Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2022

By Charlsy Panzino and Chris Hudgins

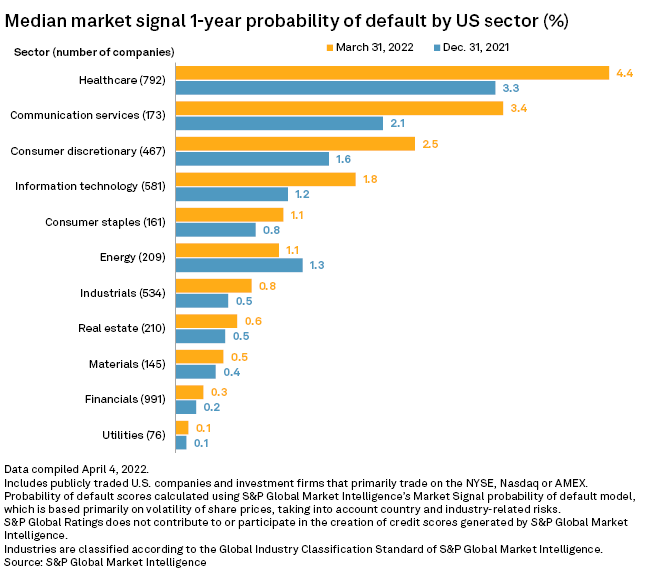

The odds of default across most U.S. business sectors rose in the first three months of 2022.

Every sector except energy recorded a higher median market signal one-year probability of default of score at the end of the first quarter than the end of the fourth quarter of 2021, according to S&P Global Market Intelligence data. The scores, which represent the odds of default within a year, are based primarily on the volatility of share prices for public companies in the sector and account for country- and industry-related risks.

The rise in probability of default scores comes as the value of every S&P 500 sector, except energy and utilities, fell at the end of the first quarter from the fourth quarter of 2021.

Vulnerable sectors

Healthcare was the sector with the highest one-year probability of default at 4.4% as of March 31, according to Market Intelligence data. This is up from 3.3% on Dec. 31, 2021.

Staffing shortages, a wave of canceled elective procedures, and pandemic fears stressed the healthcare sector, which has also been one of the leading industries with bankruptcies so far in 2022.

Communication services had the second-highest score at 3.4%, up from 2.1%, according to the data. Consumer discretionary was at 2.5%, up from 1.6%. This sector, which largely includes businesses that sell goods and services viewed as nonessential, was hit hard by the pandemic as restrictions and COVID-19 worries curbed consumer spending and outings.

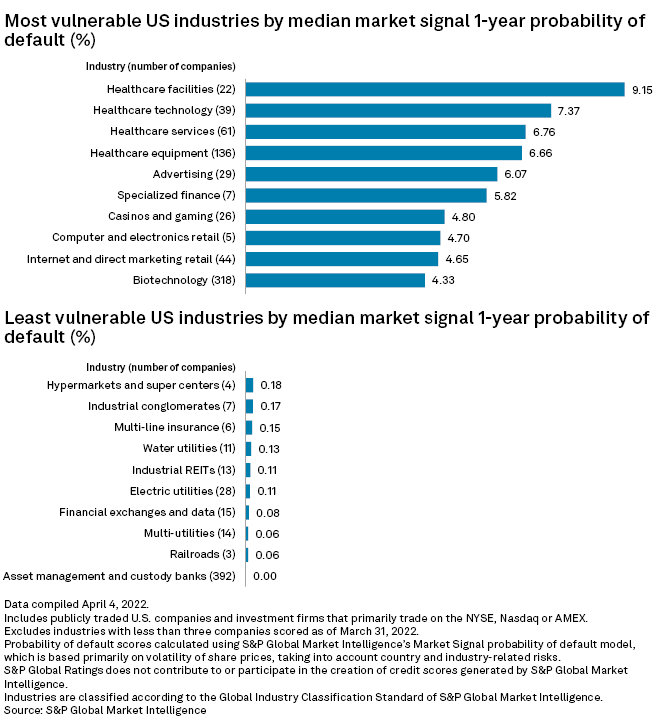

Troubled industries

Healthcare industries were in the top three with the highest probability of default scores in the first quarter of 2022, with healthcare facilities at 9.15%, healthcare technology at 7.37% and healthcare services at 6.76%, according to Market Intelligence.

Multi-utilities, railroads, and asset management and custody banks had the lowest probability of default scores among all industries for the quarter.

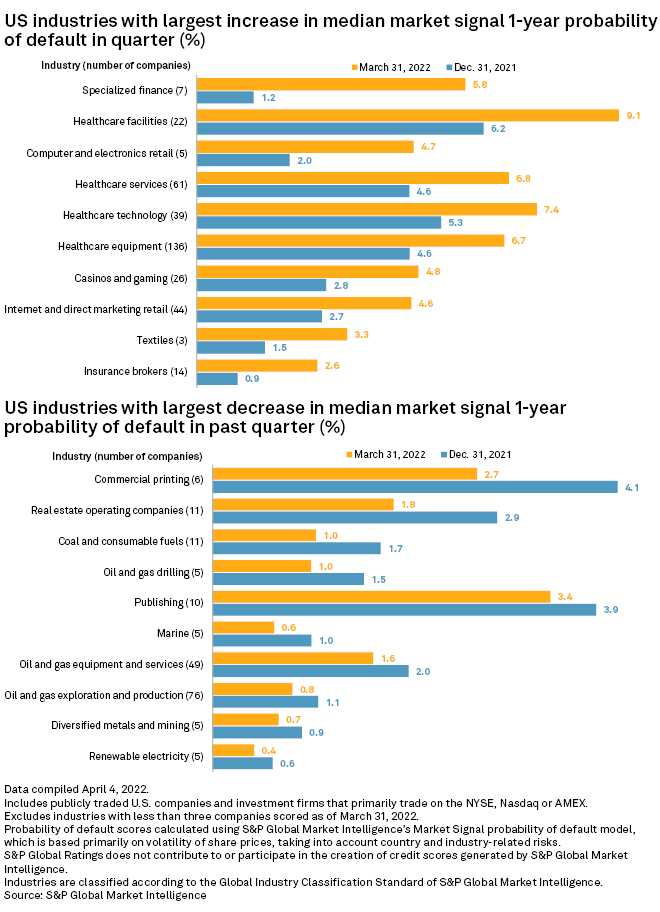

Increases and decreases

Specialized finance had the largest increase in probability of default at 5.8% as of March 31, up from 1.2% as of Dec. 31, 2021, according to Market Intelligence data.

Healthcare facilities had the second-largest increase at 9.1%, up from 6.2%. Computer and electronics retail was at 4.7%, up from 2%.

Commercial printing, real estate operating companies, and coal and consumable fuels were industries with the largest decrease in probability of default as of March 31, according to the data.