S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 May, 2022

By Aries Poon

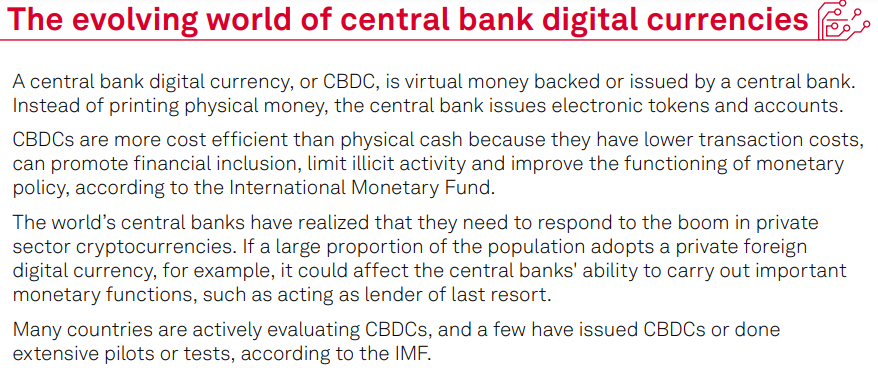

Close to 100 countries are researching or exploring central bank digital currencies pegged to their national fiat money, according to the International Monetary Fund.

Larger developed economies, where financial inclusion is less of an issue, tend to be more skeptical. The U.K. and EU have made it clear that if they develop a CBDC, it will not replace cash.The reasons are wide-ranging. Countries like Nigeria and Ukraine are hoping a central bank digital currency, or CBDC, will help them improve financial inclusion and transition to a cashless economy.

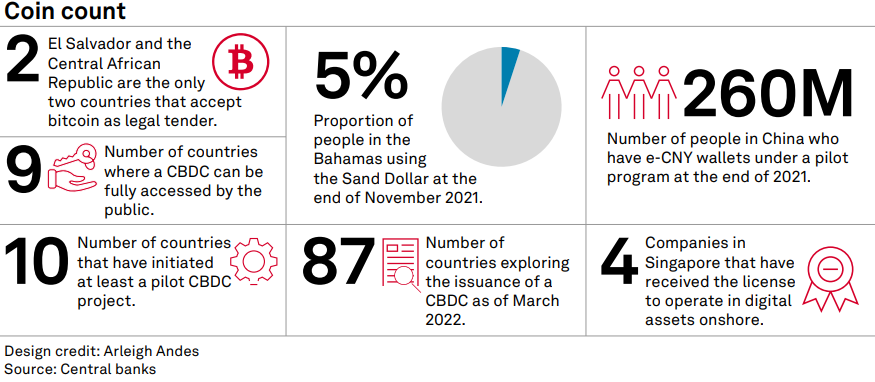

Some nations are experimenting with retail CBDCs, which can be offered to the public, while others are considering wholesale CBDCs, accessible only to financial institutions.

CBDCs are different from private-sector cryptocurrencies, such as bitcoin. Transactions in bitcoin are processed and recorded on a blockchain, which is a public, distributed ledger. There is no intermediary or central authority.

In contrast, CBDCs are controlled by central banks.

As more central banks opt to develop their own digital currencies, the cost of staying out could rise.