Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2022

By Joseph Williams and Darakhshan Nazir

U.S. information technology M&A activity remained muted in October, despite continued interest in cybersecurity targets.

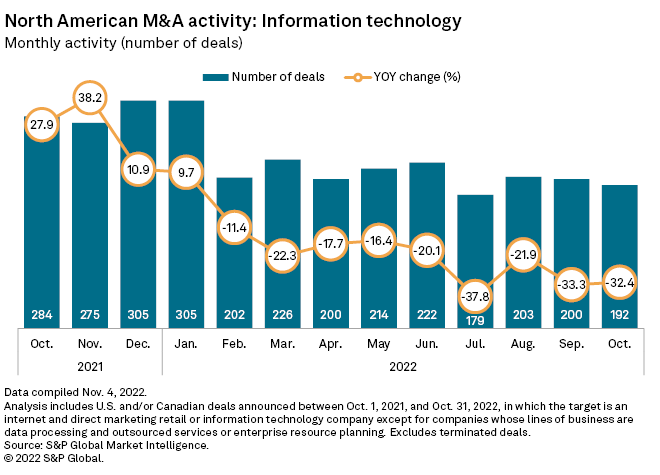

Overall, sector deal volume was down 32.4% year over year in October. At 192 transaction announcements, the month also had eight fewer deals than September, extending 2022's tech M&A downturn.

Spending on technology deals also continues to trail 2021 comparables. October's aggregate deal value was about half the aggregate values seen in an average month in recent years, according to data from 451 Research analyst Brenon Daly.

Weighing on the appetite for acquisitions, many technology companies have reported slowing revenue growth in recent quarters. Additionally, some of technology's largest acquirers are seeing their market capital slide out from under the historic highs of the prior year. Microsoft Corp. shares were off by 32.6% for the year-to-date as of Nov. 8. Its large-cap peers Alphabet Inc. and Amazon.com Inc. saw their stocks slide by 39.2% and 46.7%, respectively, over the same period.

However, private equity firms are still in the market for deals, as highlighted by Thoma Bravo LP's $2.34 billion bid for cybersecurity firm ForgeRock Inc., the largest U.S. infotech deal announced in October.

Potential acquirers are disproportionately interested in cybersecurity targets as the still fragmented and growing sector extends a multiyear consolidation trend.

While global cybersecurity M&A saw a weak third quarter, it bounced back in October. Aggregate deal values announced in the first weeks of the fourth quarter quickly overtook the total for the entirety of the third quarter.

The cybersecurity sector continued to command outsized deal multiples as well. On average, buyers valued cybersecurity targets at 9.1x their trailing-12-month revenue in the third quarter, compared to a 2.5x median valuation for the entire technology industry, according to 451 data. The median deal multiple for October was 13.4x.

* See S&P Global Market Intelligence's analysis of third-quarter cybersecurity M&A trends.

* Use our Transactions Statistics page to run a custom screen of M&A by industry or geography.

Thoma Bravo valued ForgeRock at 10.6x its trailing revenue.

While private equity buyers are not immune to the factors that have made other would-be acquirers more cautious, private equity firms are sitting on large amounts of cash and still looking for opportunistic transactions. Despite the overall slump in deal volume across the U.S. information technology industry, private equity increased its sector dealmaking activity in October, according to 451.

Six of the year's top 10 U.S. infotech deals list private equity firms as buyers.

451 Research is part of S&P Global Market Intelligence.