Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2022

The U.S. Department of Justice is awaiting a federal judge's decision on whether to block UnitedHealth Group Inc.'s proposed acquisition of Change Healthcare Inc., and the ruling will send a strong signal to other dealmakers regarding how the courts view access to competitor data as a competitive concern.

Central to the trial is what UnitedHealth — the largest health insurer in the U.S. — would do with the vast amounts of competitor data it would acquire through buying Change, a data analysis service provider for many major managed care insurers.

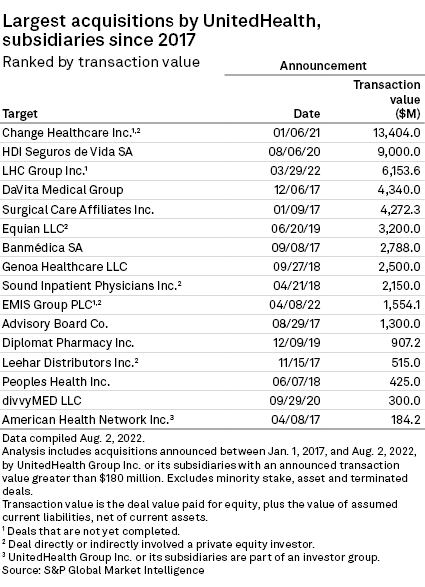

In February, the DOJ filed a lawsuit seeking to block the $13 billion deal announced in January 2021, arguing that because Change's products are widely used by many healthcare providers, United's health insurance rivals would not be able to prevent their data from being routed through Change post-transaction. This would allow United to co-opt its rival insurers' innovations and their competitive strategies while reducing their incentives to pursue those innovations in the first place, the DOJ complaint argues.

Closing arguments wrapped up in Washington, D.C., on Sept. 8 and Judge Carl Nichols is expected to rule on the case in the coming weeks.

According to Kaenan Hertz, managing partner with Insurtech Advisors, Change has been vocal about how one in three U.S. patients' medical records are touched by its clinical connectivity solutions. Such a vast array of information could prove valuable to United, potentially increasing the value of its Optum subsidiary, if the company decides to spin off its analytics division.

"[The deal] pretty much gives United a monopoly on a heck of a lot of claims-related data and [pharmacy benefit manager]-related data and that's why they're excited about it and they're willing to pay a hefty price," Hertz said. "The other side of it is, does that monopoly now mean that other payers or providers will be less comfortable extracting data using those services?"

Counsel for United pushed back against the DOJ, arguing during the trial that the company already has access to analytics information via Optum and that it has not misused that data due to safeguards already in place, including existing firewalls and data-security policies.

Horizontal vs. vertical

While horizontal merger challenges are typical for the DOJ and Federal Trade Commission, the agencies seek to block very few vertical mergers, said Kevin Hahm, a partner with law firm Hunton Andrews Kurth. Before the DOJ's failed bid to stop the AT&T/Time Warner deal in 2018, it had been decades since a vertical merger was litigated in court.

"From time to time, the DOJ or the FTC will seek an enforcement action against a vertical merger, but settle the matter through a behavioral or conduct remedy like a firewall, which the defendants offered up in United-Change," said Hahm, who worked on United and Optum's $4.3 billion acquisition of DaVita in 2019 during his time with the FTC.

The theory of harm in a vertical deal is that after the merger, the acquirer will have both the incentive and ability to behave differently to disadvantage rival competitors, Hahm said. In the instance of the United-Change deal, a firewall goes to whether or not United will have the ability to misuse the information against its rivals or competitors.

"As far as whether United's incentive would change, it claimed that it wouldn't be in its interest to disadvantage rival insurers because their business is so important and that misusing their information would result in reputational harm to Change," Hahm said.

Optimizing acquisitions

The proposed acquisition is the largest deal announced by United Healthcare in the last five years, a period in which the massive managed care insurer continued to grow. Other deals include the acquisition of home healthcare company LHC Group Inc. for $6.15 billion, which is also expected to be folded into the Optum branch when completed. Another data-focused acquisition involved PatientsLikeMe Inc. in 2021, which focuses on patient social networks.

Several of United's competitors have also been active dealmakers, including Elevance (formerly Anthem), which acquired Integra Managed Care in 2022, home-based nursing company MyNexus in 2021 and behavioral health organization Beacon Health Options Inc. in 2020.

"The focus has been less around acquiring customers, but rather acquiring additional distribution partnerships and especially analytics providers," Hertz said.

The ability to harness data by processing and enriching it is going to be a competitive concern that arises more and more, according to Diana L. Moss, president of the American Antitrust Institute.

Over the last 20 years there has been an "incredible amount" of consolidation in the U.S. healthcare markets, Moss said in an interview.

"This has created a supply chain with very few competitors in critical segments and the effect of that is to increase incentives to exercise market power against medical providers," she said.

The DOJ has pursued a more interventionist antitrust agenda under the Biden administration, which caused Aon PLC to abandon its proposed $30 billion acquisition of rival broker Willis Towers Watson PLC in July 2021 after a similar court challenge.