Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Sep, 2021

By Adrian Jimenea and Cheska Lozano

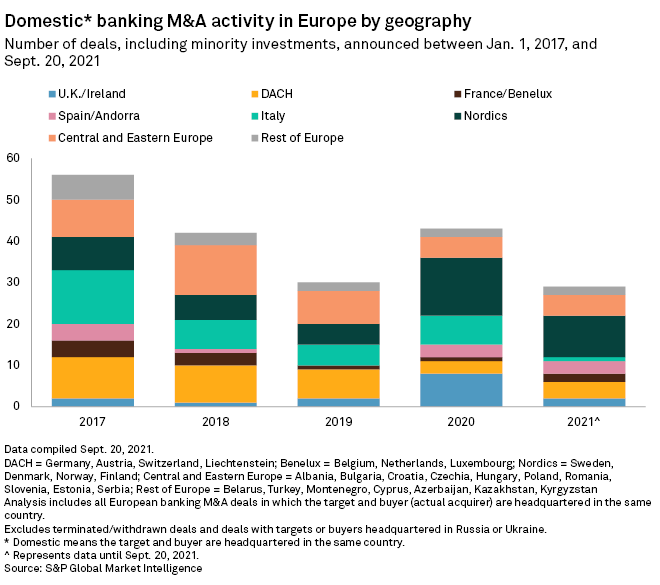

The number of mergers and acquisitions among banks in Europe in 2021 may outstrip the total in 2020, with deals where buyer and seller are based in the same country making up the lion's share, according to an analysis by S&P Global Market Intelligence.

The volume of transactions so far this year has already exceed that of 2019 and, by Sept. 20, had reached about 80% of the volume for the whole of 2020. Thirty-nine deals had either been announced or closed, versus 48 for all of 2020.

European banking M&A is "sizzling hot," according to Hyder Jumabhoy, a partner at London-based law firm White & Case. Bright spots in the first half included Spain, Italy, Germany, Poland and Denmark, Jumabhoy said.

The flurry of deals can be attributed to "a confluence of conducive conditions," including the need for scale, the availability of compatible targets and support from regulators, Jumabhoy told Market Intelligence. Watchdogs, particularly the ECB, have also changed their approach such that they now allow banking stability to trump too-big-to-fail concerns, Jumabhoy added.

The ECB has recognized that newly combined banks must take large costs up front and wait for the potential synergy benefits. With that in mind, it has said it will not penalize banks with credible M&A plans by setting higher Pillar 2 capital requirements based on the front-loading of costs.

In-market deals

For years, bank M&A in Europe largely consisted of domestic or in-market deals, in which the target, buyer and seller are based in the same country.

That trend is continuing this year. Of the 39 deals so far, 29 are in-market, Market Intelligence data found. Nordic banks lead the pack with 10 deals. Banks in Switzerland, Germany and Austria have signed four deals, while those in Central and Eastern Europe have signed five.

