S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Feb, 2021

By Anser Haider

The video game industry experienced a banner year in 2020 as the coronavirus pandemic led to a surge in demand for home entertainment. Analysts are optimistic that the trend will boost demand for new gaming consoles.

Major U.S. game publishers Activision Blizzard Inc., Electronic Arts Inc. and Take-Two Interactive Software Inc. beat earnings expectations in the September 2020 quarter. Although the three companies have raised their respective full-year guidance through 2020, executives have repeatedly cautioned that 2021 is shrouded with uncertainty and that they are unlikely to reach the heights achieved during the pandemic that resulted in stay-at-home orders in many parts of the world.

Analysts, however, think that the sheer demand for new video game consoles from Microsoft Corp. and Sony Corp. and the new software set to launch on the devices will ensure that the industry maintains growth even after COVID-19 subsides.

Activision, EA and Take-Two Interactive are set to report their holiday quarter earnings results in the coming weeks, and analysts expect the companies to beat their respective December 2020 and full-year 2020 forecasts.

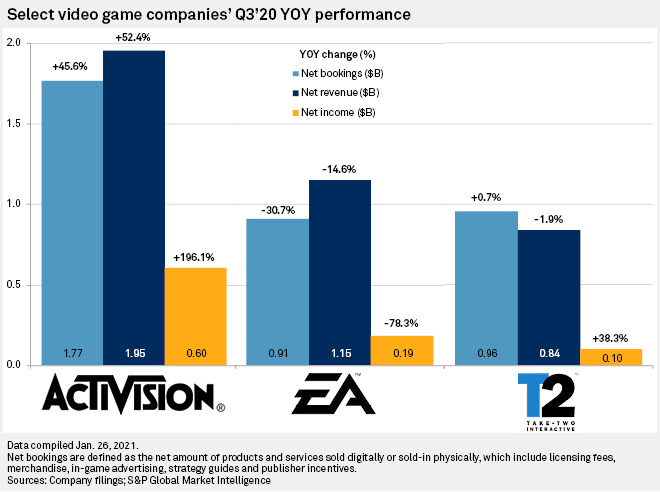

Activision continued to lead among the major U.S. game publishers in the September 2020 quarter, with its Call of Duty franchise continuing to thrive. The company's total net revenues grew 52.4% year over year to $1.95 billion, while net income grew 196% to $604 million. Net bookings — products and services sold both digitally and physically — grew about

While EA's September 2020 quarter results were down year over year, they came ahead of the company's guidance on the popularity of its sports franchises. The company's net revenue was down 14.6% year over year to $1.15 billion, net income fell 78% to $185 million, while net bookings declined about 31% to $910 million. EA did not raise its full-year 2020 guidance, but CFO Blake Jorgensen noted during the company's last earnings conference call that EA already raised its full-year guidance by about $500 million at the end of its first quarter.

Take-Two Interactive did, however, raise its full-year 2020 guidance after beating estimates for its September quarter on the enduring strength of its Rockstar Games Inc. unit's titles. The company's net revenue was down 2% year over year to $841.1 million, net income was up 38% to $99.3 million and net bookings were up 7% to $957.5 million.

Consumer spending on video games in the U.S. set a new record of $56.9 billion in 2020, up 27% from a year ago, according to an NPD Group report. Spending on gaming hardware reached $5.3 billion, up 35% from 2019 and the most since $5.6 billion in 2011. This growth was driven by sales of Microsoft's new Xbox Series X and Series S consoles - which attributed to its most-successful gaming quarter ever - as well as Sony's new PlayStation 5 console, which is reported to have broken launch-sales records for the Japanese company as well. Meanwhile, Nintendo Co. Ltd. upped its fiscal full-year guidance as sales of its Switch console in the holiday quarter were well above expectations.

"The COVID-19 pandemic has had significant impact on gaming behavior, usage and spending as people immerse themselves in virtual worlds because the real world is off limits," said Daniel Ahmad, a senior analyst at Niko Partners. "We predict that people who discovered gaming in 2020 will continue playing, and based on results of Niko's COVID-impact surveys of Asia-based gamers, experienced gamers who increased gaming time will spend more time and money on games in 2021 than they had pre-pandemic."

"It is extremely difficult to launch a console during a global pandemic, with Sony and Microsoft facing a number of issues prior to launch," Ahmad said. "While production has returned to full capacity, we note that ongoing component shortages, higher than expected demand and a direct impact on global logistic has led to shortages at retail for both consoles."

Ahmad said the situation is expected to improve in the first quarter, but it may still take the holiday period before everyone who wants one can get their hands on one. Microsoft also admitted in its recent earnings call that demand for the new Xboxes will continue to be constrained by supply.

Michael Goodman, director of digital media strategies at Strategy Analytics, said that the second half of 2021 will have an impact on media and entertainment as the pandemic starts getting under control and people have more options for free time. On the flipside though, he noted that it will be the first full year for the PlayStation 5 and Xbox Series consoles, which will continue to sell out for a while as the demand for these devices is only going to increase in the coming months.

"While game spending will decline as consumers turn to other activities, the industry will receive a significant bump from the new generation of hardware and software," Goodman said. "Overall, we'll see positive results driven by continued spending on the new consoles and games."