Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jul, 2021

By Sophia Furber and Cheska Lozano

Italy's special servicers — which collect debts and negotiate with borrowers that have defaulted or are in arrears — may be in for a rough ride as the country continues to weather the effects of the coronavirus pandemic, according to industry insiders.

Special servicers play an important part in Italy's bad debt ecosystem, managing relationships with debtors behind the billions of euros of nonperforming loans that lenders have securitized and moved off their balance sheets in recent years. Since the pandemic hit, their job has become tougher.

Delays in the Italian judicial system, suspension of foreclosures and disruption to the commercial real estate market have frustrated many special servicers' plans for extracting value from bundles of bad debt. DBRS Morningstar said in a June 1 note that Italian NPL collections were "significantly underperforming" expectations, largely due to the effects of the coronavirus crisis, and that 21 out of 22 special servicers working on NPL transactions that the rating agency rates have had to change their business plans at least once.

Broad underperformance of bad loan securitizations in Italy has been a salutary reminder of the importance of "achievable business plans, manageable leverage and prudent asset diligence," Richard Roberts, head of origination and corporate development at Arrow Global, an asset manager specializing in purchasing, collecting and servicing bad loans, said in an email.

But the challenges are unlikely to create bottlenecks in the bad debt industry, and Italian banks looking to off-load soured loans in the coming months should find no shortage of willing takers.

"I would not say that current problems will affect volumes of future investments in new NPL portfolios and securitizations going forward. ... I think that banks willing to sell NPLs will find a ready and reactive market in future months," Massimo Famularo, managing director and head of Italian NPLs at Distressed Technologies, an alternative investment adviser, said in an email.

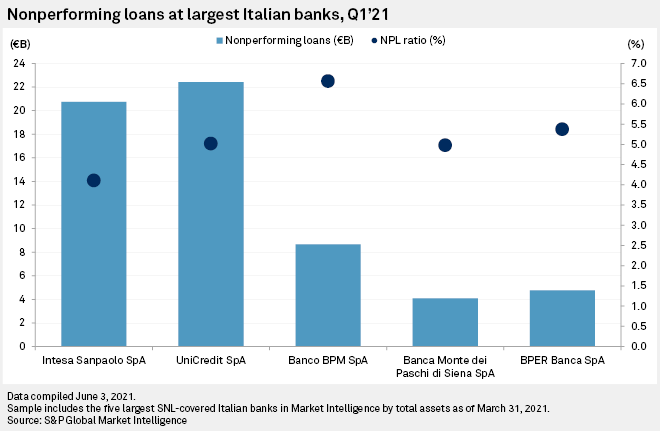

This is good news for Italian banks, which are predicted to face an influx of more bad debts as a result of the pandemic. The Italian central bank said in April that it expects that a deterioration in credit quality during the period 2021 to 2022 could result in around €9 billion of loan losses for the country's lenders. An influx of new NPLs would come at a time when Italy's largest banks are still dealing with a heavy burden of existing bad loans from the last credit cycle. UniCredit SpA had about €22 billion of gross NPLs as of the end of the first quarter of 2021, while Intesa Sanpaolo SpA had €21 billion.

Underperforming loans

The Italian government has actively encouraged banks to use securitization as a way of shifting bad debts off their balance sheets in recent years, having introduced Garanzia sulla Cartolarizzazione delle Sofferenze, or GACS, a decree that offers a state guarantee on the least-risky tranche of debt in a securitization, in 2016. Italian banks have disposed of around €87 billion of bad debts with the help of GACS since the scheme was introduced, according to calculations by KPMG, a professional services provider. The European Commission approved a one-year extension of GACS in June this year.

Although GACS has widely been hailed as a success from the perspective of Italian banks, many of the securitizations it helped to produce are now underperforming.

DBRS Morningstar said in its June note that it had downgraded 10 Italian NPL transactions at the time of writing, as a result of lower expected collections as per business plans submitted by special servicers.

One of these is the 2Worlds S.R.L. securitization, which is backed by €1.0 billion of loans originated by Banco di Desio e della Brianza SpA and Banca Popolare di Spoleto SpA. The downgrade relates to the A and B notes of the transaction, and DBRS Morningstar cites lower-than-expected collections as the main reason.

Moody's said June 17 that it had downgraded €80.9 million of class A notes in the Popolare Bari NPLS 2017 S.R.L. securitization, also citing delays in debt collection as the main reason.

The loans, which are concentrated in the south of Italy and the islands, originally belonged to troubled cooperative bank Banca Popolare di Bari SpA, which the Italian central bank placed into special administration in December 2019.

Lockdown measures imposed to control the coronavirus "directly and severely" affected the judicial system, creating a backlog of cases that led to a delay in recoveries of debts underlying the securitization, according to Moody's. The rating agency expects delays of between six and 12 months to recoveries of debts in the securitization as a result.

With delays to recoveries, special servicers are feeling the heat.

"The very first impact is on revenues and profitability, because most special servicers have fees strictly linked to actual collections, so any slowdown in collections has substantial consequences on [profit and loss]," Famularo said.

For doValue SpA, a special servicer, collections on Italian NPLs are lagging those in other European countries. The stock collection rate for the Italian market as a percentage of the gross book value of the portfolio stood at 1.9% for the 12 months to the end of the first quarter of 2021, compared with 8.4% in Greece and Cyprus and 4.2% in Spain and Portugal, according to a company filing.

The revenues of Cerved Group SpA's credit management business unit took a hit in the 12 months to the end of the first quarter of 2021, falling 12.2% to €35.76 million, partly due to delays in collections as a result of court closures caused by the pandemic, according to a company interim report.

Cerved, itself the subject of a takeover bid, had been in talks with various private equity groups in March regarding the sale of the credit management business.

Cerved did not respond to a request for comment while doValue declined to comment.

Unrealistic expectations?

But special servicers cannot entirely lay the blame for low collections on the pandemic. In many cases, the original business plans they laid out for collecting debts and recouping value from bad loan transactions were overly optimistic, according to Famularo.

"In my opinion, current difficulties in working through existing NPLs will lead to additional changes in business plans, but it is not easy to distinguish which part of the change is actually due to change in the environment and which is simply the result of unrealistic initial forecasts," said Roberts.

There is no reason to think that Italy's bad debt market will seize up, but difficult market conditions could impact the pricing of NPL transactions, according to Alessio Pignataro, head of European NPL at DBRS Morningstar.

"In any market scenario what matters is pricing," Pignataro said in an email.