Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jan, 2023

By Ben Dyson

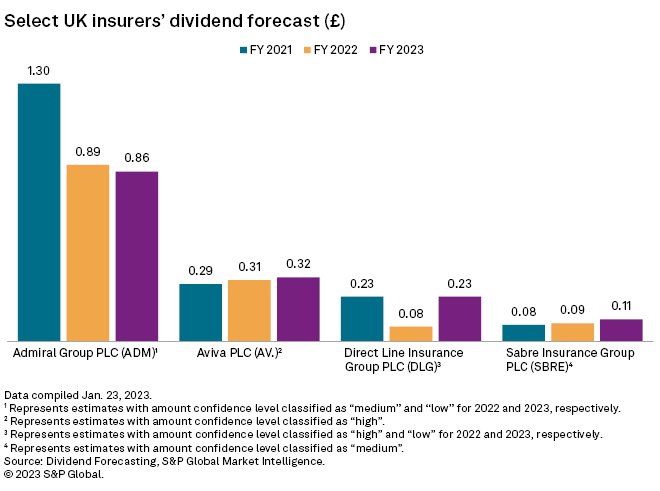

Direct Line Insurance Group PLC's shock cancellation of its final 2022 dividend has set the tone for a difficult 2023 for U.K. nonlife insurers, particularly in personal lines.

Final dividends are unlikely to be at risk at other listed U.K. nonlife insurers, but the trends underpinning Direct Line's decision — particularly claims inflation — will be a drag on profits industrywide this year after an already bruising 2022.

The outlook for U.K. nonlife insurance in 2023 is just as bad as it was for 2022 or possibly even worse, according to Ekaterina Ishchenko, a director at Fitch Ratings covering Europe, the Middle East and Africa.

"The margins are very, very thin," Ishchenko said in an interview. "We expect the combined ratio to be significantly above 100% for 2022 and 2023."

Car trouble

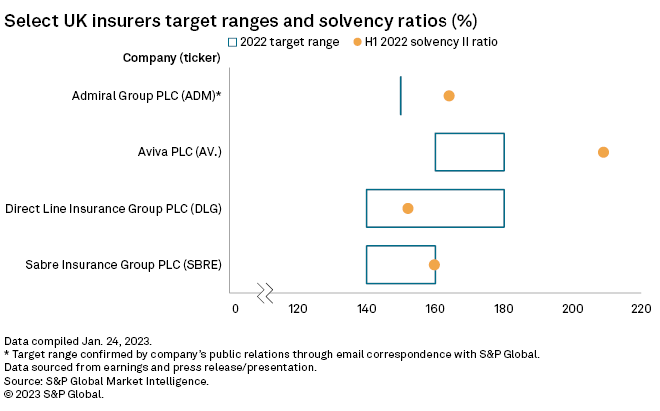

The combination of £90 million of claims from freezing weather in the U.K. in December 2022, a further increase in third-party motor claims inflation and a fall in the value of its commercial property investments prompted Direct Line, one of the U.K.'s biggest personal lines insurers, to cut its dividend. The company in a Jan. 11 profit warning said the triple-whammy brought its solvency coverage ratio to the lower end of its preferred range of 140% to 180%. A little more than two weeks after Direct Line issued that warning, CEO Penny James resigned.

"I don't think the others are that close to the wire to begin with in terms of capital positions," Panmure Gordon analyst Abid Hussain said. "I would expect [other insurers'] capital positions to move downwards if there are similar hits, but I don't think they need to go so far as removing the dividend."

While the wider industry may be spared the measures Direct Line has had to take, it still faces a challenging year. EY forecasts that net combined ratios will be 115% in U.K. motor insurance and 116% in home insurance in 2022, which it said would be the worst results in well over a decade. The consulting firm expects a combined ratio of 114% for motor and 109% for home this year.

Aviva PLC also saw an increase in third-party damage claims in motor in the fourth quarter of 2022, which was one of the reasons that its measure of motor claims inflation increased to a range of 9% to 11% from 8% to 10% a quarter earlier, Owen Morris, managing director of personal lines for Aviva's U.K. general insurance business, told analysts at a Jan. 25 conference.

Home insurance has likewise seen an increase in both frequency and severity of claims. The hot summer in 2022 triggered a wave of subsidence claims, and increases in labor and materials costs have made repairs more expensive.

Limited power

Insurers' main defense against claims inflation is to increase prices, but their pricing power is curtailed by competition and the higher cost of living squeezing policyholders' ability to pay. Regulatory pressures are also limiting insurers' maneuvering on pricing and claims handling.

The U.K. Financial Conduct Authority's ban on charging cheaper prices to new customers while increasing them for renewing ones triggered "very large drops" in premiums in the first half of 2022, particularly in home, Ishchenko said. Motor prices were less affected, but rates were already low there because of discounts to offset lower claims frequency during COVID-19 lockdowns, she said.

"When you add up the economic pressures, plus what the regulator is expecting from insurers, it really gives you a difficult scenario," Kareline Daguer, insurance director at Deloitte's European Centre for Regulatory Strategy, said in an interview.

Like their peers elsewhere, U.K. insurers are paying higher prices for more limited reinsurance cover following the recent renewal season. Price increases were as high as 75% for property-catastrophe excess of loss cover, Aviva CFO Charlotte Jones said on the Jan. 25 call.

While Aviva's own price increases were far less steep, structural changes to the cover meant Aviva had to retain more risk and accept more limited coverage reinstatements. Though the cover allows Aviva to continue its business as planned, "that is not necessarily the case across the market, so we could see some change in some [companies'] ability to trade," Jones said.

Winners and losers

Through the gloom, there are brighter signs on the horizon for at least some U.K. insurers.

Price increases in motor should continue to be strong at the start of 2023, and claims inflation may end the year at 4% or 5%, according to Berenberg analyst Thomas Bateman. While combined ratios will not come anywhere close to "normal levels" this year, insurers that have not been heavily affected by the FCA's renewal pricing restrictions, such as Admiral Group PLC and Sampo Oyj-owned Hastings Group Holdings Ltd., should see their ratios normalize in 2024, Bateman said.

For Direct Line, however, 2023 will be focused on finding a new CEO and rebuilding investor trust and capital levels. Following its profit warning, the company said it had bought a three-year, 10% quota share reinsurance cover that would boost its year-end solvency capital ratio by 6 percentage points. But that deal is not a fix, said Bateman, who thinks the company should be operating in the top half of its preferred solvency ratio range.

"They need to recapitalize and they need to be clear on how they're going to do it rather than just muddling through," he said.

Direct Line declined to comment for this story.