Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jan, 2023

By Eri Silva

|

The Metals Co. has collected 3,000 tonnes of polymetallic nodules from the sea bottom, shown here in the hold of the company's Hidden Gem vessel. |

The future of deep-sea mining rests with an obscure United Nations-delegated body that must write exploitation regulations by July 2023 or potentially set back an industry seeking to supply key metals for the energy transition.

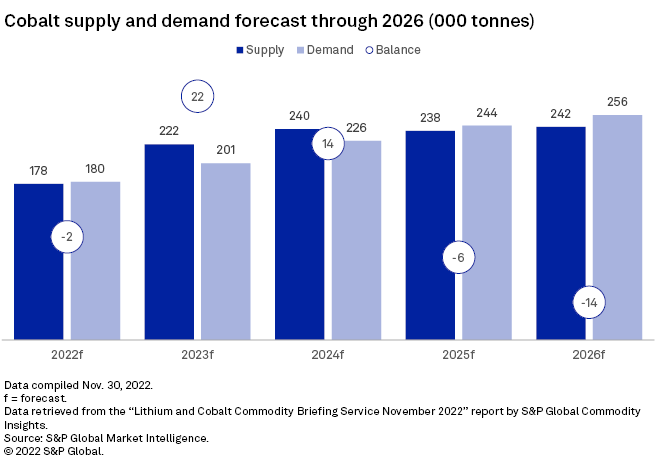

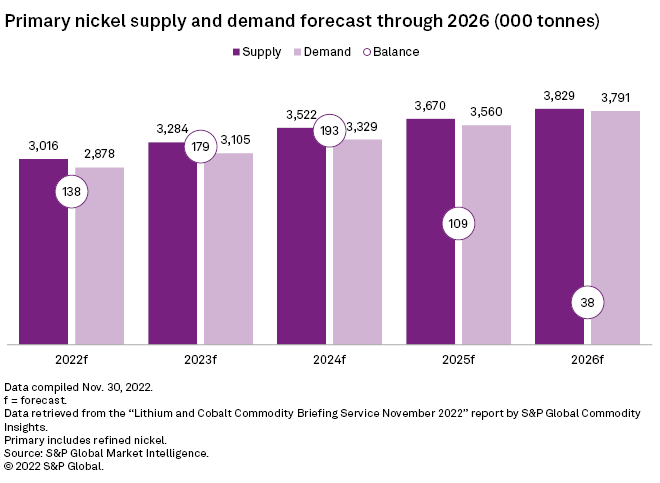

Potato-sized mineralized structures, known as polymetallic nodules, rest on the seafloor at depths of 4 kilometers to 6 kilometers. These nodules hold greater reserves of battery metals such as cobalt, nickel and manganese than can be found on land and copper that could supplement dwindling land-based reserves. In November, a subsidiary of Vancouver-based The Metals Co. Inc., or TMC, lifted 3,000 tonnes of nodules from the Clarion-Clipperton Zone, a valuable stretch of ocean floor between Mexico and Hawaii.

The company cannot legally sell a single nodule until they receive an exploitation contract from the 167-country International Seabed Authority, or ISA, which is charged with creating and approving exploitation regulations for deep-sea mining. TMC's plan to apply for an exploitation permit triggered a two-year regulatory development process that will set rules for exploiting the ocean bottom. If the ISA does not complete and approve the regulations by the July 2023 deadline, it could cause financial trouble for TMC and other companies targeting the deep sea.

Meanwhile, member nations, including Germany, Costa Rica and Panama, have stepped forward to call for a delay in issuing new rules until the environmental impact of hoovering up the sea floor for battery metals is better understood — a grave concern for scientists and environmentalists.

"What annoys me in these comments is they cite a lack of understanding of the science. We are about to dump data into the ISA deep databank, which will triple the data that is currently available, and by the time we complete, we estimate that we will be providing a 10x amount of data," TMC CEO and Chairman Gerard Barron told S&P Global Commodity Insights. Barron added that he sees "a lot of virtue signaling" within environmental groups.

