Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2022

Though Spotify Technology SA is a latecomer to the audiobook market, analysts say the Sweden-based streaming service still has an opportunity to challenge its deeper-pocketed Big Tech competitors in the space.

Spotify launched its audiobook store in September after buying Findaway World LLC for $121.1 million earlier this year. The new store features a catalog of more than 300,000 titles, making it larger than that of long-time market leader Audible, which offers more than 200,000 titles. Audible is owned by Amazon.com Inc.

Spotify's audiobook store does have several limitations. Namely, audiobooks can only be purchased in the Spotify Web Player, and they are only available in the U.S. Nevertheless, analysts believe Spotify is well positioned to take market share with its new business line, noting the company's past successes with podcasts and the strong overall growth in audiobook sales.

"There is an opportunity to become a market leader here, just like it did with podcasts," said Annie Langston, audio analyst at MIDiA Research. "Spotify is fast becoming far more than just a music service."

Growth opportunity

Audiobooks represent a relatively small but growing market. Audiobook publisher revenue grew 25% in 2021 to $1.6 billion, marking the 10th straight year of double-digit growth for the industry, according to the Audio Publishers Association.

A Spotify spokesperson declined to answer questions from S&P Global Market Intelligence about the company's audiobook strategy or its relationship with Apple Inc. Spotify opted out of allowing in-app purchases on Apple devices in 2016 due to the audio streaming company's objections to Apple's 30% fees to developers who sell through Apple's App Store. Spotify will continue to sell all of its subscriptions outside of the App Store.

Apple does not have a stand-alone audiobook platform, but it makes a limited selection of titles for purchase through its Apple Books app.

"We think that the Spotify Machine that we've built and successfully deployed to grow the music and podcasting industries will work for audiobooks," a Spotify spokesperson wrote in an email to Market Intelligence.

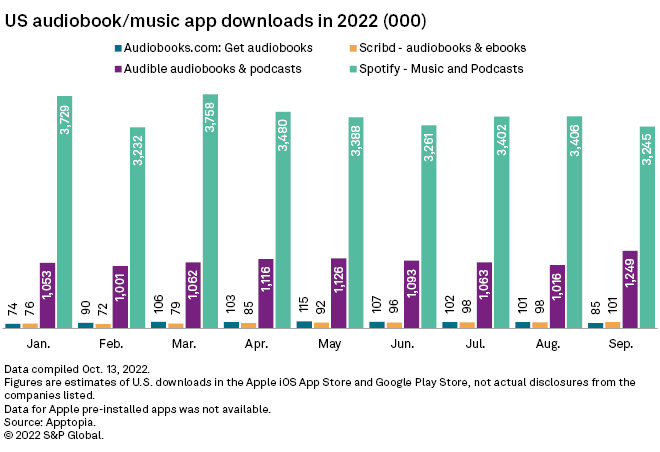

Spotify dwarfs its competitors in terms of monthly app download data, according to Apptopia, an app analytics provider. Spotify recorded 3.2 million downloads on the Apple App Store and Alphabet Inc.'s Google Play Store in September, compared to Audible's 1.2 million. The two next most popular audiobook apps, from Scribd, Inc. and Audiobooks Inc., saw downloads of 101,197 and 85,148, respectively.

Spotify's active users have grown by 25.5% since the fourth quarter of 2022 through the second quarter of 2022, according to S&P Global Market Intelligence data. Its paid subscriber base grew by 21.3% over the same period.

While Spotify missed an opportunity to capture market share in audiobooks earlier, there is room for both Spotify and Audible to be successful in this space, said John Freeman, vice president of equity research at CFRA Research.

"There doesn't necessarily have to be a winner-take-all market because they all have to come to some degree of standardization," Freeman said. "There's not going to be a situation where one company like Audible is going to be able to crowd [Spotify] out."

Stumbling blocks

That is not to say there are no risks to entering the audiobook market.

"Audiobooks are much more complex to license than podcasts and the rights are generally owned by professional book publishers who have very specific licensing frameworks and approaches," said MIDiA Research's Langston. "This contrasts strongly with podcasts, which are most often widely disseminated without royalty structures."

In addition, the significant growth that resulted from more users listening to audiobook content at home during the COVID-19 pandemic has flattened out, Langston noted.

Earlier this month, Morgan Stanley equity analysts Benjamin Swinburne and Thomas Yeh cited uncertainty about Spotify's audiobook play as a reason for revising their price target down from $140 to $120.

"While Spotify believes audiobooks will ultimately carry an accretive gross margin profile, limited visibility into those future business models (and associated investment needs) gives us reason to be more cautious near-term," the analysts wrote in an Oct. 12 analyst note.

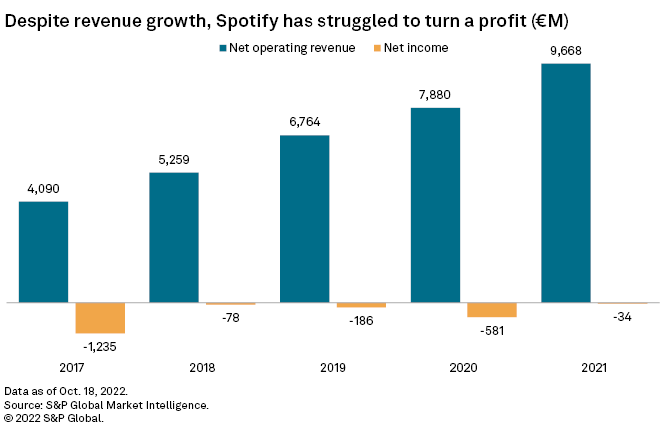

Spotify is not in a position to throw unlimited funds at a new business line. Though the company has grown its revenue considerably in recent years, its bottom line has remained in the red.

"They're talking about $10 billion-plus in revenue now," Freeman said. "And they're not making any money."

Growth vectors

Still, analysts see plenty of growth opportunities from audiobooks, especially once Spotify starts offering them internationally with foreign language translations.

In Sweden, 23% of survey respondents said they listened to at least one audiobook monthly, compared to 19% of German survey respondents, according to a nationally representative survey during the second quarter of 2022 conducted by MIDia Research.

"There are markets that already over-index the consumer average for audiobook penetration — the top two being Sweden and Germany," Langston said. "So yes, there are international growth opportunities for audiobooks within markets that already show an aptitude for the format."

Along with expanding its content coverage, expanding the creator economy will be a growth factor for Spotify, Langston said.

"The platforms that are able to foster and grow creators will be the key to reaching new users," Langston said.

Spotify's diversification can also help smaller creators and develop a community of artists, Freeman said, but he cautioned that Spotify should stick to its core business and not get distracted by bundling too much content on its platform.

"Spotify is still an odds-on favorite to be one of the few major audio players," Freeman said.