Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 May, 2022

DISH Network Corp. will introduce a postpaid service this fall in an attempt to sweep market share from the already-strong wireless incumbents and cable wireless players.

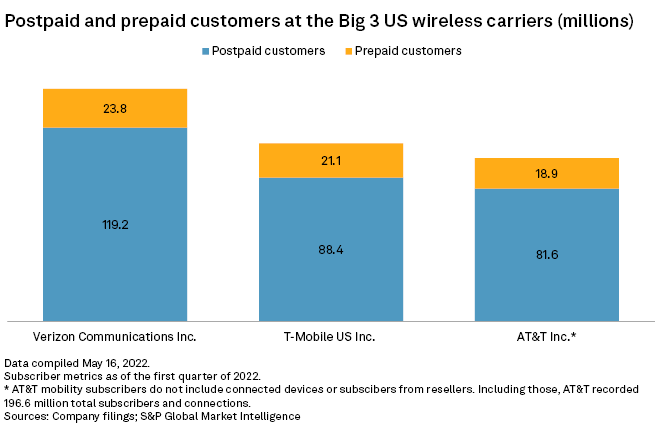

During its recent investor day, DISH outlined plans to spin off its current prepaid mobile brand Boost into a postpaid service called Boost Infinite. By 2025 or 2026, DISH hopes to reach up to 40 million wireless subscribers. By comparison, the three largest U.S. wireless carriers — Verizon Communications Inc., T-Mobile US Inc. and AT&T Inc. — each count over 100 million postpaid and prepaid wireless customers.

DISH Executive Vice President of Retail Wireless Stephen Stokols emphasized that DISH is not starting from zero. DISH ended the first quarter of 2022 with 8.2 million retail wireless subscribers, thanks largely to its 2020 acquisition of Sprint's Boost Mobile prepaid brand. That equates to roughly a 2.6% share of the wireless market and a 12% share of the prepaid market, according to Stokols.

"We're going to take Boost from the prepaid market to the mass market," Stokols said. "We're not going to spend billions on trying to create a new brand from scratch."

While not starting from nothing, DISH is starting from a shrinking wireless base. Retail wireless net subscribers decreased by approximately 343,000 in the first quarter of 2022 compared with a net loss of 161,000 in the year-ago quarter.

DISH's wireless offering also currently relies on mobile virtual network operator agreements with T-Mobile and AT&T as DISH builds out its own 5G network. For the past several quarters, DISH has focused on building out its 5G footprint in Las Vegas and has plans to expand into more markets.

Until DISH can build out a meaningful 5G footprint of its own and rely less on its MVNO partners, the lack of owner economics could be a limiting factor to DISH's postpaid mobile growth, said Lynnette Luna, an analyst at Kagan, a media research group within S&P Global Market Intelligence.

"DISH said competitive pricing will correlate with owner economics," Luna said. "The more traffic it can push over its own network, the more aggressive it will be on the pricing front. So I don't expect an overly dramatic pricing change to start with."

DISH's postpaid goals rely on the utilization of embedded Subscriber Identity Module technology, where customers do not need a physical SIM card. This means subscribers from other carriers could switch to DISH postpaid service without the hassle of going into a DISH physical store. Stokols said 60% of shipped devices will be eSim enabled by 2025, presenting an unprecedented opportunity for smaller carriers like DISH to "disrupt" the wireless environment.

"The friction in switching wireless carriers that's existed for decades will not be there in the next few years," Stokols said.

Luna said DISH may be overestimating just how widely utilized eSIM technology will be.

"We are still a long ways from a smooth transition between eSIM devices," Luna said. "Even those devices that have eSIM still have compatibility problems among carriers. I would really like to see some innovation from Boost on the digital front because that is still largely unexplored."

DISH is migrating customers off of Sprint's legacy platform to a digital operator platform. Whereas new pricing plans would take three months to go live on the old platform, the new platform allows DISH to take plans live within days or even hours, Stokols said.

"The key advantage for Boost, if it delivers on its promises, will be an ability to be nimble in the market and change pricing plans on the fly," Luna said.