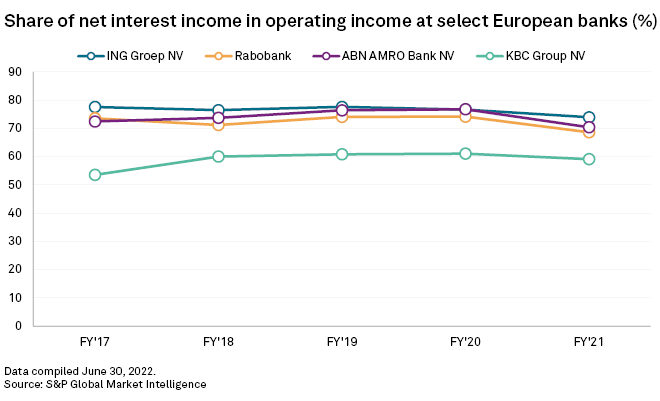

| In 2021, net interest income accounted for nearly three-quarters of ING's operating income. |

ING Groep NV could beat its medium-term net interest income target amid a tightening of monetary policy.

The Amsterdam-based bank in mid-June unveiled new medium-term targets, saying its eurozone retail book would benefit from about €2 billion of additional net interest income, or NII, in a scenario based on a 50% pass-through of positive rates to customers. This came shortly after the European Central Bank said it intends to raise interest rates in a bid to contain rising inflation, providing banks, especially retail-heavy ones like ING, with an opportunity to earn more from interest-bearing assets such as loans.

The targets were based on future rates as they were at the end of April, though; they have increased since then.

"This could suggest further upside to our targets," a spokesperson for the bank told S&P Global Market Intelligence in an email. The potential upside would be partially absorbed by the "progressive relationship" between market rates and the percentage of pass-through, the spokesperson said.

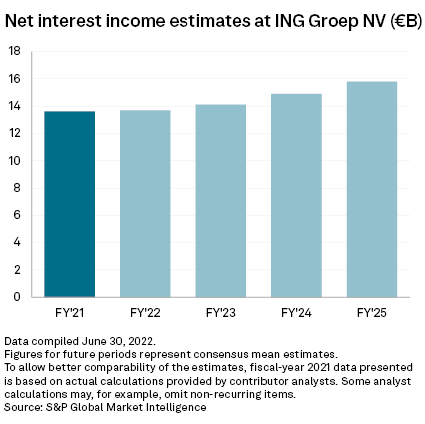

ING's NII would reach €15.80 billion in 2025, up €2.18 billion from the actual €13.62 billion for 2021, according to consensus analyst estimates collected by Market Intelligence as of June 30.

Revenue driver

ING is more reliant than its peers in Belgium, the Netherlands and Luxembourg on NII, which made up 74% of the bank's total operating income in 2021, compared to 70% at Rabobank, 69% at ABN Amro Bank NV and 59% at Belgium's KBC Group NV.

Benelux banks have turned to fees to boost profits amid a low interest rate environment, and monetary policy tightening promises higher revenues on the NII side. The ECB, the base rate of which is currently negative 0.50%, intends to raise this by 25 basis points in July, followed by another hike in September.

It would not be a surprise if ING upgrades its medium-term targets when it reports second-quarter earnings, Thomas Couvreur, associate director for equity research at KBC Securities, told Market Intelligence in an email. The bank has remained relatively resilient despite its material exposure to Russia and Ukraine, he said. As of April, ING had €6.7 billion of exposure to Russia.

The bank may have been too conservative with its own estimates because of the "sharp increase" in forward rates since the end of April, UBS Research analyst Johan Ekblom told Market Intelligence.

ING faces fewer headwinds than ABN Amro from the removal of negative rates on deposits, which were introduced in the Netherlands as banks looked to offset ultra-low central bank rates, Ekblom said. KBC's interest rate exposure is different since rates in the central and Eastern Europe region, where it has a large presence, are expected to come down in 2023.

Near-term profitability pressures

Overall, ING is well geared to meet its goals, according to analysts, although the bank could face profitability pressures in the near term.

The repricing of assets as rates increase will take time, and banks may find it difficult to fully pass through the higher rates to borrowers in the short term due to stiff competition, Andreea Playoust, director for Europe, Middle East and Africa banks at Fitch Ratings, said in an email. How they go about the end of the ECB's targeted long-term refinancing operations, or TLTRO, will also impact NII, Playoust said.

TLTRO III, which offers banks long-term funding at attractive rates to ensure continued lending, and which has helped ING's income in recent quarters, is set to end later in 2022. ING CFO Tanate Phutrakul has said the program's expiry will lead to the bank losing roughly €300 million of NII.

The increase in rates directly affects funding costs, causing difficulties for ING in 2022, Couvreur said. He also said the end of negative rate charging on deposits will weigh on NII this year.

The upside on the rate sensitivity will be seen more in 2023 and 2024 than this year, according to Ekblom at UBS.

IHS Markit recently downgraded its interim 2022 dividend forecast for ING, reflecting the expectation of a decline in first-half profits. In terms of capital returns, however, ING is still implementing a €380 million buyback, and more is expected to come.

The "key challenge for NII is re-adjusting the loan book," the ING spokesperson said. The bank will present its interim results Aug. 4.