S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2021

By Brian Scheid

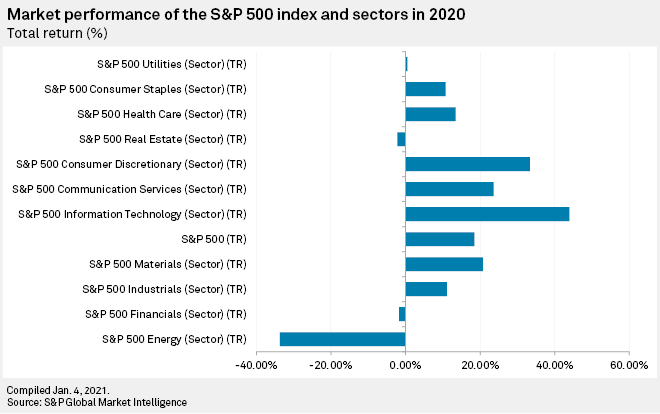

Despite repeated surges in coronavirus cases and a dim labor market, the massive gains by a few big stocks pushed the S&P 500 to record after record in 2020 and an 18.4% gain for the year on a total-return basis.

The New Year's Eve close was the index's 33rd record high in 2020 and marked the eighth time since 1928 that the large-cap index closed a year at a fresh peak. But the gains, including 20 new record highs since COVID-19 took root in the U.S., were uneven, and the market grew more top heavy in 2020 as mega-cap stocks flourished in the pandemic and other sectors languished.

"Unless you're a mega-cap tech company, nothing about 2020 was easy," said Michael O'Rourke, chief market strategist at JonesTrading.

As 2020 closed, the largest 10 stocks held 27.4% of market value, up 4.7 percentage points from a year earlier, according to data provided by Howard Silverblatt, senior index analyst with S&P Dow Jones Indices. In addition, Apple Inc., which gained 82.3% on a total-return basis including dividends; Amazon.com Inc., which rose 72.6%; and Microsoft Corp. at 42.5%, accounted for more than 53% of the S&P 500's total return in 2020. Take out the top 30 stocks by market cap and the S&P 500 actually fell 0.03% in 2020.

The S&P 500's information technology sector, which includes Apple and Microsoft, surged 43.89% on the year, the most of any sector. Consumer discretionary stocks, a category that includes Amazon, saw a 33.3% gain.

Conversely, financials fell 1.7% on the year, real estate stocks dipped 2.2%, and energy sector stocks fell 33.7% due to a steep decline in oil prices and a record drop in demand as lockdown orders gutted travel.

The path forward will likely vary starkly by sector again in 2021, analysts said.

"Some sectors will bounce back quicker than others," said Craig Erlam, a senior market analyst with OANDA. "Travel and tourism, for example, could see plenty of pent-up demand come the spring of next year, which could see them continue to make up significant lost ground. The recovery may be harder for the hospitality and retail sectors. The big winners will remain tech as some of the effects of the pandemic are irreversible, so we could still see them perform reasonably well, but there's certainly more opportunity elsewhere heading into 2021."

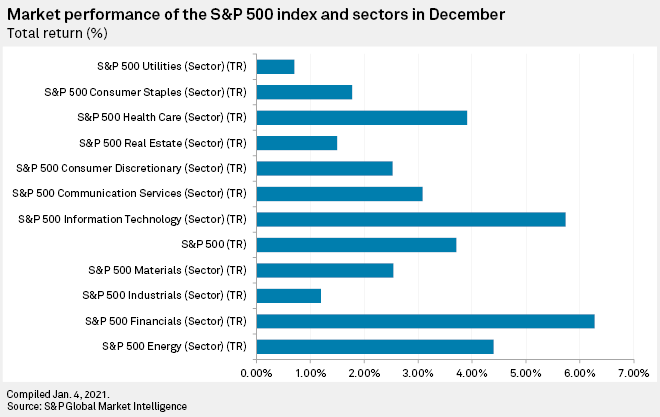

The S&P 500's energy sector saw a bit of a rebirth in late 2020 on news of successful vaccines; those stocks jumped 28% in November and 4.4% in December.

"The end to the COVID nightmare is in sight and with it the ability of the energy market to look through current lockdowns to a more normalized demand outlook in [the second half of 2021]," said Eric Nuttall, a partner and senior portfolio manager at Ninepoint Partners.

The greater S&P 500's 2020 rally, in which valuations skyrocketed, followed the briefest bear market in history and may not be close to over, largely due to accommodative monetary and fiscal policy.

"Stock market investors are apparently in the same bullish mood as they were before despite growing concerns over valuations and the economy," said Fawad Razaqzada, a market analyst with ThinkMarkets. "The disconnect between economic reality and the markets have thus broadened, all thanks to cheap central bank and government money flooding the financial markets."

The S&P 500 jumped 3.7% in December, with all 11 sectors gaining ground. Financials stocks increased 6.3% on the month, the biggest gainer of any sector, while utilities gained the least at 0.7%. The index increased nearly 11% in November, also with all 11 sectors increasing that month.

S&P Dow Jones Indices and S&P Global Market Intelligence are owned by S&P Global Inc.