Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Oct, 2022

By Adrian Jimenea and Marissa Ramos

|

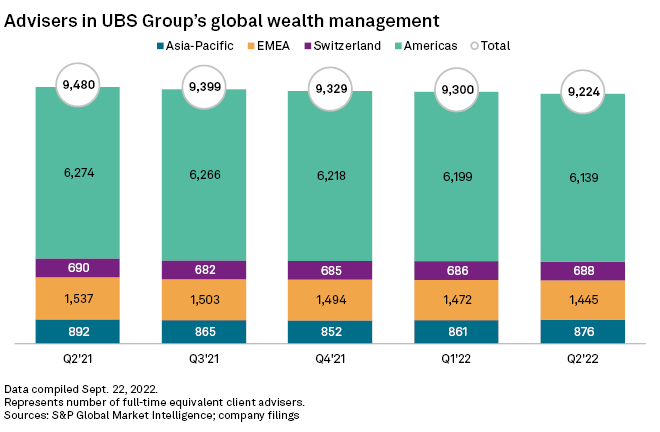

As of June 30, UBS had 876 full-time advisers covering its Asia-Pacific wealth management business. |

UBS Group AG must leverage its digital expertise as it seeks to boost its presence in China's mass millionaire wealth management market.

In August, UBS Global Wealth Management outlined a new business model for China, which included plans to double the number of customers in the mass millionaire, or private client, segment over the next three years, finews.com reported.

This segment comprises individuals with a net worth of between $1 million and $5 million and accounts for roughly a mid-single-digit percentage of its total number of clients in China.

Growing wealth in China

China is home to nearly 10% the world's people with a net worth above $1 million, according to the Credit Suisse Global Wealth Report 2022. The number of millionaires in the country rose by more than a million as of 2021-end versus a year prior, according to the report.

The rise of new economic sectors in the world's second-largest economy, especially in tech, has created a group of young, wealthy individuals, according to Joanne Peng, research analyst at Cerulli Associates, a financial services-focused global research and consulting firm. First-generation entrepreneurs are gradually handing over their business to their family members, and the management of family wealth and inheritances has become a key priority, Peng said in an email interview.

Such a clientele requires services that are primarily digital and allow access other asset classes. Wealth managers should bolster their service capabilities in order to access these customers, said Peng.

"As wealth management services in Greater China become increasingly commoditized to appeal to a wider mass market, institutions offering such services should employ automation and algorithmic technologies to effectively enhance the client experience," Peng said.

Hamers was a major proponent of the transition to digital banking at Dutch bank ING Groep NV, where he was CEO for seven years before taking the helm at UBS in November 2020. Mobile interactions with ING accounted for approximately 82% of its 4.5 billion interactions in 2019, his final full year at the bank, compared with 52% of the roughly 2.5 billion interactions in 2016 being mobile.

In China, UBS' private client expansion will be driven by its Circle One content platform, according to the finews.com report. The bank will reportedly offer three engagement levels: bank-led investing via discretionary portfolio management, an advisory model and self-directed investing. The platform will also offer content through videos and podcasts.

The first phase of the rollout was in Asia-Pacific, ahead of launching in the U.S. and Europe in 2023.

UBS declined a request for comment.

UBS in Asia-Pacific

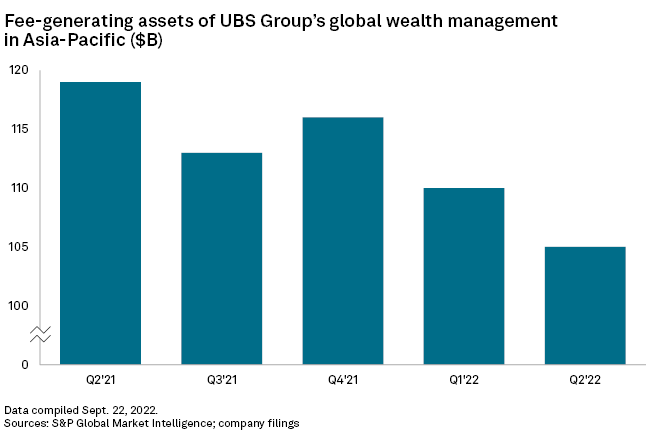

UBS' new business model for China comes at time when fee-generating assets in the region have been on the decline, hitting $105 billion at the end of June, down from $116 billion at the end of 2021.