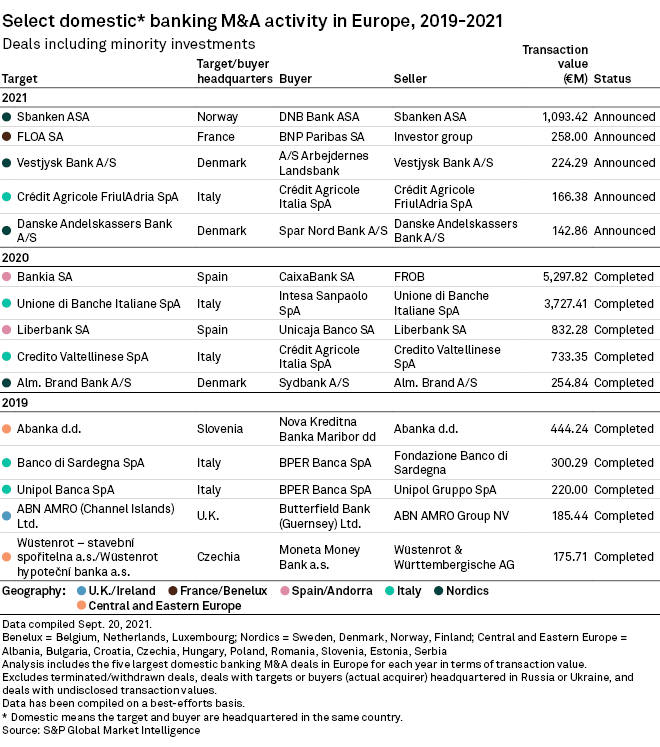

Noteworthy deals in the Nordics this year include Norway-based DNB Bank ASA acquiring peer Sbanken ASA. In Denmark, A/S Arbejdernes Landsbank bought a minority stake in Vestjysk Bank A/S, while Jutlander Bank A/S and Sparekassen Vendsyssel merged. Nordic banks also made up 14, or nearly a third, of the 43 domestic deals in 2020.

Spain-based CaixaBank SA acquiring smaller peer Bankia SA was among the biggest deals in 2020. Unicaja Banco SA also bought Liberbank SA. In Italy, Intesa Sanpaolo SpA successfully merged with Unione di Banche Italiane SpA, while Crédit Agricole Italia SpA — a unit of France-based Crédit Agricole SA — bought Credito Valtellinese SpA.

Domestic deals make sense, rating agency Fitch said in a recent report, given how fragmented European banking sectors are. Such deals offer second-tier banks opportunities to benefit from scale and allow them to "compete on a more level playing field," Scope Ratings also said in an Aug. 19 report. For national champions, domestic deals offer opportunities to consolidate their position.

According to Jumabhoy, banks are looking to utilize the "M&A dry powder" they stored up in 2020. Their moves also come in response to alternative offerings by challengers, neo-banks and big tech companies. Domestic deals allow banks to benefit from economies of scale, by cutting the per-unit cost of providing financial products, and from scope, by providing bolt-on or ancillary products.

Scope Ratings also said the economic benefits from domestic deals continue to be very strong because the recession has enshrined the negative rates/flat yield curve outlook.

A KPMG report also said domestic deals became "a critical lever" for trimming branch networks and boosting profitability as banks grappled with elevated loan loss provisions amid the COVID-19 pandemic, which ultimately hurt profits. On cross-border mergers, KPMG said such transactions may take some time to gain traction as they need to "deliver credible synergies, accommodate regulatory constraints and navigate accounting headwinds."

Scope Ratings also said cross-border deals "offer very little incremental returns" amid a low-rate environment. There is also the presence of "structural challenges" such as benefits being limited by the lack of cost and funding synergies because of ring-fencing rules and the absence of a "complete" banking union.

No signs of slowing down

The momentum for consolidation "shows no signs of slowing down" and is set to continue in 2022, Scope Ratings said, adding that the focus would likely still be with domestic deals, which would take "the lion's share of activity" despite a supervisory push for cross-border deals. For Jumabhoy, domestic and regional consolidation could even escalate in the short-to-medium term.

In Italy, UniCredit SpA is conducting due diligence to potentially acquire parts of Banca Monte dei Paschi di Siena SpA, while Banca Carige S.p.A. - Cassa di Risparmio di Genova e Imperia is looking for a merger partner. German federal state banks Landesbank Hessen-Thüringen Girozentrale and Landesbank Baden-Württemberg are also merging their savings bank services operations. Additionally, there has been speculation over a potential combination between Swiss giants UBS Group AG and Credit Suisse Group AG.

In the U.K., there are expectations of a consolidation among challenger and digital banks, which Scope Ratings said was "a very crowded market with dozens of incumbents" but with difficult profitability prospects. Deals could center on segments or business lines or on large banks wanting to boost their digital channels targeting "mobile-enabled challengers."

Should cross-border deals emerge, they would likely be by large foreign banks seeking to expand in core countries through bolt-on acquisitions and not mergers of equals, Scope Ratings said.

Banks in Russia and Ukraine, where government ownership means banks are subject to different market dynamics, were excluded from this analysis.