S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jul, 2022

DNB Bank ASA reported a higher profit for the second quarter, thanks to a sharp rise in net interest income that was helped by rising interest rates, customer repricing, volume growth and the integration of Sbanken ASA.

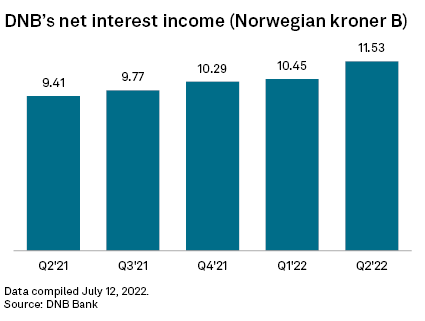

The Norwegian bank's second-quarter group profit attributable to shareholders rose 22.5% year over year to 7.61 billion Norwegian kroner from 6.21 billion kroner. Net interest income, or NII, also rose 22.5% to 11.53 billion kroner. The group's NII reflects the full effect of the repricing of customer loans and deposits implemented at January-end and the partial effect of the repricing from mid-May.

The inclusion of Sbanken contributed 405 million kroner, CFO Ida Lerner said in a July 12 earnings presentation.

"NII effects come if and when we change the customer rates. The notice period on repricing of loans to customer gives a lag effect," Lerner said.

The Norwegian central bank raised its policy rate from 0.75% to 1.25% in June and expects to raise it further to 1.5% in August. The recent policy rate forecast also indicates a rise to about 3% toward mid-2023.

"We have announced a price adjustment in relation to that change in policy rate [in June], and this will take an effect on our numbers from mid-August," DNB Bank CEO Kjerstin Braathen said.

A fourth repricing, to be implemented in August, is estimated to have an annual effect of about 2.5 billion kroner, Lerner added.

Market volatility and inflation

"Volatility, I think, is a word that stands out that really characterizes the quarter that we are now putting behind us," Braathen said. Even so, Norway's economy has continued to perform "very solidly" with high activity during the quarter, which was reflected in DNB's results, the CEO noted.

Inflationary pressure in the Norwegian economy has been higher than previously expected, but it remains lower than in other European economies, Braathen said.

DNB expects to enter into a period with higher inflation and increased customer activity, which will impact the group's cost levels, but it remains committed to its target of achieving a cost-to-income ratio of below 40% toward the end of 2023, according to Lerner.

DNB's shares closed July 12 up 4.0% at 187.95 kroner apiece.

As of July 12, US$1 was equivalent to 10.20 Norwegian kroner.