S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2023

By Peter Brennan and Umer Khan

The burden of debt repayments rose sharply for U.S. companies in the third quarter of 2022.

The median interest coverage ratio, which tracks the ability of companies to cover interest payments on their debt by dividing earnings before interest and taxes by the cost of debt-interest payments, of companies rated BBB- or higher by S&P Global Ratings fell from 8.98 to 8.19 in the third quarter of 2022, according to the latest S&P Global Market Intelligence data.

The decline breaks a near-continuous increase in the ratio since the second quarter of 2020 and indicates that companies are feeling the pinch of rising borrowing costs and a weaker economy.

Non-investment-grade companies

Lower-rated companies also experienced a decline. The median interest coverage ratio for non-investment-grade companies — below BBB- — fell from 4.52 to 3.93 in the third quarter, according to data from Market Intelligence.

Among non-investment-grade companies, there were sharp declines in the healthcare sector, from 4.65 in the second quarter to 2.85, and materials, from 5.5 to 4.56. Only information technology and energy bucked the trend, with the latter sector benefitting from high oil and gas prices to boost its median ratio to 9.51 from 7.09.

Debt under control

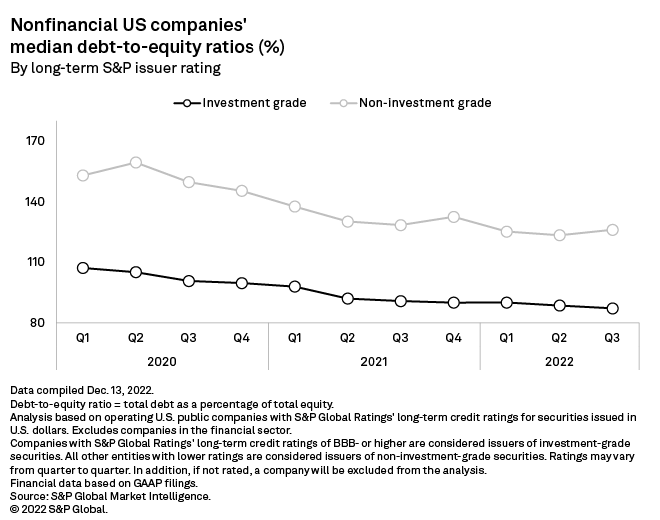

While the burden of debt is increasing, the median debt-to-equity ratio continued to fall for investment-grade-rated companies in the third quarter of 2022.

The median ratio — calculated as total liabilities as a percentage of shareholder equity — fell to 87.26% from 88.64% in the second quarter.

Debt-to-equity ticked up for lower-rated companies, from 123.42% to 126.12%, though remained well below the COVID-19-era peak of 159.4% in the second quarter of 2020.