S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Nov, 2022

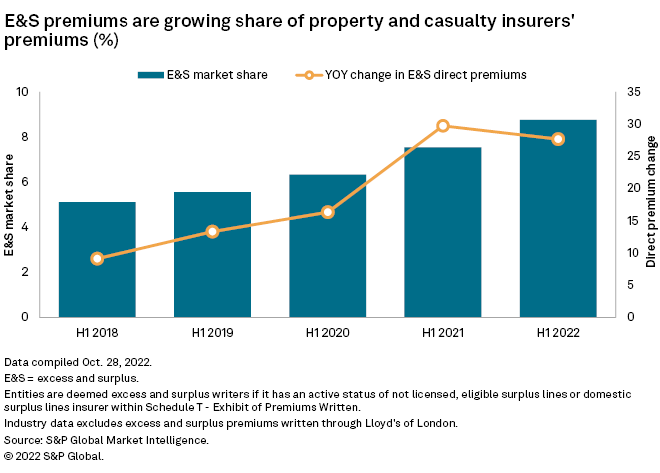

Premium dollars continue to flow into the U.S. excess and surplus market, which constituted 8.7% of the country's total property and casualty industry during the first half of 2022, according to an analysis by S&P Global Market Intelligence.

Excess and surplus, or E&S, direct premium written in the U.S., excluding the Lloyd's of London syndicates, surged to $37.60 billion during the first six months of 2022, an increase of 27.6% compared with the prior-year period. In comparison, the total U.S. P&C market, excluding E&S premiums, grew by only 8.4% during the same period.

While the year-over-year premium growth in 2022 was substantial for E&S premiums, it was slightly less than the 29.7% growth seen during the first six months of 2021.

Surplus line carriers tend to cover complex or high-risk businesses that are unable to find insurance within the traditional or admitted market. The regulatory model tends not to be as strict as the framework for admitted carriers, which affords E&S businesses greater flexibility in setting premium rates and terms for its policies.

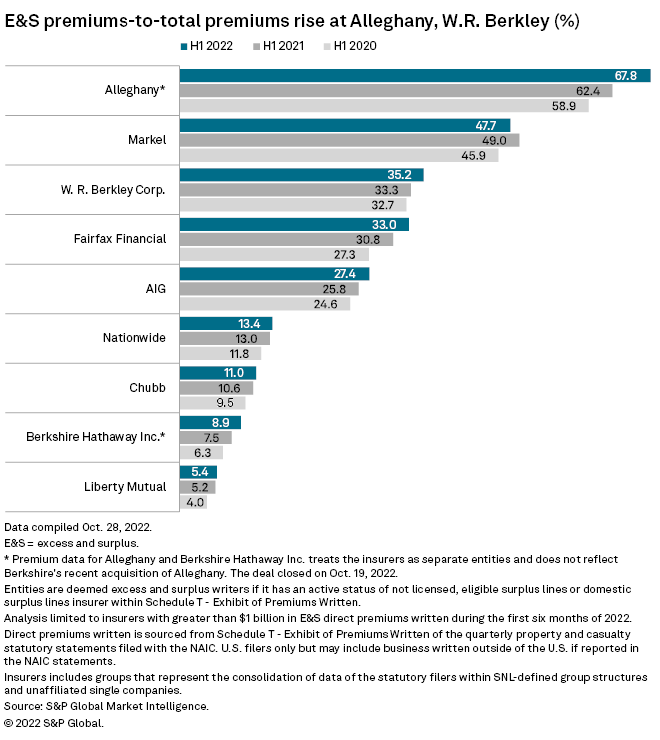

Markel bucks the trend

Of the U.S. underwriters with more than $1 billion in surplus premiums through the first six months of 2022, Markel Corp. was the lone company to see its share of E&S direct premiums compared with its total premiums fall during the period. The decline in the insurer's share of E&S direct premiums can be attributed to its admitted premiums growing faster than its surplus premiums.

|

* |

Markel's surplus direct premiums grew by 9.8% to $1.96 billion during the first half of 2022 compared with the 15.5% growth within its admitted premiums.

