S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Aug, 2022

By Alex Blackburne

|

A reservoir in Spain. Low rainfall and high temperatures have dented hydropower production in Southern Europe. |

Brutally dry conditions in parts of Southern Europe have led to a significant downturn in hydropower generation so far in 2022, exacerbating an already perilous situation in the energy market as the EU grapples with the realities of ditching Russian gas.

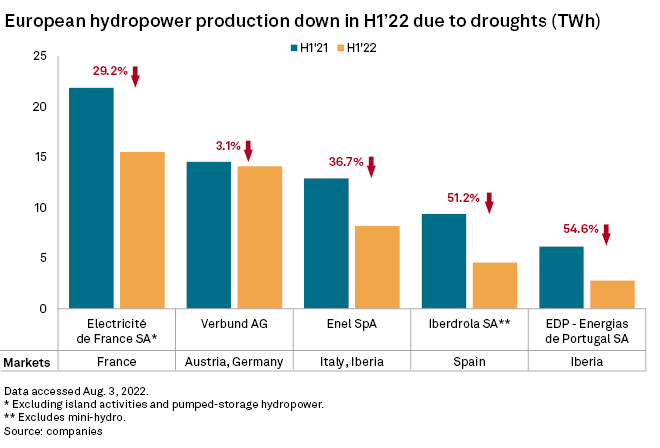

Some of Europe's largest hydropower operators, especially those with plants in Iberia, Italy and France, saw production decline steeply in the first six months due to sustained high temperatures and low rainfall. The dry spells meant monthly hydro production in the EU dropped below solar power for the first time in July, according to grid operator data aggregated by research firm Fraunhofer ISE.

Amid the droughts, many hydro operators are suffering financially as they are forced to buy power at record-high prices on the spot market to replace missing hydro volumes.

The hydro generation of Electricité de France SA, or EDF, was down nearly 30% year over year in the first six months, resulting in a negative earnings impact of €1.4 billion and compounding outages in the state-controlled utility's sprawling nuclear fleet.

The poor hydro performance is "in the context of historically low water levels as a logical consequence of the drought in France," Chairman and CEO Jean-Bernard Lévy told analysts July 28.

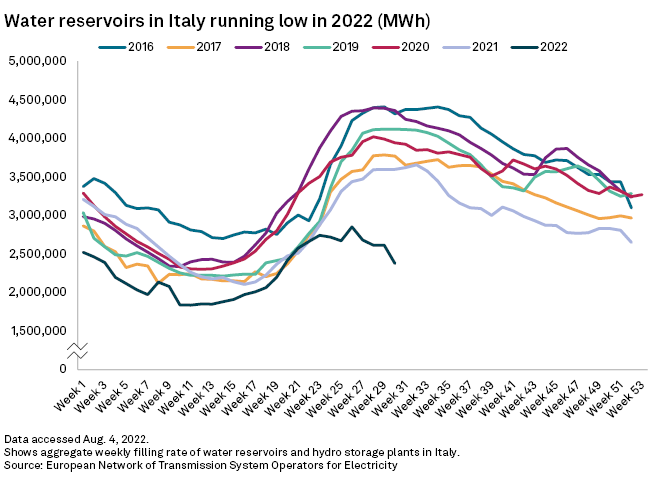

Enel SpA's first-half hydro generation in Italy and Iberia was more than a third lower than in 2021. "The situation is extremely dry in Europe," CFO Alberto De Paoli said on the company's July 28 earnings call, adding that hydro availability in Italy and Spain is roughly 40% below the historical trend.

Iberia is among the worst-affected regions: Portugal's hydro stocks are at their lowest levels in recent times — with reservoirs at 29% of capacity on July 31, compared with the average of 63% over the last decade — due to what grid operator REN - Redes Energéticas Nacionais SGPS SA described as the "worst drought in 100 years." In neighboring Spain, three large hydro complexes were running at restricted output in mid-July due to scarce rainfall and above-average temperatures.

EDP - Energias de Portugal SA saw its Iberian hydro generation more than halve in the first six months compared with a year ago, translating into a €19 million loss of earnings after the unit recorded positive EBITDA of €281 million last year. Iberdrola SA's hydro output in Spain was also down 51% in the period.

Fluctuations in hydro generation are nothing new, but the frequency of extreme conditions is increasing as a result of climate change, according to experts.

"It seems like these extreme fluctuations happen more often," said Anton Schleiss, a retired civil engineer who now coordinates Hydropower Europe, an EU-funded project to develop a roadmap for the industry. "We have more often wet years and more often dry years."

Operators typically guard against such variations by using their reservoirs. In Southern Europe, that means storing winter rainfall for use during the dry summer months, while Alpine reservoirs store meltwater from glaciers in the summer to use over the winter.

"If the reservoirs weren't there, we would already be in a blackout everywhere," Schleiss said in an interview.

Record-low hydro stocks aggravate an already tight power generation landscape in Europe. EDF's nuclear output in France is well below normal levels due to plant outages, while coal units are having to return in many markets because of gas shortages.

French nuclear output stood at 26.9 GW on Aug. 3, according to system data — well below the approximately 40 GW seen in early August last year. Beyond EDF's technical issues in its fleet, the utility has also been forced to restrict production at certain plants because of high river temperatures, which mean it cannot use water for cooling purposes.

These factors combined could lead to a gas supply risk in the coming winter, according to Glenn Rickson, head of European power analysis at S&P Global Commodity Insights. The EU is already calling on member states to reduce their gas consumption to help the bloc navigate potential further disruptions of Russian imports.

"Every unit of non-gas generation that is below expectation now implies that gas has to turn up," Rickson said in an interview.

Many hydro operators in Europe cashed in on surging power prices last year, but that dynamic has been turned on its head.

In an interview with Commodity Insights in July, EDP CEO Miguel Stilwell d'Andrade said the company has been forced this year to buy back replacement electricity volumes on the spot market to make up for its lower hydro production. EDP sold forward its hydro generation at €60/MWh, then purchased power on the market for €230/MWh, the CEO said.

Assuming normal rain levels in the second half of the year, the company will look to hold back some production to help replenish its reservoirs, Stilwell d'Andrade told analysts July 29. With stocks running low and winter approaching, operators face a decision to generate now or store water for production later.

"If you are producing now and having to buy back [power] in the winter, you're looking at having to pay at least double," Rickson said. "Inevitably, the shortfall that we're seeing now will feed into the winter."

In the Alps, reservoirs have seen lower inflows this summer due to less snowfall last winter, according to Schleiss. The longer-term trend in the region is toward a more challenging hydro picture, given its glaciers are disappearing. Glaciers feed water through to reservoirs slowly but snow melts quickly, which will push storage capacity to the limit.

For now, though, the attention is on the coming winter.

"We can hope that the winter is not too cold in Europe and that we have a lot of precipitation that brings additional water to the reservoirs," Schleiss said. However, if the winter is particularly cold, "then we will really have problems."

Commodity Insights reporter Andreas Franke, who writes for S&P Platts Dimensions Pro, contributed to this story. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.