Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Apr, 2021

Even as the pandemic took a heavy toll on several of its businesses, The Walt Disney Co. fared well through the pandemic as it renovated the Mouse House to become more of a Mouse Platform.

Like many firms, Disney shares took an initial dive in 2020 when it became clear there would be no big screens on which to debut its big-budget blockbusters, no crowds to congregate at its theme parks and less advertising for its TV networks. Shares hit a low point on March 23, 2020, down over 40% from New Years’ Day. By comparison, the S&P U.S. BMI Media and Entertainment Index was off around 26% and the S&P 500 was down about 30%.

But the company's investments in its streaming platform seemed to come at the exact right time. On April 8, 2020, Disney reported 50 million subscribers for Disney+, less than five months after the service launched in the U.S. Those numbers helped push a 22% recovery for the stock from the pandemic low.

After further surprising Disney+ announcements, released even as the company's legacy businesses continued to suffer, investors saw Disney as one of the new architects of the future of streaming entertainment, and they rewarded Disney with a valuation that looked more like that of a growth company than a mature media and entertainment business.

By the end of 2020, the company reported 137 million streaming subscribers across its various platforms, with expectations for that figure to grow as high as 350 million by the end of 2024. Disney also reorganized its business segments and its film release strategy to prioritize streaming.

By the close of markets April 5, about a year after the company began furloughing nonessential staff across its lines of business, Disney shares closed up about 122% from the pandemic low point, and up 32% from the opening of 2020 when coronavirus was just a whisper on far-off winds.

Investors at the end of 2020 were paying a price-to-levered cash flow value of 134.2x for Disney shares, up from 30.2x in the fourth quarter 2019.

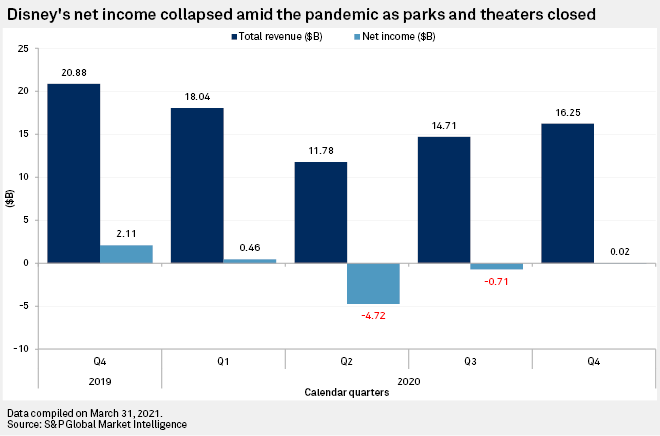

That is particularly notable considering the company's top and bottom lines remained hard hit by the pandemic. Disney collected $16.25 billion in revenue in the fourth quarter of 2020, down from $20.88 billion a year earlier. The company recovered some of its profits, but only a very narrow slice, reporting $17 million in fourth-quarter 2020 net income attributable to shareholders, compared to $2.11 billion a year prior.

Disney's losses over the pandemic period complicate the use of EPS-based valuation metrics to determine how investors are pricing the shares.

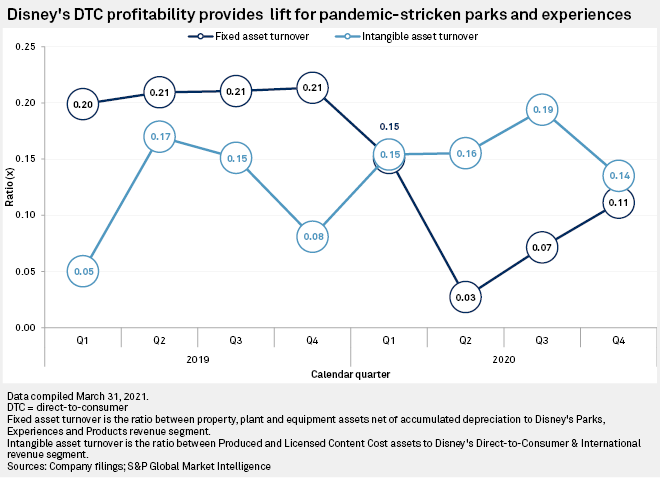

But while Disney is getting renewed and redoubled enthusiasm amid its streaming success, that streaming success does seem to be supporting the otherwise beleaguered business. It has been drawing more and more of its revenue per unit of value from its intangible assets, which include the Disney+ platform, as well as ESPN+, Hulu and other streaming services, as less revenue comes from the value of its fixed assets, like theme parks and product manufacturing.

Disney's fixed asset turnover is the ratio between the value of its fixed assets — including real estate, products and equipment — to the general revenue category to which those assets contribute, namely its parks, experiences and products business segment. That ratio has been severely beaten during the pandemic, down to 0.03x in the second quarter 2020 from 0.21x in the fourth quarter 2019. It recovered to just 0.11x in the fourth quarter 2020.

Meanwhile, its intangible asset turnover, the comparable metric that shows how effective its intangible assets are at driving revenue, is up year over year. It closed 2019 at 0.08x, matched the fixed asset turnover ratio in the first quarter 2020 at 0.15x and hit 0.19x and 0.14x in the third and fourth quarters of that year, respectively.