Roughly 68% of Alleghany Corp.'s total direct premiums written in 2022 are within its surplus units, the most among the largest E&S writers. This analysis was completed prior to Berkshire Hathaway Inc.'s acquisition of the firm. Alleghany's share of surplus premiums was up 5.5 percentage points in the first half of 2022 compared with the first half of the prior year.

On a pro forma basis, the combined Berkshire and Alleghany entity's surplus direct premiums should account for 12.0% of its total premiums through the first six months of 2022.

Commercial liability coverages lead E&S premiums

Over half of surplus direct premiums are written within commercial liability lines of business. For full year 2021, E&S direct premiums totaled $63.17 billion, with an aggregate of $38.62 billion written in several commercial liability business lines. Individual business lines and the state-level break-out for surplus writers are only available on an annual basis.

The share of direct surplus premiums against the total industry is the greatest within the reported "other liability claims-made" coverage. Roughly one-third of the reported direct premiums in the business line in 2021 were recorded in surplus writers.

While E&S premiums account for a small fraction of the industry's total commercial auto business, the business line experienced the largest growth over the last five years. The five-year compounded annual growth rate was 25.6% during the period.

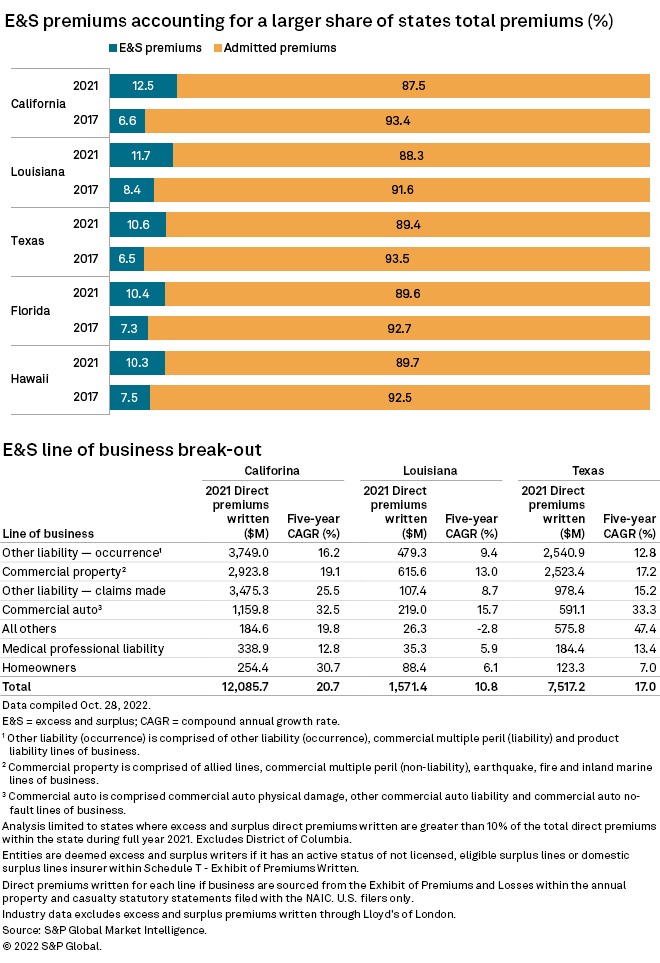

Five states with double-digit E&S market share

There were five states, excluding the District of Columbia, at the end of 2021 where the share of E&S premiums made up more than 10% of the state's total premiums. The largest is California, where the state recorded $12.09 billion in surplus premiums in 2021, which equates to roughly 12.5% of the state's total premiums.

Surplus premiums within the commercial auto line of business recorded the largest CAGR of 32.5% in the Golden State, followed by homeowners insurance at 30.7%. Wildfire risk and a lack of adequate rate increases have caused several insurers to pull back from the California homeowners market, which should continue to fuel the outsized growth in the state's homeowners surplus market.

So far in 2022, American International Group Inc. has exited the admitted market, Chubb Ltd. has significantly scaled back its exposure, The Allstate Corp. stopped writing new business and Lemonade Inc. halted its direct business in the state.