UBS, along with cross-town peer Credit Suisse Group AG, faces wealth management headwinds in the region, especially as COVID-19 lockdowns weigh on investor activities. Heightened caution among clients, shown through deleveraging, was a key theme in the first quarter for both banks, S&P Global Market Intelligence previously reported.

An immediate challenge for the bank is the weak global economic and market outlooks in China in 2022 and 2023, said Patrick Rioual, a senior director at Fitch Ratings. This challenge is expected to affect market valuations and transaction volumes, which in turn will affect fee and commission revenues, Rioual said via email.

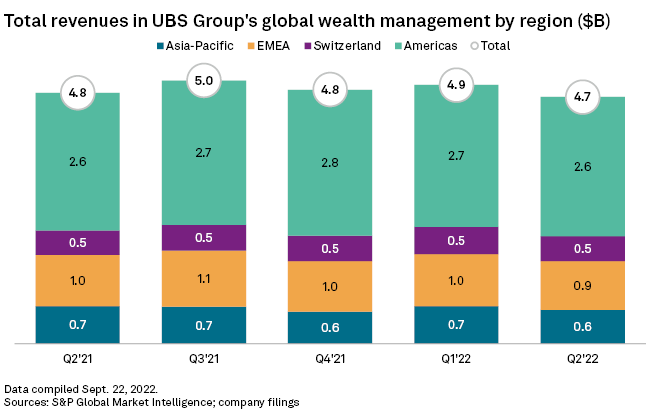

Asia-Pacific wealth management revenues at UBS fell to $641 million in the second quarter from $709 million in the first quarter and $711 million in the same period a year before. Globally, revenues at the wealth management division amounted to $4.67 billion in the quarter, with the Americas contributing the most.

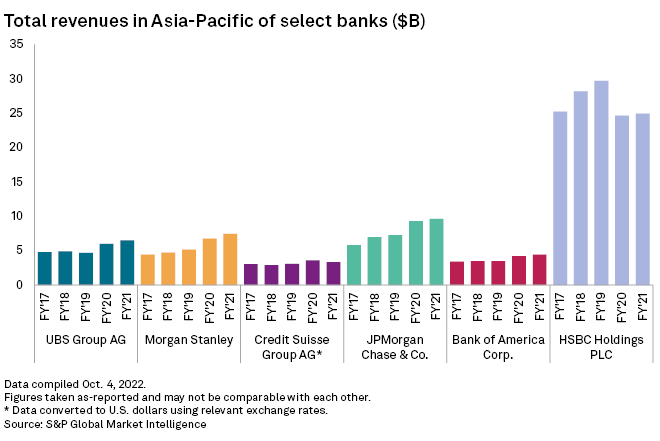

UBS stacks up relatively well versus other global banks with significant operations in Asia-Pacific but still falls behind some Wall Street peers, data suggests. In 2021, UBS generated Asia-Pacific revenues of $6.5 billion. By comparison, JPMorgan Chase & Co. and Morgan Stanley generated $9.7 billion and $7.5 billion, respectively, in the same year. However, all three banks are dwarfed by Asia-focused HSBC Holdings PLC, the biggest bank by assets in Europe, whose Asia-Pacific revenues hit $24.9 billion in 2021.

Wealth management leader

UBS had 876 full-time advisers covering its Asia-Pacific wealth management business as of June 30. Globally, the entire business employed more than 9,200 advisers, according to company filings. UBS' current private clients team for China has about 60 employees, according to the finews.com report

As the world's largest wealth manager, UBS can leverage its expertise when competing in the mass millionaire segment. The opportunity for the bank is in having the capacity to deploy its wealth management resources "in a cost-efficient manner to serve customers beyond the ultra and high net worth brackets," according to Pauline Lambert, executive director for financial institutions at Scope Ratings.

While China has been a strategic market for the bank for a while now, the termination of its $1.4 billion acquisition of Wealthfront Corp. in the U.S. could allow UBS to devote more management attention to the country, Lambert added.