S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Oct, 2023

By Karl Angelo Vidal and Annie Sabater

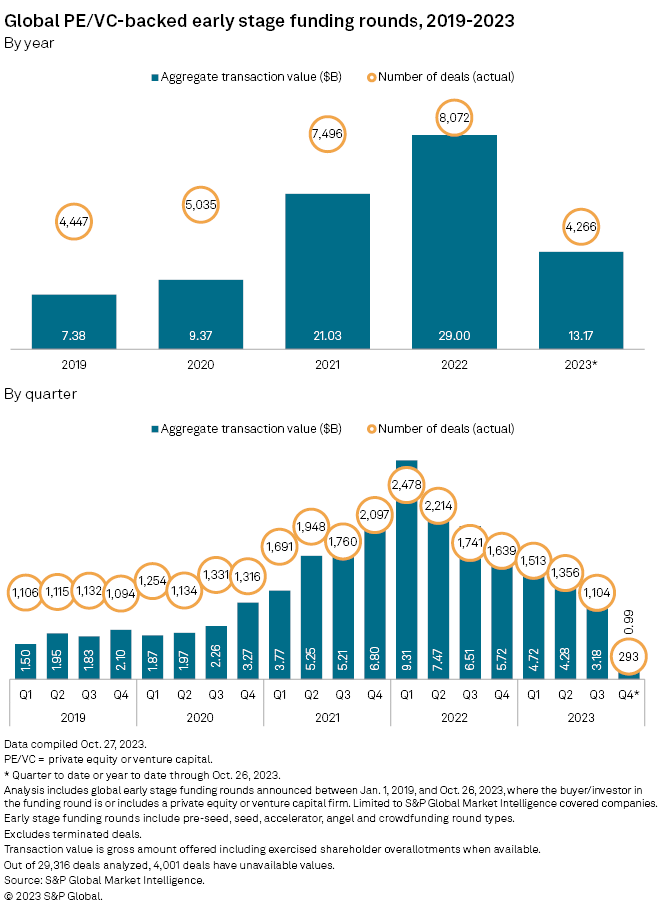

The number of early-stage funding rounds backed by private equity and venture capital firms globally dropped 36.6% to 1,104 in the third quarter from 1,741 a year earlier.

Both the volume and value of early-stage rounds, which include pre-seed, seed, accelerator, angel and crowdfunding, have been in decline for six consecutive months since the first quarter of 2022, according to S&P Global Market Intelligence data.

Total transaction value also slipped to $3.18 billion in the July-September period from $6.51 billion for the same period in 2022.

For the year to Oct. 26, early-stage rounds totaled 4,266, on track to finish well below the 8,072 rounds recorded for full year 2022. Transaction value totaled $13.17 billion, compared to $29 billion for the entire 2022.

Sector, geography focus

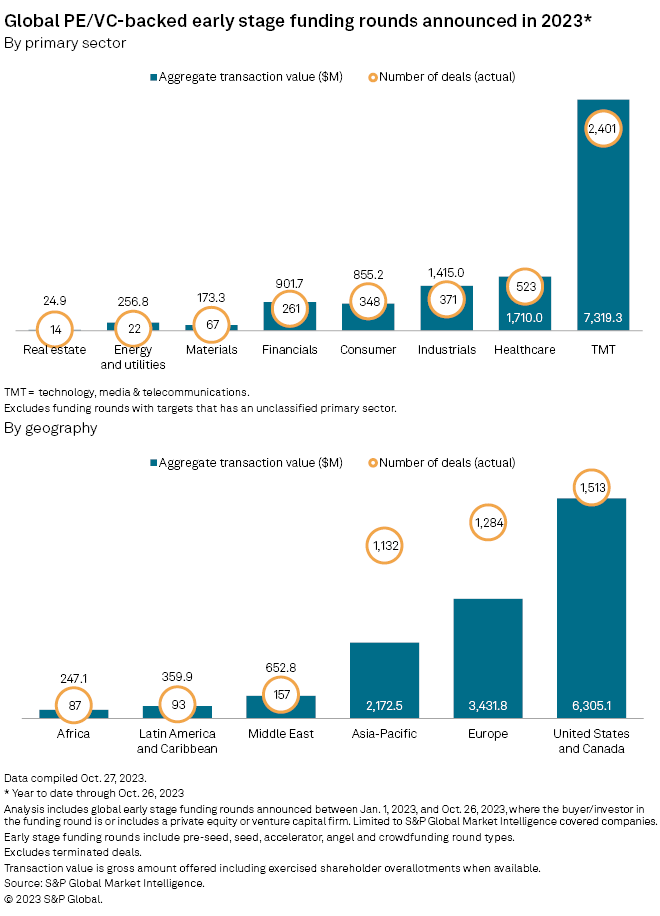

Private equity and venture capital deployment was mostly active in the technology, media and telecom sector with 2,401 early-stage funding rounds in the year to Oct. 26. The healthcare and industrial sectors logged 523 and 371 funding rounds, respectively.

– Download a spreadsheet with data featured in this story.

– Read about venture capital investments in the third quarter.

– Explore more private equity coverage.

In terms of geography, companies based in the US and Canada registered the highest number of private equity-backed early-stage investments, with 1,513 rounds. Companies based in Europe and Asia-Pacific came next with 1,284 and 1,132 rounds, respectively.

Most active firms

Antler Innovation Pte. Ltd. has been the most active investor in early-stage funding rounds so far in 2023. The Singapore-based venture capital firm participated in 289 deals, according to Market Intelligence data.

California-based accelerator Y Combinator came in second, participating in 181 rounds, while Colorado-based Techstars Central LLC was third with 64 rounds.