanced, eliminating some $400 million of desirable loan paper from the market.

The original E2open loan comprised a $920 million, L+575 unitranche loan and $30 million revolver. Last month, a $525 million first-lien covenant-lite term loan due 2028 (L+350, 0.50% floor) at an original issue discount of 99 was finalized. Goldman Sachs led the arranger group, which included Credit Suisse, Golub, Jefferies, Deutsche Bank and Blackstone. The credit agreement included a $75 million revolver.

|

"The SPAC provides another type of IPO to create a more liquid balance sheet for a company, which can then move into the syndicated loan market or otherwise eliminate high-yielding private debt," said Casey Alexander, an equity research analyst who tracks BDCs at Compass Point.

"At the end of the day, the goal of a private credit provider is to get paid back. It’s a liquidity event for both a private equity sponsor and the private credit provider. People may get some repayments earlier than they would like, but long term it's healthy for the private equity ecosystem."

Even the debt providers themselves are joining the SPAC party.

Dyal Capital Partners and private credit provider Owl Rock Capital Partners LP plan to merge with a SPAC and list the company. Dyal, which owns minority stakes in private investment firms, is a unit of Neuberger Berman Group LLC. Neuberger would retain a "meaningful" stake in the combined company. Owl Rock shareholders are due to vote on the transaction on March 17.

SPAC fever

Borrowers on the smaller end of the market are also targets for SPAC transactions. Some lenders end up holding equity stakes in companies at the same time they receive a loan repayment.

"The interesting question is what the private credit provider will do with the equity stubs they acquire through these transactions. Some companies have struck gold with these deals," said Compass Point's Alexander.

Examples worth noting are Trinity Capital Inc.'s equity stake in Lucid Motors and PennantPark Investment Corp.'s holding in Cano Health, both acquired through SPAC transactions, Alexander said.

Venture debt providers such as Trinity Capital, Hercules Capital Inc. and TriplePoint Venture Growth BDC have drawn attention as "SPAC factories." TriplePoint Capital's BDC shareholders heard in an earnings call last week that more than 20 of its portfolio companies have either announced, or will soon announce, SPAC exits.

In response to a question over whether the trend had changed the firm's view on underwriting investments, TriplePoint Venture CEO Jim Labe said the company was not trying to 'game' whether a SPAC exit was possible when making investment decisions.

"We're not running our business these days on SPAC fever," Labe said in a March 3 earnings call.

Labe also said the possibility for a SPAC exit had widened to more industries.

Among TriplePoint's highlights in quarterly earnings were several SPAC transactions involving its portfolio companies: View Inc. unveiled plans to go public through a SPAC merger; Hims Inc. closed its SPAC merger and listed on the NYSE; and Groop Internet Platform Inc., known as Talkspace, announced plans to go public through a SPAC transaction.

"It's not just for what we call moonshot technology companies, R&D companies, electric batteries [but it's also for] revenue-generating companies, some which are doing extremely well and [are] cash flow-positive, which are also getting out," Labe said.

"It takes away that whole administrative issue and hassle of having to raise that next equity round ... We think it's a good trend right now, but we're not dependent, or running our business, on it."