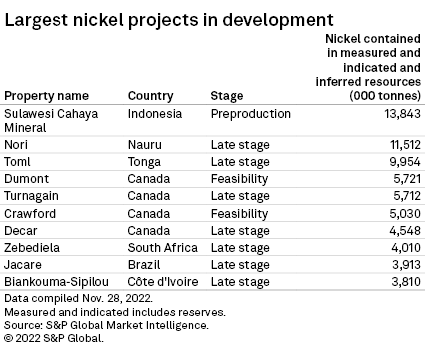

TMC advancements force action

Few companies had attempted to make a commercial operation out of deep-sea mining until 2021, when the tiny Pacific Island nation of Nauru said its sponsored entity, TMC subsidiary Nauru Ocean Resources Inc., or NORI, would apply for an exploitation contract in 2023. Since 2011, TMC has undertaken exploration in the Clarion-Clipperton Zone, an area that hosts about 46 million tonnes of cobalt and 270 Mt of nickel. TMC has progressed most in an area with 356 Mt of measured nodules. Extraction from the company's November pilot reached a sustained production rate of 86.4 tonnes per hour, and the next pilot will target a production rate of more than 200 tonnes per hour.

But the company's plans depend on the ISA issuing its rules on time. During TMC's third-quarter earnings call Nov. 15, Barron revealed that the company had 12 months of cash on hand to move from exploration into commercial production.

"It's not negotiable," Barron told Commodity Insights. "This isn't the case of waking up one day and deciding, 'should we be doing this,' or 'shouldn't we be doing this?' It's been decided it's happening."

TMC's two exploration contracts in the Clarion-Clipperton Zone under subsidiaries NORI and NOML, both sponsored by small island states, comprise enough in situ metal for 280 million electric vehicles. The most advanced project is estimated to have a net present value of about $16 billion.

Barron said complaints by the scientific community fail to consider the environmental harm created by land mining and noted that investors are excited about the company.

"We have the ability to even further contract our cost base if we needed to," Barron said. "And as evidenced in our recent capital raise, we've also got a group of shareholders who have indicated they're happy to keep funding the business."

The company opened a $30 million follow-on equity offering on Dec. 22, 2022.

In comparison, deep-sea mining hopeful Nautilus Minerals Inc. undertook a restructuring in early 2019 and went into bankruptcy later that year after failing to secure financing for a vessel for its Solwara 1 copper-gold project off the coast of Papua New Guinea.

Not so fast

At the recent COP27 climate summit, French President Emmanuel Macron went so far as to call for an outright ban on deep-sea mining.

"The oceans must be basically what space was a few years ago: a new frontier for cooperation and multilateralism," Macron said during the summit. "There too, on this issue, we must do everything to protect climate and biodiversity solutions in our oceans."

Adopting exploitation regulations will require a consensus from all member states in the ISA council. Member state Germany has spoken out against approving deep-sea mining until there is sufficient environmental research.

These countries have the support of many people in the

"Beginning oceans mining now or beginning oceans mining in the next few years would create great peril for ocean health," Douglas McCauley, the director of the Benioff Ocean Science Laboratory, a research lab at the University of California,

McCauley and other marine experts have signed a petition calling for a pause on deep-sea mining. A similar petition has been signed by various businesses including automakers BMW Group and AB Volvo (publ).

Countries such as Costa Rica, Panama, Chile and Ecuador are calling for a "precautionary pause" until regulations are comprehensive enough to provide sufficient environmental protections, regardless of the deadline.

At a Nov. 4 meeting of the ISA council, Spain said the environmental protection process "still needs a lot more study and reflection." And during an ISA council meeting in July, Chile said it would not be "privileging a deadline for a contractor to initiate underwater mining works against the interests of all humanity."

Objection is not the end

"If all the countries agree, then they can be adopted. If countries don't agree, then obviously more work is needed," ISA Secretary General Michael Lodge said during an interview. "You could only adopt regulations for any sphere of human activity on the basis of the information that you have at the moment."

If the ISA deadlocks over the approval of new rules, all is not lost for TMC and its competitors, according to a marine law study by Pradeep Singh, a Fellow at the Institute for Advanced Sustainability Studies in Potsdam, Germany, a research center partially owned by the German government.

If regulation is not implemented before NORI enters its application, the council still must consider the application — but not necessarily approve it.

"To be honest with you, the reason I wrote that paper was because some states were coming up to me and saying that, 'Oh, you know, if we missed the deadline, we're done for it,'" Singh told Commodity Insights. "I said, 'No, no, this is not how I see it.'"

In the meantime, ISA members will engage in heavy negotiations after receiving input from stakeholders in the initial stages of the process.

"I think that, by sort of going down this road into exploration, without there being exploitation regulations, this was already an assumption of risks by those contractors," Singh said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.