Dividends at Germany's two largest listed banks are set to increase each year through 2024, consensus analyst estimates compiled by S&P Capital IQ show.

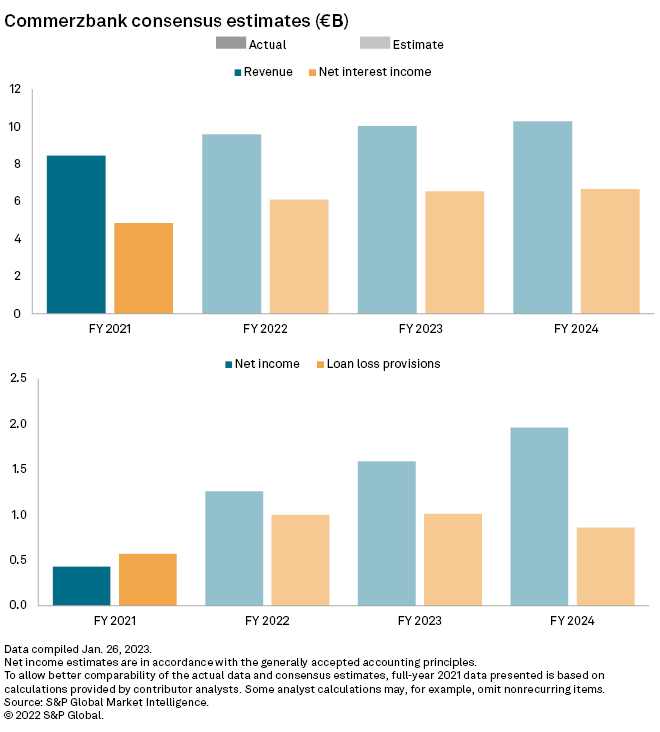

Higher revenues and profits, driven by rising interest rates, will fuel the improved payouts. Net income at Commerzbank is expected to more than double to €1.26 billion in 2022, consensus estimates show, before rising to €1.59 billion the following year and €1.96 billion in 2024.

Given consensus estimates and the current 435-basis-points buffer above minimum requirements, Commerzbank is expected to resume dividends from 2022, UBS analysts said in a Jan. 20 earnings preview note.

Deutsche Bank is expected to hike 2022 dividends by 50%, thanks to rising rates and improving profitability, analysts at S&P Global Market Intelligence's dividend forecasting team said in a report Dec. 12, 2022.

Net income at Germany's largest lender is expected to climb to €4 billion in 2022, the highest level since 2011, Market Intelligence data shows. The result is expected to edge down to about €3.9 billion in 2023, rising again to about €4.4 billion in 2024, consensus estimates show.

Apart from revenue tailwinds from rising rates, the better-than-feared macroeconomic developments in Germany toward the end of 2022 will support fourth-quarter profits at both Deutsche Bank and Commerzbank, the UBS analysts said.

Consensus analyst estimates compiled by Deutsche Bank put its fourth-quarter net attributable profit at €992 million. This is below the prior quarter's €1.21 billion but well above the €263 million booked a year ago, according to Market Intelligence data.

Average consensus projections released by Commerzbank suggest that fourth-quarter net attributable profit will rise to €374 million from €195 million in the previous quarter. It reported a €421 million profit in the year-ago period, Market Intelligence data shows.

Commerzbank booked €747 million of additional provisions for mortgage holidays and potential claims related to Swiss franc-denominated loans in the portfolio of its Polish unit, mBank SA, which weighed on the group's third-quarter profit in 2022.

Yet the bank was upbeat about its future performance, setting higher revenue and operating income targets for 2024. Commerzbank could raise its guidance further with its fourth-quarter earnings release Feb. 16, according to Deutsche Bank analyst Benjamin Goy.